CDN Fastly Wins Content Delivery Business For Amazon.com and IMDB Websites

I’ve been tracing a lot of content over the past 60 days to see what changes have taken place with the surge in certain types of content consumption, specifically across OTT video, Xbox and PlayStation software downloads and commerce sites. Over the past few weeks I’ve seen a change where images that use to be coming from Amazon’s CDN CloudFront, are now coming from Fastly for both the Amazon.com homepage and their IMDb website. This isn’t any sort of test or trial as it’s been consistent like this for a few weeks.

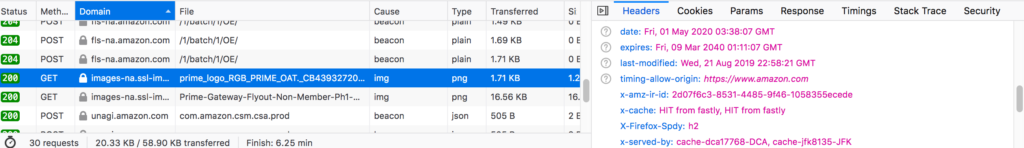

As you can see from the screenshot above, images from Amazon.com’s homepage are now being delivered by Fastly. While many CDNs are trying to grab a large share of the long-form video traffic and gaming downloads in the market, that’s business Fastly has mostly stayed away from. OTT video and software download traffic has very low margins, if any at all. Some of the largest customers get to set the price and CDNs that want that business don’t have much leverage to push back.

As you can see from the screenshot above, images from Amazon.com’s homepage are now being delivered by Fastly. While many CDNs are trying to grab a large share of the long-form video traffic and gaming downloads in the market, that’s business Fastly has mostly stayed away from. OTT video and software download traffic has very low margins, if any at all. Some of the largest customers get to set the price and CDNs that want that business don’t have much leverage to push back.

But with small object delivery, like images loading fast on Amazon’s home page, it’s the opposite. Customers will pay for a better level of performance and in this case, Fastly clearly outperformed Amazon’s own CDN CloudFront. This isn’t too surprising since CloudFront’s strength isn’t web performance, or even live streaming, but rather on-demand delivery of video and downloads. I can’t tell what volume of traffic this equates to for Fastly, but even though all the images are very small in size, it’s the home page of Amazon.com and IMDb, so it is substantial. Amazon.com is usually ranked in the top 15-20 largest websites, in terms of traffic by Alexa, and IMDb usually hovers around number 60.

While all of the commercial CDNs are typically group together from a product comparison standpoint, many of them really do target certain markets over others. Fastly does have some overlap with other third-party CDNs when it comes to media delivery, but not for the commoditized high-volume traffic. For video, they have fine tuned their network specifically for live and don’t want the kind of big SVOD traffic that many of the OTT providers have, since it requires a big capex spend, for little if any profit in return. And with pricing for the largest media customers having seen a big drop in the last quarter, Fastly continues to target customers that simply don’t want the lowest price around. That’s a good strategy considering the pricing I saw in Q1 on some of these large volume media deals are now down to the $0.0006-$0.0007 per GB delivered. At that price, it’s almost impossible to make money, unless you own the network or have some other kind of cost advantage.