In a post about mobile acceleration in June, I dug into some of the technical reasons why mobile content tends to load so slowly on mobile devices and is so often interrupted by the spinning wheel and plagued by slow response times. In this post, I'll give a bit more background on why alleviating the aggravating and unpredictable latency experienced by most smartphone users is so critical and why this service is at the heart of the future of the CDN market.

Last holiday season, online auction and eCommerce giant eBay became a mobile commerce (mCommerce) giant when sales soared by 134% to well over $100 million over the holiday shopping season. eBay was hardly alone. Most of the major retail players saw enormous percentage increases year-over-year in commercial transactions and purchases that originated from mobile devices. If the early days of online commerce are any guide, then the increase should actually accelerate further for the 2011 holiday season.

Meanwhile, Groupon, the hottest daily deal company, is betting heavily on location-based deal offers to expand its reach, with the U.S. mobile display advertising market likely to eclipse $600 million in 2011. With PayPal now supporting person-to-person mobile payments, that market, still quite nascent, will likely take off in the same manner that PayPal grew quickly as a person-to-person payments vehicle in the earlier days of the Internet. All of these segments are extremely sensitive to latency and slow page-loads.

Today, just building a mobile-friendly app is not enough. Rather, as these businesses drive broader vertical trends towards monetization and maturation in mCommerce, mobile deals, mobile advertising, mobile payments, and social networks, acceleration of mobile content will be the fastest growing part of the CDN and content acceleration sector over the next few years. eBay may have started out with the belief that a nice app would be a sufficient mobile strategy, but increasingly, companies that are serious about mobile monetization will begin to view their mobile application delivery network and ecosystem in the same way that they view their online commerce strategy. They will begin to create a mobile-specific business and monetization strategy that emanates from the user back down through the technology stack to ensure maximum engagement and a minimum of activity interruption for users on handsets and tablets. We are already seeing that with some of the early adopters that I'll discuss a bit later.

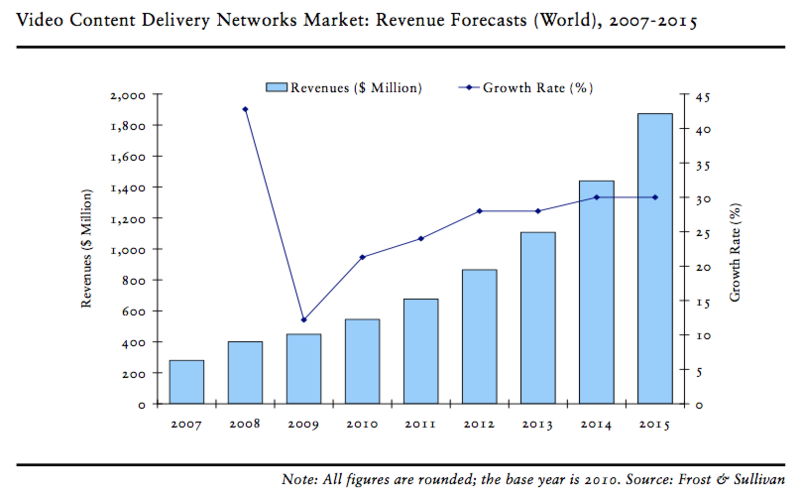

Frost & Sullivan is forecasting that by 2015, mobile advertising revenues in the U.S. alone will rise from $491 million to $2.04 billion. That's compared with total global mobile advertising revenues today of roughly $2 billion. By that year, mobile commerce is expected to reach $119 billion in total transaction value and half the world's mobile subscribers could be making mobile payments. According to a survey of 1800 people by advertising and marketing agency Leo Burnett, 50% of consumers use a mobile device as part of their shopping experience, be it searching for deals, locating product information, or executing on-the-fly price comparisons.

In the U.S. location-based-services (FourSquare, Gowalla, Loopt) usage on mobile devices will hit 50 million users in the U.S. alone, up from 16 million users. Use of social networks over mobile devices is soaring, according to ComScore. In 2010, 30% of smartphone users accessed social networks via mobile browsers, a hefty increase from 22.5% in 2009, Twitter and Facebook saw huge increases in mobile usage at 347% and 112% year-over-year growth, respectively. So what do all these numbers really mean for companies in the mobile commerce space? We're now talking about a major monetization engine for many companies, something that really took hold for the first time in 2010 and will continue to demand more attention from companies with mobile monetization plays in the near future.

The reason for this is because the business and revenue impact of mobile latency is no longer a trivial thing that can be passed off as part of leading edge technology adoption. Similarly, it's no longer just the alpha adopters who will get angry at a brand that delivers a poor mobile experience. Now its tens of millions of Americans and hundreds of millions of people worldwide with access to high speed wireless data networks. Here are just a few of the ways that latency can crush revenues. In the mCommerce segment, slow-loading coupon offerings will convert users at much lower rates. This will become a more acute problem as coupon offerings go from national to regional and local targeting, some even with same day purchase requirements.

In this new reality or hyper-local and up-to-the-minute deals, the old ways of caching coupons in legacy CDNs for broad swatches of the country or very large regions no longer works well. Taking that thought one step further, slow-loading location-based deals will make it harder for companies to execute on loyalty or proximity offerings targeted to specific users who may be regular customers. For a company like Groupon, which not only will rely on local deals but also time-sensitive local deals, the penalty for high latency is even higher because their deals go away quickly, eliminating opportunities for further revenues.

