The 2011 Streaming Media West show will take place November 7-9th at the Hyatt Regency Century Plaza in Los Angeles and I've just started placing speakers today. Below is the advance program for the event which details every session title and description. The HTML5 track will be shared shortly. I've already lined up some great moderators from Variety, CNET, Cable Labs, TechCrunch, AOL Video, ReelSeo.com and others who are involved. Keynotes will be announced soon.

I have hundreds of speaker submissions to still review but if you see something below your interested in, better try and grab it before it's gone. Email me at mail@danrayburn.com

Tuesday, November 8th, 2011

A101 – Facebook: Transforming The Future of Online Media

Join Facebook and other leading media companies to discuss new methods of distributing digital media assets to the largest social media platform in the world. Technologies covered on the panel include HTML5, adaptive streaming, authentication, live events, tablets, mobile and DRM. The panel will also cover unique and highly targeted marketing opportunities to over 700 million global users of Facebook. Explore ways to transform social networking and digital media distribution into making mounds of cash.

Moderator: Tim Napoleon, Co-Founder, President, Alldigital

B101 – How the Cable Industry is Changing the way Video is Delivered

Cable operators are pursuing a new market-based approach to enable IP delivery of cable TV services to consumer owned equipment. This session will explain the benefits for subscribers and CE equipment manufacturers of new IP-based, in-home cable services and how market-based solutions are providing cable content directly to an expanding range of consumer owned equipment. Learn the role standards organizations play in the development of these platforms and the key technologies used to enable both the hybrid tru2way and direct IP solutions.

Moderator: David Broberg, VP, Consumer Video Technology, Cable Television Laboratories

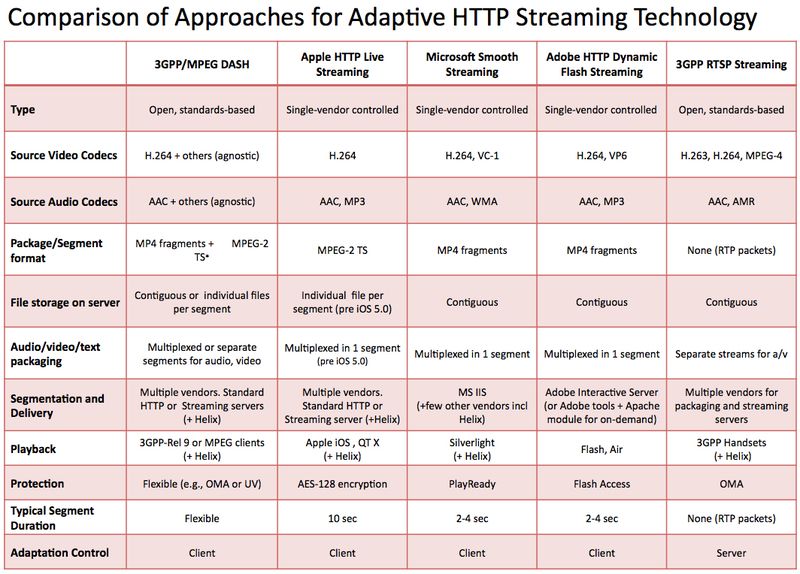

C101 – How To: Encoding For Adaptive Streaming

This seminar identifies the most relevant adaptive streaming technologies and details the most critical factors for comparing them. Next, the seminar details how to choose the ideal number of streams and key encoding parameters. Then it provides an overview of options for encoding and serving the streams, and closes by describing techniques for serving multiple target platforms like Flash and iDevices with one set of encoded H.264 files.

Presenter: Jan Ozer, Principal, Doceo Publishing

A102 – Google TV Demo: The New World of Smart TVs

Like the smart phone before it, the smart TV will bring a new layer of functionality to your existing home entertainment experiences. In this session, executives from Google will examine the value the web will bring to TV, the opportunities for content providers and developers, and the common myths and misperceptions around smart TV. Attendees will also see an overview of Google TV, including the latest developments on the platform, the killer apps, and what lies ahead.

