Yesterday, Brightcove filed an amended S-1 as the company prepares to have their IPO in the coming months. The company is looking to raise between $50-$60M from their offering and estimates shares will be priced between $10-$12. After IPO expenses and spending approximately $7M to repay an outstanding loan, the company looks to net about $40M in working capital. Depending on the share price, Brightcove would have a market cap of between $275-$300M, which is about 5x 2011 revenue.

While I saw lots of folks repeating the highlights from the filing in their blog posts and simply cutting and pasting the numbers, I didn’t see anyone asking the questions that have yet to be answered regarding Brigthcove’s revenue or the size of the market they are in. It’s also clear that many folks only read the first few pages to the filing and not the whole document as their are lots of data points that gives one a lot to think about, and question. It’s just another example of many showing that too many blogs only care about publishing as many 500 word posts as possible in one day, rather than actually telling a story, engaging a reader, or trying to explain the impact a company could have on the broader market.

Brightcove had revenue of just over $63M in 2011 which makes them the largest provider for online video platforms, sold direct to content owners. Other video platform vendors selling direct to MSOs like Cisco, thePlatform and Kit digital have more revenue than Brightcove, but aren’t selling into the same vertical with the same solution. Many people want to compare a Brightcove to thePlatform or Kit digital, but they are selling very different solutions and should not be compared to one another.

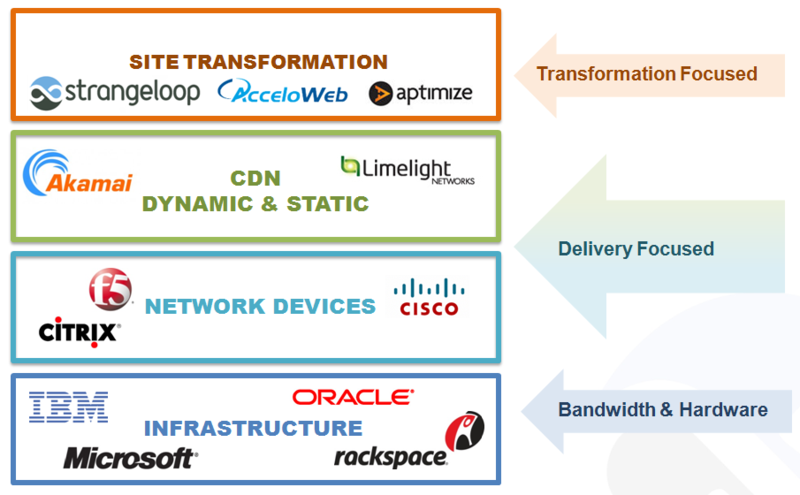

There are three kinds of online video platform (OVP) providers in the market. Those that sell direct to content owners, those that offer carrier grade solutions to MSOs and vendors that offer video management platforms for enterprise customers who deploy video inside their firewall. Brightcove has been going after the enterprise market as of late, but most of their customers are still content owners and publishers in the media space and I have yet to see Brightcove enter the carrier and MSO vertical as of yet.

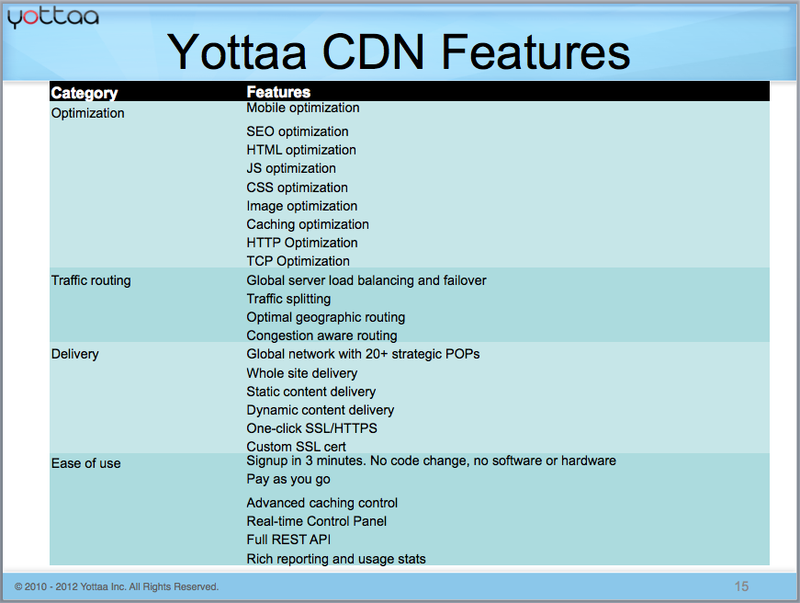

But the real question is what’s the breakdown of Brightcove’s revenue and how much of it comes directly from their SaaS business? Through Brightcove’s CDN partners like Limelight Networks and Akamai, almost 9 billion streams went through Brightcove’s platform last year. That’s a lot of bits and since the delivery of those videos are handled by a third party, Brightcove pays the CDNs for those delivery services and marks up the bandwidth to their customers. So one has to wonder what percentage of Brightcove’s total revenue comes from the re-sale of bandwidth? Brightcove doesn’t break that number out in their filing and the company told me they could not comment on those details when asked.

