Latest Data Shows What It Would Take To Convince Operators To Upgrade Their Video Encoding With New Codecs or LCEVC Enhancement

In 2020, over 80% of video streaming traffic still used the H.264 codec, which seems staggering when you consider we’ve had HEVC and VP9 around for quite a while and there are even more advanced options on the way (AV1, EVC, VVC, LCEVC). This isn’t news to anyone who is close to this stuff and has been widely discussed before, but we should be taking a frequent look at what continues to block progress in one of the most fundamental components of the streaming media stack.

I recently conducted a survey on behalf of compression experts V-Nova, and then moderated a webinar (which you can check out here) to discuss the results with Luis Vicente, CEO of sports OTT operator Eleven, and Karam Malhotra, Global VP Revenues for Asian top 10 video app SHAREit. The survey’s focus was on key barriers to improve the quality-of-experience operators are serving their customers. Over 200 senior business and technical decision makers responded from a broad range of industry verticals and the results provided some real food for thought. You can download all the results from the survey for free, at this link.

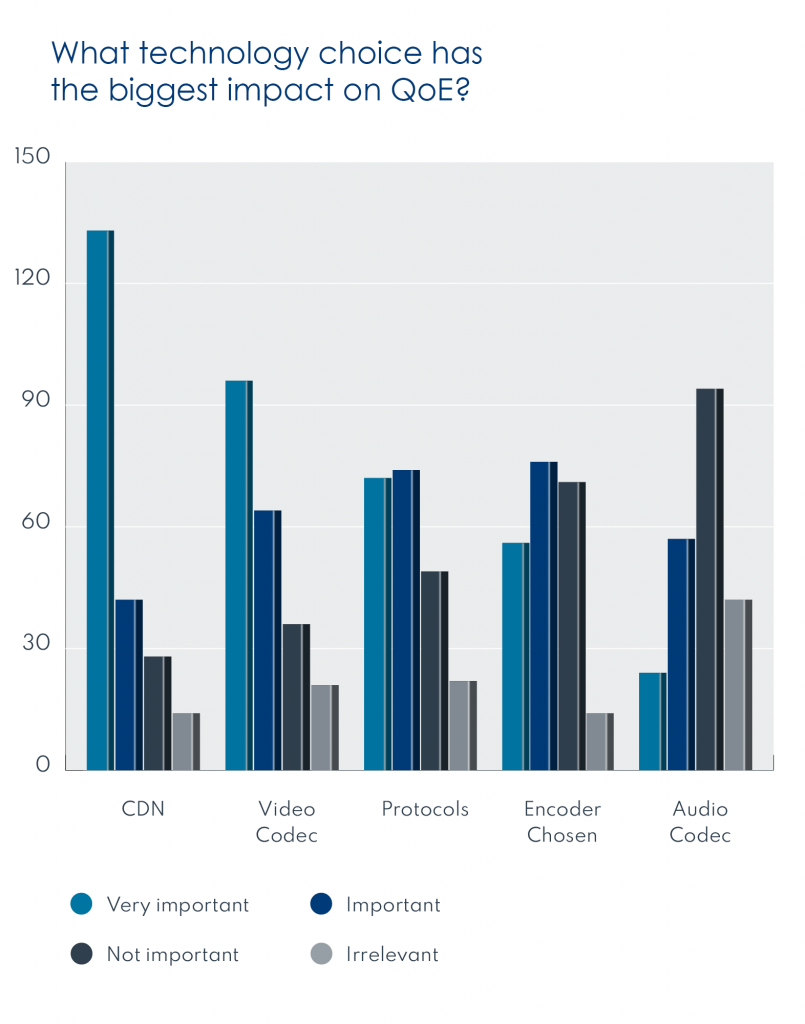

From the results of the data, it was enlightening to hear which components of their video delivery systems people think are most critical for QoE. CDN comes out top here and in my view that’s simply because it’s the easiest to measure and everyone’s first thing to look at. This is indicative in part of services tending to consider components like video codecs as a fixed constant because changing them is assumed to be a long-term project, which it doesn’t have to be. Interestingly, however, video codec came out close second in terms of relevance to QoE.