Presenter: Donagh O'Malley, Global Head of Content, Google TV

B102 – Driving Video Views & Engagement with SEO and Social Media

Thanks to social media platforms and search engine optimization, a tremendous opportunity exists in building new audiences and driving views via outside channels. In this session, speakers will present and discuss the case for social video and video SEO. Additionally, panelists will showcase real-life examples and case studies as well as provide expert guidance in terms of both planning for and implementing successful strategies and tactics to boost exposure and discover-ability.

Moderator: Mark Robertson, Founder, ReelSEO.com

C102 – Best Practices For Enterprise Communications

One size doesn't fit all when it comes to matching video delivery platforms with enterprise communication strategy. A town hall meeting with the CEO is a very different thing than a geographically dispersed team meeting, and different technology requirements are needed for each. To further complicate things, all video delivery platforms have their strengths and weaknesses, and different departments in the organization often own different parts of the technologies and strategies. What's a communicator to do? Learn from experts in corporate communications, event planning, and technology support about best practices for finding and using the right mix of video technologies to reach your audience most effectively.

Moderator: Patty Perkins, Team Leader, Wells Fargo Creative Services Technology, Wells Fargo

A103 – Simplifying the Multi-Format Video Workflow

A variety of streaming formats-Silverlight, Flash, HLS, WebM-is generally required to serve the multitude of screens through which content is consumed. Each format can include separate workflows, storage components, and strategies. Network-based media processing offers an increasingly popular approach to simplifying these workflows. How does packaging of media elements in the network (versus on the encoder) work? What are the benefits? What additional features are possible with network packaging (DRM, CAS, ad insertion)? Does this approach work for both small and large operations? In this session, we'll answer these questions and hear various approaches to this new workflow methodology.

Moderator: Matt Smith, VP, OTT Strategy & Solutions, Envivio

B103 – An Open Dialogue Between Video Ad Buyers and Sellers

This session will be a frank discussion with ad video buyers and sellers to discuss their perspective on what's really working in the online video advertising industry. What matters more, content or audience? Is it one or the other, or does each approach present significant opportunities? Also, is video advertising still an industry of empty promises in regards to transparency? What specific expectations do buyers and sellers have around control, and how are they affecting the growth of their business?

Moderator: Teg Grenager, Co-Founder, VP, Product, adap.tv

C103 – The Digital Living Room

Join experts from all sectors of the digital video world to discuss the ever-changing topic of “The digital living room” and how content producers and creators, service providers, and other video web services will thrive in this new economy. What business opportunities lie in the coming surge of Internet connected TVs? What role does mobile video play in the future of the digital living room and streaming content in general? Come hear what technologies and services are poised to be the market's biggest disruptors and how content owners, producers and distributors can capitalize on them.

A104 – Data vs. Content: Who's the Real Star of Online Video?

The rise of online video has opened up a world of metrics and audience data that can help us understand consumers' interests in a way that has not been possible before. At the same time, the growth of online content consumption drives investment in premium content to satisfy the demand. In this session, speakers will discuss what makes up good inventory-whether prioritizing audience data crunching or investing in high-quality, premium content will create the most engagement and return on investment. Ad networks and content platforms will debate which of these two approaches will prove the best for monetizing the boom in online video.

Moderator: Ran Harnevo, SVP, AOL Video

B104 – How-To: Technical Set-Up of Live Streaming Production

This session provides tips and tricks, best practices, and lessons learned regarding the technical set-up of live streaming production. Learn how to stream multiple formats from a single encoder, use social networking overlays, leverage adaptive bitrate streaming, and transition between live streams from multiple camera angles using multi-encoder synchronization. Come learn how to deliver interactive, high-quality experiences for your next live event.

Presenter: Rob Roskin, Senior Manager, Video Operations and Emerging Technologies, MTV Networks

C104 – The Impact Of Carrier Based CDNs On Video Delivery

This panel will discuss the CDN plans and implementations of

major North American carriers for delivering video to the last-mile. Topics will include the technologies, economics and product offering that make carrier CDNs compelling and how they may disrupt the traditional CDN model. Panelists will provide updates on their companies' strategies, perspective on the market and unique relationships their companies can forge with content owners and other partners.

