Everywhere I turn, all I keep reading about is the "pricing wars" taking place in the CDN market and how much it is affecting Akamai and Limelight. Yet to date, I have not seen a single article in the media or from an analyst that actually mentions any real numbers or examples when it comes to the pressure in the market. Many keep saying Akamai and Limelight are feeling pressure, but then give no details on what percentage of their contracts, customers, business or products they think it is affecting. Most of them, don’t even know what the services cost. Way too many analysts are speculating without any real data on the true impact of the pricing decline in the market.

The Wall Street Journal had an article from last week saying that "On average, content-delivery companies charge customers 30 cents to 60 cents for each gigabyte of content transported, say industry insiders. Some media and video sites move hundreds of thousands of gigabytes each month, meaning their fees can total in the hundreds of thousands of dollars." If you are moving that much data, you are not paying a rate even close to that. The article also went on to say that "Panther Express, a small content deliverer in New York, now says it plans to drop its prices 20% to 30%." 20-30% of what? Without knowing the starting price, those numbers meaning nothing. And how can you write about Akamai and Limelight’s stock price taking a beating and then talk to pricing in the market and use Panther as an example of how prices are declining? Panther Express does not even support streaming, does not support Flash streaming, does not do live streaming etc… all stuff Akamai and Limelight support. So if you are going to use an example, use one that fairly compares one companie’s CDN product to another.

The pricing pressure discussion in the CDN market is overblown by analysts. Yes, the price per GB delivered has dropped from Q3 to Q4, but Limelight is not the one dropping pricing. In fact, Limelight’s price per GB delivered is nearly identical to where it was 12 months ago, except for a very small percentage of their largest customers. And while Akamai had to drop much of it’s pricing for the past 3-4 months, specific to video delivery only, much of that has since stabilized. For customers looking for more than just video delivery, in many cases these customers are still willing to pay Akamai more for their services since Akamai offers more than just video delivery. Are they willing to pay 50% more? No. But paying about 20% more per GB delivered is not uncommon.

Many analysts need to better understand that customers are not buying on price alone. And when you look at the actual pricing data, which I will publish tomorrow, the reason the pricing average has dropped in the market is due to all the new CDNs in the industry who are selling on price alone or are trying to ramp up their business with lower pricing. New entrants like EdgeCast and BitGravity are pricing lower in the market which is normal for newly launched CDNs. And there is no pressure from the P2P players on the major CDNs in terms of reducing CDN pricing. P2P is NOT a replacement for CDN, it’s a compliment.

The whole pricing pressure discussion is way overblown in the market. Yes, there was some adjustment, in particular by Akamai, but that’s pretty much done and moved on now. And when Akamai or Limelight does give guidance to the market and says we are feeling some pricing pressure, it’s not across their entire business, across all of their contracts or even across their entire product line.

Over time, CDN pricing is going to be going up, not down. CDN providers are still closing business at a higher rate then their competitors based on crucial factors like reporting, SLA, geographic reach, formats supported, etc…. if this was only about the lowest price in the market, many of these CDNs would have gone out of business already. Limelight and Akamai are not in the business of pricing contracts under cost. That’s not a model of survival. The majority of customers do not buy on price alone. I hear from customers all the time they are willing to pay a little bit more, on average 20-25% from what I hear, for things they see value in from the different CDNs. The key is how the CDN shows them that value and what it is worth to the customer.

And even with pricing pressure, Limelight and Akamai are still growing at a rate of at least 40% a year. Ok, maybe that is not good enough for investors, as I am not a financial analyst and don’t care about stock prices, but it’s not as doom and gloom as some analysts want to make it out to be. Comments in the media like "the space is deteriorating" and "we can expect to see a slowdown" can be proven wrong by the data that shows growth on the number of consumers watching more video, at longer lengths, more often, on more devices AND at higher bitrates. No CDN vendor anywhere is not growing. Yet analysts want to say the market is "deteriorating"? There is no data to support that and to date, nearly no large media company has brought video delivery in-house. And no, Google and MySpace don’t count since they are not the typical media company. So where is the doom and gloom?

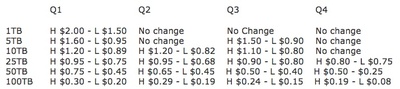

Tomorrow, I will publish the going rate for CDN pricing for video for Q4 and explain how that compares to Q3 pricing, based on the data I have seen. I will also be posting details on Level 3’s new streaming CDN pricing model, which is not, as many are speculating, 50% cheaper than their competitors in the market.