Limelight Launches Managed CDN Offering For Carriers, Is A Deal With F5 Next?

This evening, Limelight Networks announced their new managed CDN offering, called Limelight Deploy, aimed at helping telcos, carriers and service providers build and deploy CDN services inside their network. While this is a new product line for Limelight, they aren’t new to the carrier space and have already built out networks for Bell Canada, starting in 2009, and Asia’s largest telecom provider, Bharti Airtel in 2010. In what I think is related news, I have gotten a lot of calls today asking me about rumors people are hearing about F5 buying Limelight Networks. I have not heard any of those rumors, and it makes no sense, but my guess is that F5 may be working to license Limelight’s CDN technology the same way Juniper just licensed CDN technology from BitGravity. But that’s just a guess.

The licensed and managed CDN business has really been heating up over the past few months and is still dominated by EdgeCast who has the most carrier based licensed CDN deployments and re-sellers in the market. But unlike EdgeCast who simply licenses their software to carriers, Limelight’s approach it to actually help build and manage the CDN component of the carriers network with their professional services group. In conversations with Limelight, the company said carriers were asking for more hands-on help and Limelight’s goal is to help the carrier build and manage the network with the carrier eventually taking over 80% of the operation of the service on their own. This approach also allows network operators to get their CDN up and running much faster since they get to leverage Limelight’s expertise of running a network over the past ten years.

Customer’s who use Limelight’s Deploy solution are not required to have to re-sell or use Limelight’s off-net services, but that’s clearly an option if they want to. Limelight also said they have no desire to create a federation of CDNs, like EdgeCast has done, although nothing would stop Limelight’s customers from exchanging traffic amongst one another if they wanted to. Limelight said their Deploy offering will be offered worldwide and that they now have a dedicated team inside the company, focused just on their managed CDN offering.

There are two primary uses cases for a managed CDN and not ever customer is trying to “reduce their cost” like you hear people say. The first use case is a carrier that is looking to add CDN services and expand their product portfolio with products that are adjacent to services they already offer on their network, thereby increasing their revenue. The second use case relates to the network operators who have the eyeballs and are concerned with the volume of video being delivered over the last-mile to their customers. In this case, most of them are trying to control their costs, improve their quality of service (QoS) and create content services that will allow them monetize the video they are delivering. (think Xfinity) Limelight says that customers for their managed CDN offering range in size and could be asking for help to build out small deployments in the 10Gbps range to customers who have the desire to support 700Gbps within three years time. Not surprisingly, Limelight and all the managed and licensed CDN vendors I talk to say the biggest demand for these services comes from outside the U.S.

The terms “licensed CDN” and “managed CDN” will probably start being used in the industry as if they are interchangeable, but they are really very different solutions. Right now, there are basically three different kinds of licensed, managed or carrier based CDN products in the market. EdgeCast, Jet-Stream and Aflexi offer software based licensed CDN services. Limelight Networks and Highwinds offer managed CDN services which go beyond a software license and vendors like Juniper and Cisco are or will offer carrier based CDN solutions that combine hardware with software, but won’t help the customer actually build the CDN. Alcatel-Lucent is also in the business, but is targeting MSOs more than carriers. Other vendors like Akamai have talked about a licensed CDN product but have not yet entered the market.

Limelight’s Deploy offering is somewhat unique in the market as their platform isn’t only focused on helping carriers build their own CDN for video delivery, but also for website and application acceleration services. EdgeCast also has this functionality in their application delivery network, which can also be licensed by carriers and it is expected this is what AT&T will license when they stop re-selling Cotendo once Akamai completes the acquisition of the company. Vendors like Juniper are focusing more on the video side, but then also offer a transparent caching component that some of the other managed and licensed CDN vendors don’t have. If you’re a bit confused by all of these different technologies, you’re not alone.

In the past two years, it’s my opinion that the CDN market has been pretty stagnant, with not a lot in the way of new services being offered in the market. The term “CDN” usually referred to the delivery of video content and small objects as a service based business, but that’s about to change. Content delivery products and offerings now encompass services like video delivery, licensed and managed CDN, dynamic site acceleration, front-end-optimization (something you will hear a lot more of soon), mobile content acceleration and a host of other services. These days, calling a product or a company a “CDN” offering, could mean a lot of very different things.

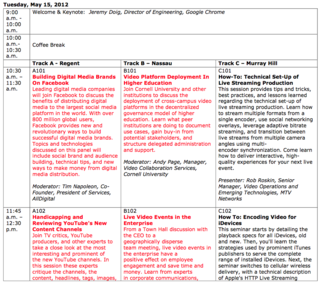

The CDN industry is starting to get really interesting again and we’re starting to see lots of new types of CDN services and products coming to the market. We’ll be covering all of these CDN technologies at the fourth annual Content Delivery Summit, taking place May 14th in NYC. You can come see these technologies in-action, talk to the carriers that are using them and hear about real-world deployments.

Realted Posts:

– Updated List Of Vendors In The Content Delivery Ecosystem

– An Overview Of Transparent Caching and Its Role In The CDN Market

– Transparent Caching & CDN Merging: Juniper Licenses BitGravity’s CDN Technology

– Here’s Why The Future Of The CDN Business Is In Mobile Content Acceleration