(Note: Visit www.cdnpricing.com for the most up to date pricing) In the last few weeks, we've seen a lot of analysts and others commenting on CDN "pricing wars" but none of them are mentioning any actual numbers on what the CDNs are charging or showing any real data on the pricing trends. So with that in mind, I'll detail what the going rates are today, how they have changed from last quarter and who it's affecting most in the market. In many cases, the pricing wars are not as drastic as many make it out to be, as many times, services are not being compared equally. Also, a lot of customers still don't know what the going rates are and are still signing contracts at high rates.

As an example of customers who don't know the going rate, last week two content companies each of whom do over 100TB a month in streaming delivery called me asking for data on pricing trends. In both cases they said they were paying just above $0.40 per GB with Akamai. They simply didn't know that the going rate for 100TB a month is on average, between $0.12 – $0.19 at Limelight Networks, Internap or Mirror Image. And I'm talking straight vanilla delivery of video via streaming and progressive download, not some custom need or custom requirement.

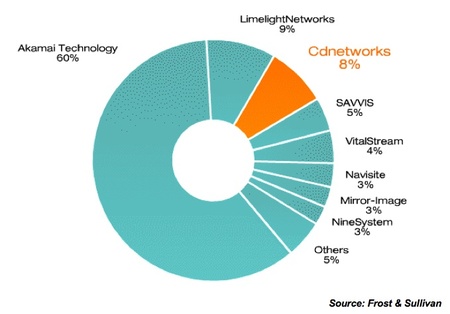

In many cases, Akamai is still getting paid 2x what the going industry rate is when charging customers on a monthly per GB delivered model. Now Akamai and others may say that Akamai is charging more due to a different level of service, reach etc…. but that can only be determined as being true or not true by the customer themselves who are comparing the same product from one CDN to another. That being said, Akamai is feeling the pressure to reduce it's pricing as more and more customers see that the pricing gap between Akamai and everyone else in the market has been so wide, for so long. Yes, two years ago Akamai was the only game in town for certain sized deals. But today, no one can argue that when it comes specifically to content delivery for video, there is more than just one option. With more providers in the market and some customers using a dual-vendor strategy, Akamai is no longer the only game in town for most deals.

Over the past 60-90 days, Akamai been aggressively cutting their pricing in half on large deals to be able to keep the business. While they are not matching the lowest pricing in the market, they are coming close to it on large deals, classified as over 100TB a month. I've heard from at least six customers in this time frame who have confirmed their pricing to me as being half what it was last year with Akamai on large deals. In some of these cases, when they negotiated these contracts six months or a year ago, the Akamai pricing was still the same. It's only in the last 60-90 days that Akamai has really started to reduce pricing on larger deals due to pressure in the market.

I'm also hearing that two year deals are not being signed as much and that customers are doing quarterly and yearly bandwidth commits with all the CDNs, instead of monthly commits. Another trend I am seeing is not bandwidth commits, but rather revenue commits where a company promises to spend X amount of dollars on any service with the provider over the course of a year. This practice is not new, but I am seeing more of them and they are more common with Akamai since they offer more than just CDN services. In many cases, the bundling of services other than content delivery for video is a major reason why many of the streaming only CDNs lose business. It may not be because their service is not as good as an Akamai, it's that they don't offer other products like whole site hosting, application delivery and other non-CDN products. For some customers this does not matter but for others it does and it's a deal breaker.

Every week, customers from the media and entertainment, broadcast, government and enterprise verticals call me asking for pricing data. They want to know who is out there, what they charge and what the going rate in the industry is. From all I have seen in actual contracts, RFP responses and pricing negotiations, Internap, Limelight Networks and Mirror Image are all about the same price wise. In many cases, Internap is a bit higher in pricing but I see most of that from the legacy VitalStream side and once Internap is finished integrating VitalStream into their network, I am curious to see if their pricing changes. It should go down since Internap owns the network and VitalStream didn't.

