How Instart Logic Wants to Solve Web Application Delivery

Last week, web and application delivery provider Instart Logic announced they have raised $26M in a third round of funding from Kleiner Perkins Caulfield Byers and existing investors. The company has now raised a total of $52 million and is growing quickly, with nearly 100 employees around the world. Since launching last year, Instart Logic counts a growing list of marquee clients including the Washington Post, big online retailer One King’s Lane, and SaaS provider If This Than That. The backdrop for Instart Logic’s new funding round is an increasingly commoditized CDN landscape with falling prices for vanilla caching and distribution. What were considered value-added services, such as adaptive image delivery to match device type, are now becoming more commodity type services.

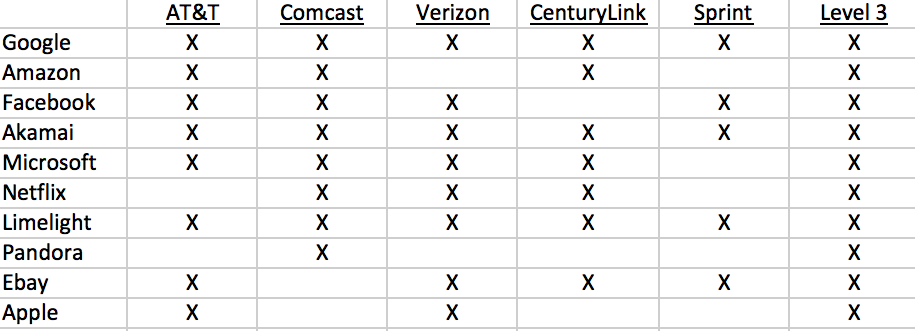

Web performance and CDN vendors, in particular Limelight Networks, EdgeCast, and Amazon, have been trying to climb up the chain of ever more complex value-added services. To date those services have focused on mobile and images, two of the biggest pain points for modern web applications. The mobile Internet is now on the verge of eclipsing the landline Internet and mobile is the primary pain point for many web applications companies. For its part, Akamai has seen real success in selling additional value added services such as security and application acceleration solutions.

Clearly, though, a new frontier is emerging. As cloud overtakes on-premise applications, the web performance needs of cloud-based apps are casting a spotlight on the problems with traditional application delivery systems. Those systems were never designed to accommodate users on wireless devices accessing highly dynamic, highly personalized, web-based applications. Cloud also overlaps heavily with the mobile trend.

Instart Logic is looking to position itself ahead of these two key trends – mobile and cloud – and wants to disrupt the whole CDN market by trying to make these older application delivery approaches outdated while simultaneously expanding the concept of what a high performing web app can do. Their dual-sided (client-cloud) platform was built to accelerate web and mobile in what they say is a very different way than traditional CDNs. Their technology works at the application layer, not the network layer and adds intelligence and business logic to the acceleration process that prioritizes the parts of a web app users will click on first or needs to see the most in order to interact with the app.

Instart Logic says their “secret sauce” is a heavily patented client-cloud platform that inserts a small virtualization layer onto the browser. This forms a closed loop that pumps information about how applications are consumed on the client side back to Instart Logic’s servers in the cloud. The information and analytics allows Instart Logic to aggressively and accurately prioritize the order that bits and bytes are shipped down to the browser in granular detail to allow users to interact with their applications much faster. This client-cloud architecture is something that I haven’t seen any other CDN using right now and I have not heard of any other company with similar technology for web apps.

Such a tight connection between the web performance service and the user device is particularly relevant when wireless networks bog down. By shrinking the data footprint of web applications and shipping only the most relevant information, Instart Logic better handles wireless congestion. It’s important to note that in Akamai’s latest earning call, the company cited strong media demand driven by delivery requirements for higher quality images over 4G networks as a key source of revenue growth. Instart Logic directly attacks this market with a product it claims is significantly faster and higher quality than Akamai’s multi-stage image downloading. Beyond images, the client-cloud architecture lends itself nicely as a differentiated way to compete with Akamai in the value-added services business by providing a true closed-loop for tasks like client-based security or intelligent client-side storage and caching, courtesy of the newer capabilities of modern browsers.

In general, Instart Logic is building a large portfolio of proprietary technology, with over two dozen patents pending, as a long-term moat against legacy CDNs. This includes the virtualization layer technology and other soon to be announced services that the company is working on. Instart Logic also recently announced PCI Compliance, a key requirement for e-commerce sites and any provider who wants to sell services to that segment of the market. Instart Logic is still in the early days and their products have only been in general availability for less than a year. But their team has already launched multiple product revisions and a few of their customers I have spoken with are very happy with their services and tell me they are excited about the road map that Instart Logic has shared with them.

Competition with Akamai is always hard for any vendor but the fact that some marquee media clients – like Washington Post and online retailer One Kings Lane – have opted to switch from Akamai to Instart Logic, shows that the newcomer is clearly getting their foot in the door in a market that Akamai considers its sweet spot. The funding from Kleiner Perkins, too, means that Instart has the backing of yet another major VC that bets heavily on getting to IPO. This can only happen if Instart Logic attains its goal of rapid sales and market growth and Instart Logic just hired a VP of marketing who has experience building businesses into the billion-dollar sales range, including lengthy experience at Cisco. Akamai always reacts vigorously to competition and this will likely be no exception.