BitGravity Announces Live HD Streaming, But Traction Will Be Hard To Come By

On Monday, BitGravity announced their new live HD streaming offering dubbed "BG Live HD" which will be available in April. The technology supports 720p or 1080p at 30 frames per second with 1080i support in future development plans. While the demo I saw of the service looked excellent and had very good quality, I think traction could be hard to come by even with BitGravity's low pricing in the market. While I agree that the total cost of ownership for BitGravity's live system could be cheaper than some of their rivals, customers are not buying on price alone.

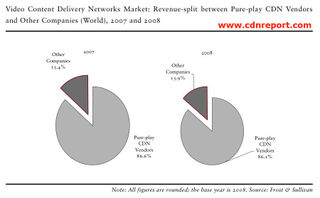

Over the past year we've seen many CDNs and live video offerings come to the market saying they can take share from guys like Akamai, Limelight and Move Networks. But to date, the big vendors still have nearly all of the live event business and content owners have yet to flock to any of the smaller players simply based on a cheaper price.

BitGravity's new live offering is not going after customers who outsource the need for a broadcast video platform to someone like Move Networks, but rather is targeting the content owner who wants to do their own encoding in-house and is not just looking at how much it costs to deliver some bits. That could be BitGravity's advantage, targeting a smaller segment of the market others aren't focusing on as hard, but it's too early to know if they can get any traction. BitGravity has been out in the market for over a year now and we have yet to hear if any major broadcasters are using their service.

In that time, BitGravity has already been offering very low prices in the market, usually half of what Limelight or Level 3 charge and many times, with no commits. I have not yet seen that aggressive pricing strategy pay off in the way of large customers and anyone who follows the CDN market knows that trying to grab market share with low pricing never works out in the long run. That said, BitGravity does not license or run their network using Adobe's Flash Media Servers, so it is possible that their costs are lower than others, but no one truly knows.

BitGravity's live HD service looks really nice, but so do a lot of others and each day it is getting more and more difficult to see the quality difference from one HD video over another. BitGravity is selling their live HD service with the value that it has very low latency, around six seconds. That's good to hear, but it still does not beat Adobe's Flash Media Live Encoder with FMS that has a default of only two seconds for a non multi-bitrate encoding. BitGravity may truly have a cheaper offering in the market but for me, the proof is seeing if BitGravity can sign up customers to use the service. If BitGravity can show that major broadcast customers are using their live HD platform, they might be able to get some traction. But until we can see if that happen, it's all speculation.

Since BitGravity is a private company, it's hard to really gauge how much money they are burning through. They raised $11.5 million from Tata Communications about six months ago and raised a smaller round of $2.5 million a few months before that. In that time, BitGravity has been doing a lot of development work and has expanded their headcount so clearly they are spending a good amount of the money they have raised.

For me, like many of the new CDNs in the market, the verdict is still out on BitGravity's potential success as we don't really know enough about their business to judge if they might have the staying power to survive in the market. Adoption is the key. If they can get customers signed up and scale their business, they have a chance. But if they can't grow revenue quick enough, they will be like a lot of the other CDNs in the market who have enough cash today, but come 12-18 months from now, will be hoping to sell their company if they can't raise more capital. Right now, it's too early to know where BitGravity may end up until we hear more concrete details about their business.