CDNetworks and EdgeCast would not share any actual pricing information with me so I can't say if they are around the industry average or are more expensive. And since they are new in the space, I have yet to see a customer who uses them or has included them in an RFP so I'll have to wait to see what they are charging. Panther Express is undercutting all of the CDNs out there on pricing BUT keep in mind, that they only support HTTP delivery, not content delivered via streaming media protocols. And there is a difference since HTTP is easier to deliver and costs less to scale. NaviSite's pricing I have not seen in awhile so I can't speak to their average rate. Since Doug Mow left the company I haven't heard anything from them or seen any RFPs that they have been included in. Same goes for VeriSign. I don't see them being included in RFPs and I have not heard of any customers of late that have signed with them. That's not to say that no U.S. customers have, but of the ones who call, none of them were using VeriSign. As for CacheLogic, they are working on a pricing model that charges customers not per GB delivered but per asset, so I really have no way to fairly compare them to the others since it's a different pricing metric. Level 3 is not yet offering streaming media delivery so we'll have to wait till Q4 of this year when their service goes live.

As for Amazon's S3 service, they don't do delivery. If you are interested in reading more about what Amazon does and does not do for CDN, read my post from two weeks ago entitled "Amazon Not Providing Content Delivery For Streaming."

Outside of the smaller regional service providers who are going after smaller customers, it leaves you with the P2P players and also companies like Move Networks. Keep in mind, many people think Move Networks distributes their own content – they don't. They use Mirror Image, Akamai and Limelight Networks to deliver their customers content. So I can't really compare Move Networks pricing to the CDNs since Move Networks uses them and it would not be a fair comparison anyway. The bottom line with Move Networks is that you pay a little more than you pay now to a CDN in order to use the Move Networks platform, that's the value they are offering, their platform and technology, not delivery. (My profile with Move Networks will be posted this week as well as an audio interview they did with Forrester)

That leaves you with the P2P players who to date, have not grabbed much market share or convinced content owners to move from CDN to P2P. In many cases, the P2P delivery networks are selling with the attitude of P2P "replacing" CDN instead of selling it as a compliment. Remember, it's about using the right form(s) of delivery based on the type of content you have, the format it is in, who the viewer is and the device it's being played back on.

So with all that being said, below is what the going rate is for streaming media delivery. These figures are based on actual contracts and RFPs I have seen in the market and comes from customers telling me on a weekly basis what they are paying. Since last quarters pricing, which I detailed here, the biggest change is at the 50TB+ per month commitment. Anything below 50TB+ has pretty much been level all year. Only above 50TB+ and really at 100TB+ is where the price has dropped from last quarter.

- 1TB: High, $2.00GB, Low $1.50GB (no change)

- 5TB: High, $1.60GB, Low $0.95GB (no change)

- 10TB: High, $1.20GB, Low $0.89GB (no change)

- 25TB: High, $0.95GB, Low $0.75GB (no change)

- 50TB: High, $0.50GB, Low, $0.40GB (Q2 high was $0.65GB, low $0.45GB)

- 100TB: High, $0.24GB, Low, $0.15GB (Q2 high was $0.29GB, low $0.19GB)

- Above 100TB: It's all over the map. I've seen it as low as $0.12GB.

Note that these are what the going rates are, not necessarily the rates that ALL customers are being charged. Also, I know some people are going to write in and say my hosting provider or co-lo facility gives me a cheaper per GB rate. But I am talking CDNs here, which I classify as those who serve video content via streaming media protocols from multiple locations in the U.S. and at least one other region of the world like Europe and/or Asia.

I've always felt that as a whole, CDNs try to keep their pricing too secret. Doing a little bit of work, it's not hard for anyone to find out what any provider charges and how that compares to the market. Yes, there are situations where the above numbers do not apply when it comes to a customer needing something specialized or custom, but that's not most of the time. I would encourage all CDN vendors to share more of their pricing data and metrics with the industry since it's not a secret anyway. What is the average per GB price that a CDN charges between all of it's contracts? Of the customers you sign up each quarter, how many of them are specific to CDN services and out of those, what percentage are specific to the delivery of video? There are a lot of metrics like this that providers could break out in the market.

Any provider who wants to use my blog as a way to share real data on pricing or any other aspect of their business, with actual numbers or ranges, you're welcome to do so in the comments section or you can write me directly and I will publish it or write a story about it with your input.