CDN Pricing Data: Average Cost Per GB Declines In Q4 Due To Startups

(Note: My latest pricing data can be found at www.cdnpricing.com)With all the talk in the market about the"pricing wars" taking place in the CDN industry, each quarter I review what the average going rate is and how it compares to pricing in the previous quarter. (Q3 pricing details here) The pricing data below is from my presentation last week at the Streaming Media West show entitled "CDN Pricing: Costs for Outsourced Video Delivery". The on-demand video of the presentation will be available shortly.

Before I get into pricing, there are some crucial things to cover. For starters, these are the average prices paid in the market. This does not mean that this is what every customer pays, or should pay. I list a high and low price based on the fact that there are a lot of variables with regards to the CDN product that end up determining the final price a customer pays. It is also REALLY important to understand that customers are not buying on price alone. In addition you CANNOT compare one vendor to another and doing so is not a fair apples to apples comparison. You can only compare the product lines of one vendor with another.

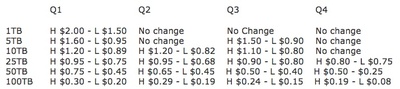

That being said, below is the pricing I have seen so far in Q4 and how it compares with Q3. If you look at these numbers by themselves, you will NOT get a full picture of the market. First, read my post from Monday entitled "Pricing Pressure On Akamai and Limelight Overblown By Analysts" which will give more insight into pricing.

While the high and low pricing average went down from Q3 to Q4, the reason behind that is the fact that a lot of new CDNs in the market are undercutting the more established players to try and grab some market share. Can they do this for awhile, yes. But over time, they won't be able to as they will lose money. For now, many of them have raised a lot of cash and can survive pricing lower in the market for the time being. For a new CDN, it is hard to sell a customer on value when you are new to the space and don't have a lot of customers to talk about. Over time, if they are successful, they won't have to lower prices and can sell on value, but that takes time.

These numbers also don't mean that every CDN in the market is undercutting the major players. In some cases they aren't and are selling on different features and functionality, not price. The bottom line is that pricing is still very fluid in the market on large deals, over 100TB delivered a month, BUT there is not as big of an impact in the market as many make it out to be. The whole idea that the CDN space is about to implode because there is a "pricing war" going on is inaccurate and backed up by no data. Are some companies not growing as fast as investors may like, yes. But don't blame that sole reason on the current or future price in the market. Again, there is more to a CDN than just the price.

And next year, pricing will be going up. When the new players in the market have been around for 6+ months, pricing will stabilize and many will realize they don't need to lower pricing to do a land grab. By then they should also have enough in place on their network to have an angle to up sell. We are at the point now where pricing has pretty much leveled off. Sure, there is always going to be a fluctuation in the market, but come 12 months from now, you won't see that much change in pricing at all from the established players. They won't give this stuff away at a lower price just to win business if they are going to lose money on the deal. Those days are over.

The pricing below is specific to video delivery, streaming or progressive download, there is no difference. This pricing does not include the platform license fee that CDNs charge for Flash Streaming. Before long, some things will be announced in the industry that will affect those numbers and I will cover the Flash Streaming license fee numbers at that time. The below numbers do NOT include video delivery costs via P2P. I will break those costs out in a different blog post as I now track those numbers separately.

So with all that being said, below is what the going rate is for video delivery based on a per GB delivered model. These figures are based on actual contracts and RFPs I have seen in the market and comes from customers telling me on a weekly basis what they are paying.

You can download all of the slides from my presentation here (Download DanRayburn-CDNPricingQ4.ppt)

I will be posting details on P2P pricing and P2P market trends shortly and will also cover a lot of what took place at the Streaming Media West show last week pertaining to P2P.