Brightcove’s Consumer Upload Service Cancellation Overblown By Many

![]()

Last week, Brightcove announced via an e-mail to users that it was shutting down its consumer upload service at their Brightcove.TV destination. Many of the blogs that covered the announcement pretty much agreed that Brightcove should not have offered the service to begin with and felt that it didn’t align well with their core service offering around professionally produced content; which is something I agree with. But much of what posts about Brightcove on WebTVwire, InsideOnlineVideo and Mashable talk about I completely disagree with. (note: I can read the

InsideOnlineVideo article in Google Reader, but the link to it on their

website is broken, hence why I don’t link to it)

For starters, too many of them compare the Brightcove.TV service to YouTube or wanting to compete with YouTube which was never Brightcove’s intention. Anyone who looks at the content on Brightcove.TV could easily see that it was not the same type of content shown on YouTube. Yes, there was some overlap, but not much. Most of it was still relatively well produced content, something YouTube isn’t. And as the story on Mashable pointed out, Brightcove’s cost to run such a destination site was probably extremely low since they were simply re-purposing the platform they already had in place. It’s not like they re-invented the wheel and dedicated a lot of internal resources to the offering.

That being said, I disagree with the Mashable article as it portrays Brightcove as a company being in trouble and not being focused with it’s offering. Shutting down Brightcove.TV does not put the company in jeopardy. It’s focus from day one has always been about it’s platform, their tools, syndication and advertising. The fact it used those tools to showcase consumer content in addition to professional content is not a big stretch. Yes, the consumer side is probably not a viable business model today, but if it costs them next to nothing to offer it, gets branding for the company name and Brightcove is smart enough to stop the offering as soon as they saw it didn’t make sense, how does that put them in jeopardy? Mashable says management has problems but the fact they shut it down only a little while after it came to market, shows to me that management understands the market opportunity and moved quickly to address it. In my eyes, there would be problems with management if they waited years to shut it down all the meanwhile saying how great it is working out, like many companies in this industry do.

The WebTVwire article also questions the long-term success of Brightcove as a company and says, "Whether the company has

a shot a succeeding now is still a question that is up in the

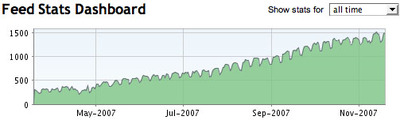

air." True, but that can be said of any company, but I don’t see how shutting down Brightcove.TV now creates more doubt. Yes, Brightcove has raised over $80 million and if we know how much revenue they were doing I’m sure their evaluation multiple would be quite high, but Brightcove is signing up a lot of new customer and content companies we have all heard of. They have large customers and they are getting more of them. While we don’t know the average price they are paying, Brightcove had 800 customers at the end of 2006. Today, Brigthcove says they have over 4,000. No, customer count does not help us in trying to figure out revenue, but look at how many companies in the industry won’t say anything about how many customers they have. At least it’s one metric we can use to show Brightcove’s growth.

As for the Brightcove service itself, options vary on how Brightcove’s solution stacks up in the market. The post about Brightcove at InsideOnlineVideo says, "Their platform is

a commodity, and they’re about to kill their own community. We may as

well relegate Brightcove to the deadpool." The Mashable article likes Brightcove’s platform and says "…they have the absolute most complex and cool back-end for their video

management system that allows for customization of how your videos

display. Personally, of the solutions I have used and looked at, I think Brightcove has the most robust tools and features in the market, however I don’t use the advertising component of the platform so I can’t speak to that functionality.

Some say that others have better tools than Brightcove and I’d love to see in the comments section who readers feel those companies are. Who do you compare to Brightcove when it comes to their platform?

For me, the bottom line is that more and more sites I visit are using Brightcove and years later, they are still focused on their core offering, that being their platform. I know what they do, what they offer and what the value is to a content owner. That is a lot more than I can say about many companies in this space who’s service offering is confusing, complex or every changing. Is Brightcove guaranteed to make it in this space? No. No one is guaranteed anymore. But the fact that many companies have made acquisition offers for Brightcove and feel they have a platform worth owning also tells me that their business is not "shaky" or "in trouble" as some bloggers suggest.