While there is nothing wrong with some of Brigthcove’s revenue coming from bandwidth, considering that the average cost per GB delivered drops at least 20-25% each year, there is only so much of a markup Brightcove can add on top of what they pay the CDNs. Some have told me that it really does not matter as the percentage of Brightcove’s revenue that comes from the re-sale of bandwidth continues to decline each year, but that’s a bad answer. Just because it is declining doesn’t mean the number isn’t material. I don’t know what percentage of their revenue is from bandwidth and I won’t put a number out there as it would be a complete guess on my part. But if the number was low, think single digits, then my guess is that Brightcove would be all too happy to say what it is.

While Brightcove admits they will lose money in 2012 and even possibly beyond, that’s not what worries me. Brightcove is trying to follow the Amazon mentality of “get big fast’ and that’s why the company has raised and spent so much money over the past few years. My biggest concern is how quickly the market Brightcove is in will grow and what the total market opportunity really is. While Brightcove gave out some of those numbers in their original filing, they are so big that they are hard to believe. Brightcove says that by their estimate their “total potential market opportunity was approximately $2.3 billion in 2011, growing to approximately $5.8 billion in 2015“.

Those numbers are far too big. If Brightcove’s entire market opportunity was $2.3B in 2011 and the company did $63M in revenue, that means Brightcove only captured 2.7% of the market. That’s not a lot. Brightcove has some really interesting methodology on how they came up with the total market size though, which you can read in detail on page 69 of the S-1 filing. My other concern with any business like Brigthcove’s is that R&D costs are high. In 2011, 25% of Brightcove’s revenue went towards R&D, which is a lot. Also, while all of Brightcove’s revenue comes from one product and the company is working towards diversifying their revenue, app cloud is an example, they have yet to do that to any large degree.

All of this aside, Brightcove does have a some positive things going for them which gives them a legitimate shot at building a long-term profitable business. For starters, Brightcove invented the market they are in and to date, even with increased competition, has yet to fall behind any of their competitors. They have lead the market for more than five years and while being a first mover is not always a guarantee of long-term success, so far, Brightcove has shown that they can continue to be the leader.

Brightcove had a total of 3,872 customers at the end of last year of which 2,571 of those customers were using the Brightcove Express product which costs between $99 and $499 a month. If those customers are all paying $250 a month on average, that means that about one third of Brightcove’s customers make up about 91% of their revenue, which is very good. At the same time, no one customer makes up more than 4% of Brigthcove’s total revenue which is a nice balance. Another thing I like is that in each of the last eight fiscal quarters, Brigthcove’s recurring dollar retention rate was at least 86%, and for all of 2011, was higher at 93%, which is quite impressive.

And finally, in order for any company to do well they have to have a good management team that has experience in building and cultivating their business, especially when it is still in the early stages of real growth. Brightcove isn’t even a $100M company yet so for them to really get to the next level with their business, management needs to be laser focused and take the necessary steps to make sure the growth happens. If there is one thing I think Brightcove is very strong with, it’s the management team they have in place.

Brightcove’s CEO Jeremy Allaire is smart, he’s easy to speak to and reachable (even if you are not a member of the media) and he doesn’t have the arrogance a lot of CEOs tend to have, which can sometimes hurt the growth of their company. You don’t see Brightcove getting into public spats with their competitors and the management team that Jeremy has built at the company has a lot of experience in building and scaling software companies in the past. That alone does not guarantee that Brightcove will be successful, but it sure helps gives them the opportunity to make it possible and they are going to be closely watched by a lot of other companies in the space who want to follow in their footsteps.

The 2012 Streaming Media East show (May 15-16 in NYC) will feature a special broadband-enabled device pavilion, allowing thousands of attendees to get hands-on with more than 50 of today’s leading streaming devices and Over-The-Top video content platforms. It is the only show where you can try out all of these devices and platforms in action, compare them side-by-side and get your questions answered – all for free.

The 2012 Streaming Media East show (May 15-16 in NYC) will feature a special broadband-enabled device pavilion, allowing thousands of attendees to get hands-on with more than 50 of today’s leading streaming devices and Over-The-Top video content platforms. It is the only show where you can try out all of these devices and platforms in action, compare them side-by-side and get your questions answered – all for free.