I’ve been out for a while with a cold, so I’m late in writing up the recent news from CDN provider EdgeCast, which on July 18th, announced a big fourth round of funding for the company, totaling $54M. But don’t let my tardiness take away from how big of a deal this is for EdgeCast, and the impact on the CDN industry.

This latest round of funding is a testament to the success EdgeCast has shown in the market over the last five years, growing their business to a run rate of $100M in 2013, with only $20M in previous funding. At a time when many services in the CDN market are facing pressure on the pricing and competitive front, EdgeCast has managed to grow quickly, with products and services that have better than average margins, because of their unique strategy. From day one, EdgeCast stayed away from contracts where all the customer wanted was the lowest price. They walked away from a lot of potential bad business deals and didn’t try to win any portion of traffic from companies like Netflix, which was a smart move on their part, since many CDNs later regretted taking on those type of deals, learning they could not make money on them. EdgeCast will compete for high volume lower margin deals in video and software delivery, but will only do profitable deals.

EdgeCast also saw a need in the market, year’s before anyone else, around licensed and managed CDN and while it accounts for less than 25% of their revenue today, it allowed them to diversify their portfolio and get revenue from high-margin services. The company now competes in the market for traditional CDN services, licensed/managed CDN, application acceleration services and recently launched a dedicated PCI network for retailers. EdgeCast has quickly grown their product portfolio to include all the major services a CDN needs to have in the market to be able to truly compete.

EdgeCast came to the market in 2007 at a time when many other CDNs were in business and has been able to survive while most of the others have gone under. (i.e. Panther Express, BitGravity, Vusion, Grid Networks). EdgeCast joins the ranks of Akamai, Limelight, Level 3 and Amazon as one of the five remaining, large-scale CDNs in the market, offering delivery services for video and other forms of content. The company says they carry more than 5% of all worldwide Internet traffic, has 4Tbps of egress capacity deployed, and at their current rate of growth, is on a run rate of over $140M by the end of 2014. The company has been profitable since Q3 of 2009 and has grown to 275 employees, all on only $20M in funding, before this latest round. That’s quite an achievement, considering that in 2009, we saw video CDN pricing decline by an average of 45%, yet EdgeCast was still able to grow.

To highlight just how well EdgeCast has done to date, with little funding, all you have to do is look at Limelight Networks numbers for comparison. Limelight, which to date has raised more than $400M, is on a run rate of about $200M in revenue for this year. If EdgeCast does in fact end the year with $100M in revenue, they will have raised about 1/6 of the money Limelight has raised, yet is already at half of Limelight’s revenue. At a time when other CDNs are struggling to grow their CDN business by double digits, and keep their margins on CDN services high, EdgeCast has managed to do both. The company has their work cut out for them moving forward because it’s much harder to grow your revenue as you get larger and have to scale out every facet of your business, but they now have the money to do it.

Unlike a lot of the later big rounds of funding that took place at Limelight Networks and Highwinds, where some cashed out, 100% of EdgeCast’s management is staying put and all of the money EdgeCast just raised will go into the company’s expansion. Some CDNs like Limelight raised a ton of money pre-ipo and then cashed out their management team, got rid of a bunch of key founders including the CEO, and then brought in a team of outsiders who didn’t have the same passion and domain expertise to drive the business forward – and those were the guys who took it public. While they had some of the founding team still there, Limelight wasn’t the same after that, a mistake EdgeCast isn’t going to make.

EdgeCast plans to use the money to grow their network, add POPs into markets they don’t service today and augment capacity in their existing POPs to handle even more traffic. They also plan to expand their sales force and put more feet on the street in different geographies as to date, EdgeCast has been selling mostly over the phone. But the bigger customers need higher touch, something EdgeCast will be in a better position to support and will use the money to enhance some of their new products such as Transact (PCI/e-commerce network) and new DNS and security offerings rolling out later this year.

EdgeCast wants to remain focused. They aren’t getting into the transcoding business, becoming an OVP, trying to be a cloud hosting company or selling any kind of network services like transit. EdgeCast has done well thanks to their focus, and with a lot of new capital in the bank, they don’t plan to lose that focus anytime soon.

Some of EdgeCast’s customers include: Twitter, Hulu, WordPress, Mercedes-Benz, JetBlue, Kellogg’s, Yahoo!, Etsy, EMI, Campbells, Overstock, Bluefly, Garmin, Pinterest and Atari.