From the results of the data, it was enlightening to hear which components of their video delivery systems people think are most critical for QoE. CDN comes out top here and in my view that’s simply because it’s the easiest to measure and everyone’s first thing to look at. This is indicative in part of services tending to consider components like video codecs as a fixed constant because changing them is assumed to be a long-term project, which it doesn’t have to be. Interestingly, however, video codec came out close second in terms of relevance to QoE.

It stands to reason that deploying new compression tech and streaming equivalent quality at substantially lower bitrates improves QoE all round by accelerating start-up times, reducing buffering incidents, increasing the % of viewers that can receive higher quality ABR profiles and reducing the traffic load on those CDNs that appear to be taking most of the heat for QoE issues.

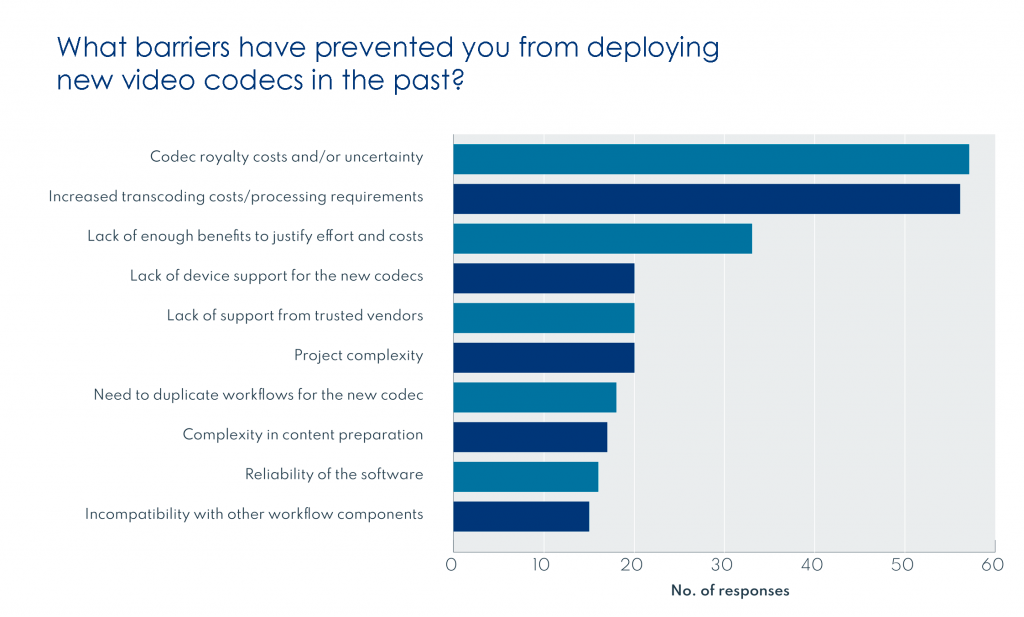

So, what are the barriers holding the industry back from moving video compression forward? As you can see below, the widely publicized royalty costs regarding uncertainties for codecs like HEVC have generated a lot of hesitancy. In addition, the increased operating costs of encoding and processing are an important barrier too. Furthermore, quite a few of the survey options on this one all point to the risk of incurring significant new costs from heavier compute requirements and the additional complexity that comes from duplicating workflows to serve different types of device. For many, royalty issues are so loud because in truth most people see unclear business benefits from deploying new video codecs and immediately incurring cost increases.

In addition, the increased operating costs of encoding and processing are an important barrier too. Furthermore, quite a few of the survey options on this one all point to the risk of incurring significant new costs from heavier compute requirements and the additional complexity that comes from duplicating workflows to serve different types of device. For many, royalty issues are so loud because in truth most people see unclear business benefits from deploying new video codecs and immediately incurring cost increases.

Despite these barriers to adopting new compression technologies, 33% of respondents reported that they are wanting to trial new options in the next 12 months, a clear acknowledgement of the need to find ways to progress somehow. This is possibly being driven by the clear need to differentiate in this evermore competitive entertainment space by launching more premium services like 4K and HDR, which 29% said they were intending to do in 2021.