Moderator: Barry Tishgart, VP, Comcast Cable

A105 – Traditional TV vs. The Connected Living Room – Who Will Win?

With the confluence of content from new media, UGC, and web-based video producers along with traditional studios, cable companies, and TV stations, what technologies are necessary to bring all of this content together onto one Internet-connected smart TV device? We've heard about the connected living room for years, but why has it not yet happened? What's holding back mass adoption of smart TV technologies? A look at how consumer demand, big media politics, and innovative new startups are coming together to make smart TV a reality.

Moderator: Mark Mangiola, Venture Partner, Canaan Partners

B105 – Making a Living on YouTube

Long gone are the days of cute kitten videos offering the only hope for "going viral," but is it possible to make a living making YouTube videos? As the audience grows more savvy and technology more accessible, the quality of content that reaches the millions of views mark needs to be more engaging and of higher production value than ever before. Meet some of the creators who are reaching these milestones consistently, as well as advertisers trying to gain access to these creators' huge audiences.

Moderator: Jenni Powell, Digital Content Coordinator, Relativity Media

C105 – How To: Enterprise Video Case Studies

This session will present case studies from leading enterprise organizations showcasing their use and deployment of video for live and on-demand applications. Attendees will learn about webcasting workflows, on-demand applications, and ways enterprise companies are using video today to improve communications, increase efficiency, and enhance their businesses.

Moderator: Patty Perkins, Team Leader, Wells Fargo Creative Services Technology, Wells Fargo

Wednesday, November 9th, 2011

A201 – Cranking Up The Content Machine

This session will focus on what it takes to build up a library of quality content that will attract viewers. What's the competition for content like among the leading streaming companies? What kind of deals are they making with content owners? What kind of content is in/out of reach? These and other questions will be answered by a panel of content syndicators as well as reps from the content companies that sell to them.

Moderator: Andrew Wallenstein, TV Editor, Variety

B201 – Best Practices for Live Streaming

Producers are taking advantage of new technologies, workflows, and production methods to create successful live events. This session will discuss the entire webcasting workflow, including how to get the video signal from the site to end user; how to build an audience; when to use multi-bit rate streaming; strategies to consider for reaching mobile devices, and how to leverage social media platforms. Presenters on this session are the ones in the trenches, producing some of the live events you see on the web today.

Moderator: Jon Orlin, Executive Producer, TechCrunch

C201 – Webcasting Tips And Tricks From The Enterprise

This session will focus on best practices from enterprise corporations who have adopted and implemented live video across their organization. See first hand how these companies are using video for internal and external communications and learn how you can better leverage assets already available inside your company. Hear first hand from those who have been successful with their deployments and learn what advice their have for others deploying live video in the enterprise today.

Moderator: Patty Perkins, Team Leader, Wells Fargo Creative Services Technology, Wells Fargo

A202 – The Business of Premium Online Video

Over the past years, the majority of online video has been short-form UGC that is not advertiser friendly. As online video consumption grows, portals, vertical content networks, and video ad networks are looking to offer premium original content being demanded by their advertisers. With this business still in its infancy, the creative and business models are still unclear. Will what works on television work online? How does content find its audience without a traditional network to market and promote it? Does it make sense to create content without an advertiser funding it? Who are the players in the new ecosystem? A panel of heavyweights from the content creation, digital media, and ad agency worlds will debate and discuss the current state and where things are headed.

Moderator: Matt Farber, President, DoubleBounce

B202 – Cutting The Cord On TV: Will Online Video Really Lead To Cable's Demise?

From Hulu to Netflix, streaming video is having a powerful impact on the traditional television industry. But are consumers really cutting the cord and bypassing cable operators in favor of online video? With the broadcast networks facing some of the same threats as the newspaper industry, will services like TV Everywhere and over-the-top (OTT) content be the industry's savior? These topics and more will be addressed by this panel of content heavyweights.