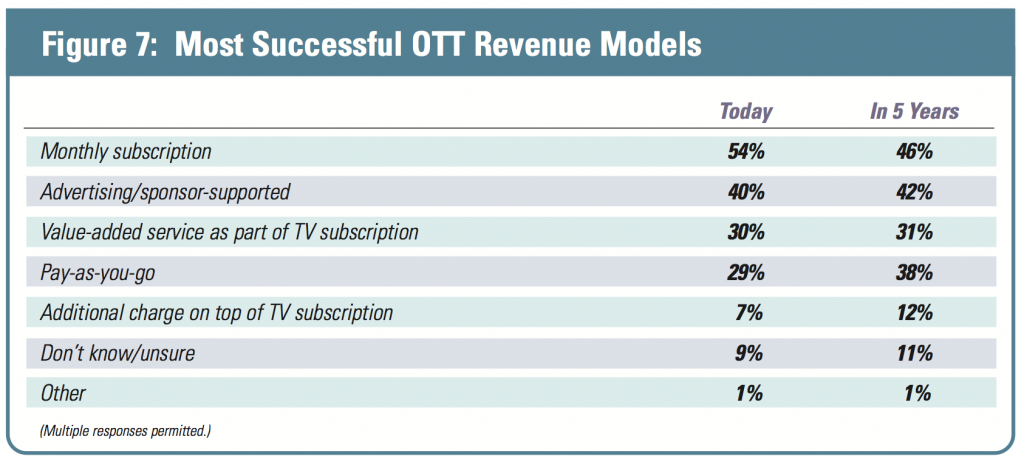

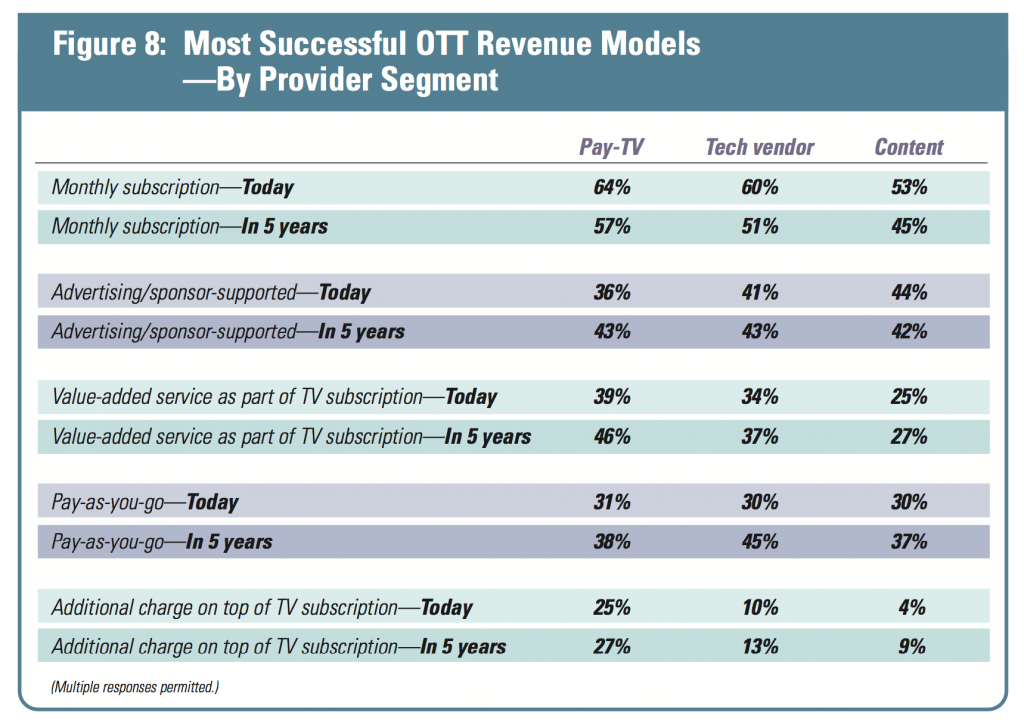

Ultimately, in the view of at least one respondent, pay-as-you-go is the most logical business model for OTT going forward. “If the costs are kept proportional, pay per view is the highest plateau of ‘democratic’ viewing,” the respondent says. “Viewers are choosing the program, and their money can go directly to the source—producers and delivery providers— eliminating the need for commercials. That means more revenues for content creators and delivery providers.” However, the respondent adds, there is still a place for commercials, which “can still find eyeballs if content is free to watch.” To be successful in this new hybrid market, providers need to “trade in high-cost delivery, which only reaches a top tier of income earners, for more viewers at lower cost.”

Ultimately, in the view of at least one respondent, pay-as-you-go is the most logical business model for OTT going forward. “If the costs are kept proportional, pay per view is the highest plateau of ‘democratic’ viewing,” the respondent says. “Viewers are choosing the program, and their money can go directly to the source—producers and delivery providers— eliminating the need for commercials. That means more revenues for content creators and delivery providers.” However, the respondent adds, there is still a place for commercials, which “can still find eyeballs if content is free to watch.” To be successful in this new hybrid market, providers need to “trade in high-cost delivery, which only reaches a top tier of income earners, for more viewers at lower cost.”