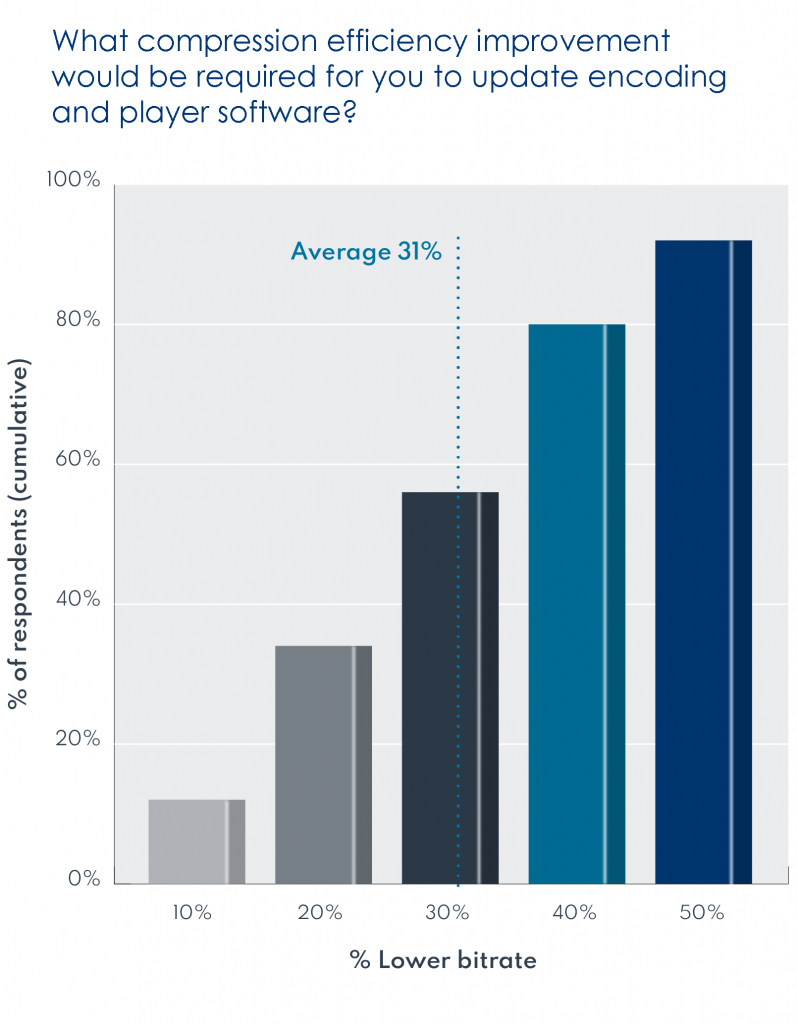

All of these survey results brings us to the question that really prompted me to do this survey in the first place, which is what would actually convince companies to upgrade their video encoding and reap the available QoE benefits? What are the key factors and where do they need to be to tip the balance?

Respondents were asked to quantify what sort of compression efficiency benefit would be needed (most easily expressed as how much could you reduce the bitrate and maintain equivalent quality). The average came out at 31% which is pretty well aligned with the typical improvement between codec generations (e.g. AVC to HEVC or VP9 to AV1) and also the uplift typically provided by using LCEVC enhancement with AVC or HEVC.

Respondents were also asked what reduction of transcoding costs would be required to convince them to upgrade (that big barrier from earlier). That came out at a very similar average of about 30%. The combination of the two answers is interesting, suggesting that transcoding efficiency is considered roughly as important as compression quality.

I then explored what impact on operating profitability would be generated by an improvement in compression tech meeting these sort of criteria. More than half of respondents felt that optimizing compression technology in this way would provide more than a 25% improvement in profitability. This is surely material, especially if we consider that improved QoE should also produce a benefit to the top line from better user retention and engagement.

A key takeaway from all of this data is that 52% of respondents don’t know what the primary cause of losing viewers from their service is, a key point that warrants more discussion another time.

The general theme that emerged from this survey is one of hesitancy to upgrade video compression because of an array of perceived complexity and cost risks. At the same time, respondents do recognize that improved compression could produce material business benefits. It’s the first time I’ve seen such a clear picture of the criteria that must be met to enable significant progress and an acknowledgement that the benefits to profitability are substantial. It’s also the first time that I see such a clear highlight on the importance of transcoding efficiency, tightly connected to the processing requirements of video codecs.

Objectively it looks like MPEG-5 LCEVC is well positioned to tackle the barriers this survey highlighted. A blend of significant improvements in compression efficiency, simple licensing terms and crucial reductions in the operational processing cost of encoding and delivery seems to be what’s needed to unlock things. It’s going to be interesting to see how that all plays out.

If you want to see all the results from the survey, you can download them for free, at this link.