Moderator: Greg Sandoval, Senior Writer, CNET

C202 – Cloud Demos: Amazon CloudFront and Windows Azure

With no up-front expenses and no long-term commitment, both Amazon's CloudFront platform and Microsoft's Windows Azure platform enable you to pay only for the resources you use, and it's simple to configure both of them within minutes to store and deliver your content and applications. In this session, you'll see how they both work and learn how to use them.

A203 – Strategies for Preparing Your Video for Tablets and Mobile Devices

If you distribute or produce content that will be digitally consumed, you are faced with preparing your media for a multitude of screens. From Android-based tablets to the iPad, iPhone 4, and beyond, mobility is the new video frontier. So what's the right strategy to reach all these devices? How many variants of one clip must a publisher create? Which platforms will yield the greatest uptake? In this session, industry leaders with hands-on experience will answer these questions and provide a best practices approach to help you develop your content to multiple devices.

B203 – How Streaming Video Is Changing The Television Landscape

Streaming sites like Hulu, CBS, ABC, and others have proven that savvy audiences are turning to their computers for entertainment, and in a way that's profitable. How are traditional and cutting-edge companies capitalizing on this trend? In addition to providing the content, how are they taking advantage of this "connected" platform as they deliver content? And finally, how might online video based subscription offerings affect cable companies to this new content source?

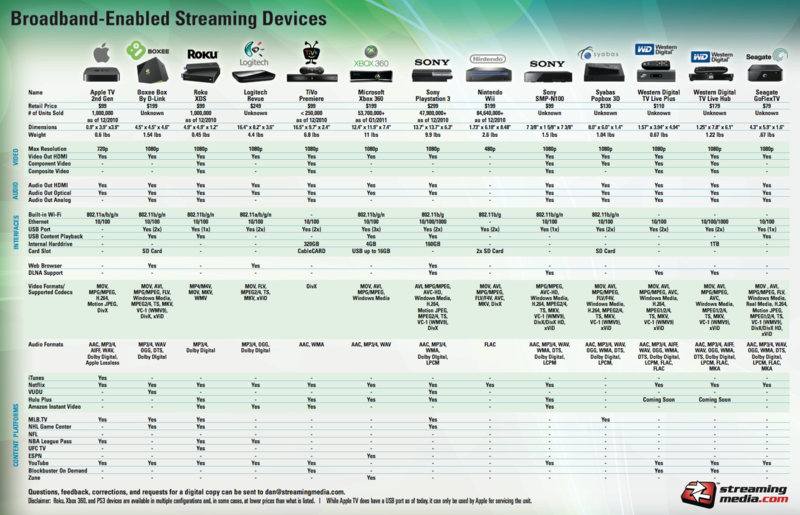

C203 – Connected Device Demos

As the number of broadband-enabled devices and platforms invading the living room continues to grow, lots of questions remain about their capabilities. In this session, company executives from some of the leading device companies will demo their latest TV platforms and devices. Attendees will see these devices and platforms in action, learn which content is available on them, and get their questions answered in a Q&A session.

A204 – How Old Media Is Embracing Online Video and New Media

This session will discuss how converging media technologies are redefining traditional distribution methods; how interactive and on-demand services are changing; and how entertainment and news video is being consumed on new platforms. Come hear from some of the leading publishers, broadcasters, and advertisers about the impact that video and new media is having upon their business models.

Moderator: Jose Castillo, President, thinkjose

B204 – Winners and Losers in Over the Top Video

Smart TVs have joined new set top boxes, Blu-ray players, game consoles, and media center PCs as ways for internet-streamed video to reach the big screen. But with so many choices, how do you pick which ones to develop for, which ones to deploy on, and which ones to ignore? This session explores everything from the possible emergence of a standard stack for Smart TVs to handicapping Roku, Boxee, Google TV, and more. We'll also explore best practices in developing apps that work across many of these devices.

Moderator: Troy Dreier, Senior Associate Editor, StreamingMedia.com