In mobile advertising, high latency means fewer impressions, lower click-through-rates, and lower monetization. Studies have shown that ads shown during searches on mobile devices have much higher conversion rates than ads served to a computer over a landline connection. That's because mobile advertising is more personal and more immediate. Someone looking for a restaurant in the Lower East Side of Manhattan is doing so because they want to find a place to eat now or very soon. Someone searching through reviews for electronics on a handset are likely standing in a Best Buy considering a purchase. So the opportunity for ad monetization is greater, unless you can't deliver the ads quickly. Mobile users will quickly move to another review site or search on Yelp instead of OpenTable if their page is loading too slowly.

As a result, publishers will not hesitate to boot slow-loading ads off their mobile sites, a trend we have been seeing on the non-mobile Internet for some time. So latency for mobile advertising has a higher opportunity cost and a higher risk, both of which are complicated by the fact that serving any content over mobile networks is far less predictable due to differences in device capabilities. Not to mention, the varying behavior of HTTP and TCP which can compound latency to aggravate an already bad latency problem, and the huge variability in network performance. So mobile advertising networks will put a tremendous premium on anything that can reduce latency and allow them to be more confident in fast delivery of their content.

In a similar vein, online offer-based engagement advertising in social games, like Farmville, is incredibly reliant on fast load-times with even faster abandon rates. Latency, thus, can be even more painful because an advertiser that broadcasts an engagement offer such as a promotional video which requires completion but interrupts the user experience with a wait time for loading media will not only lose the engagement payment, they will also have to eat the cost of network resources. Even worse, aborted engagements will cause advertisers to move to other options. Big brands hate wasting their time and money and they won't put up with latency issues for long.

These types of richer engagements put greater demands on mobile networks and start to blur the boundaries of mobile apps and mobile content from the Internet. The blurred boundaries can mean novel mobile use cases, which threaten to choke mobile networks. Do@T, for example, launched a novel search capability that takes mobile search queries and quickly routes users to relevant mobile apps that are actually called through a browser. So someone who searches for “godfather” could well end up finger swiping between Netflix and other movie-related apps, an activity that is particularly unforgiving for latency considering the swipe factor implies instant gratification.

In a social network setting, failure to provide personalized content quickly on mobile devices will reduce advertising revenues for the network. A number of the largest social networks are now using or piloting mobile content acceleration platforms from CDNs to ensure that their users, who chat, play social games, share photos and movies on the network, all remain tightly engaged. This type of highly-personalized content is difficult to cache and extremely dynamic. This, as I discussed in my last post, is something that CDNs who are only focused on video or small object delivery, simply can't handle. All of these use cases are reasons why publishers and businesses are turning to mobile-centric CDN solutions to deliver content faster and reduce latency and round trip times back to the origin server.

Equally important to the business reasons I already mentioned, (which all focus on improving user experience to maximize revenues and monetization) is the new reality that mobile businesses need to quickly dial up their network capabilities in order to maintain good user experience quality levels. VocalWall allows Facebook users to leave an audio clip as a wall comment. When the service took off, largely due to use on mobile devices, VocalWall was ready with a mobile-specific CDN and content acceleration program that allowed it to scale up effortlessly. This allows it to promise to big brands that advertising on the platform or using its paid offering end-users will not have a high-latency experience under the support of that brand.

On the upside, in mobile content delivery very small changes can reap huge rewards. For example, according to Keynote Systems, when Dell reduced the footprint of its mobile homepage by 24 kilobytes, that sliced the download time of the page by a whopping 2.74 seconds. Because the average mobile page download has 46 different components, there are huge opportunities for CDNs focused on mobile and commerce, to use intelligence to make small changes that dramatically reduce latency.

For example, mobile content acceleration services that can cache certain javascript elements which are generally loaded and reloaded for every page on a site in a CDN server close to the user can slash microseconds of round trip times, a change that might translate into a multi-second reduction in load time. And by speeding up round trip times for pages, the mobile CDN offering will not only reduce immediate latency but also compounded latency resulting from TCP assigning slower requests to a lower transport priority, creating a downward spiral of bad performance that often ends with the user clicking the back button or being forced to reload the page.

The conclusions of this are pretty simple. Now that there is real money in mobile, bad performance is a more painful problem that hits revenue numbers and corporate profitability. At the same time, the evolution of mobile behaviors and use cases (for users, publishers, and advertisers) underscores the need for new ways to overcome weakness in wireless data network delivery to ensure that content arrival on handsets can hold users and maintain high engagement rates. Fortunately, some CDNs are starting to think about these business problems and have started offering mobile content acceleration platforms, laying the groundwork for a parallel CDN technology solely focused on mobile which integrates nicely within existing CDN offerings. But a lot of work is still ahead and many CDNs don't yet have a true mobile video offering in the market, let alone a mobile acceleration one.

CDN vendors that don't start addressing these developments in the market and start offering mobile delivery platforms are going to have a very hard time diversifying their business and growing their revenue over time. This is the next chapter of the CDN business and it’s developing in real-time right now.