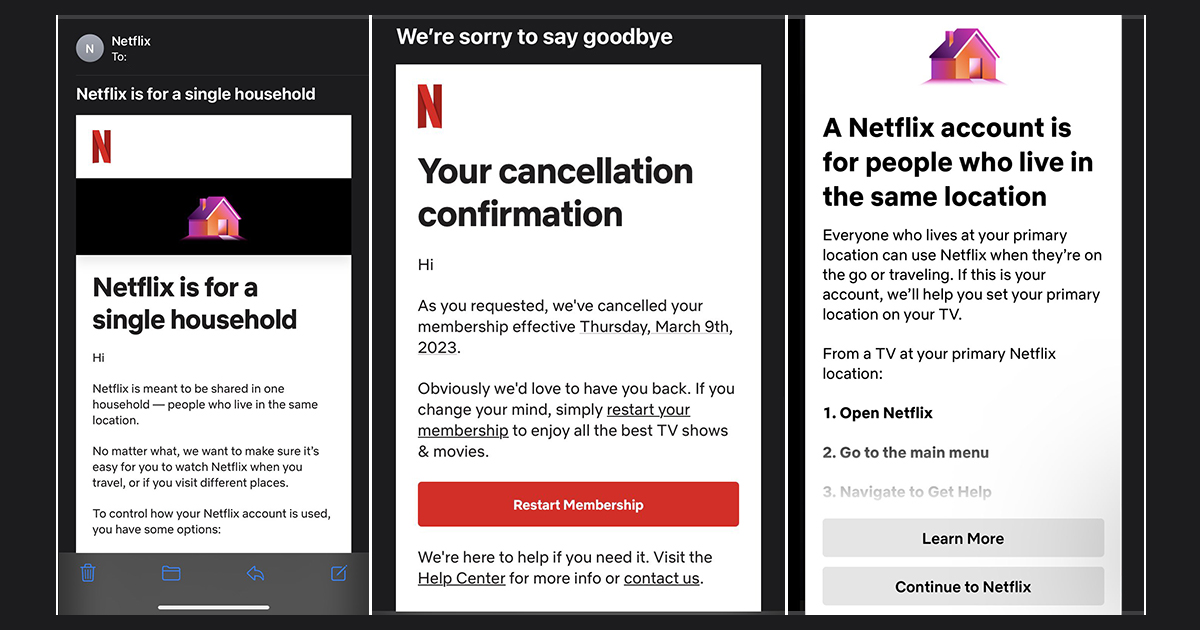

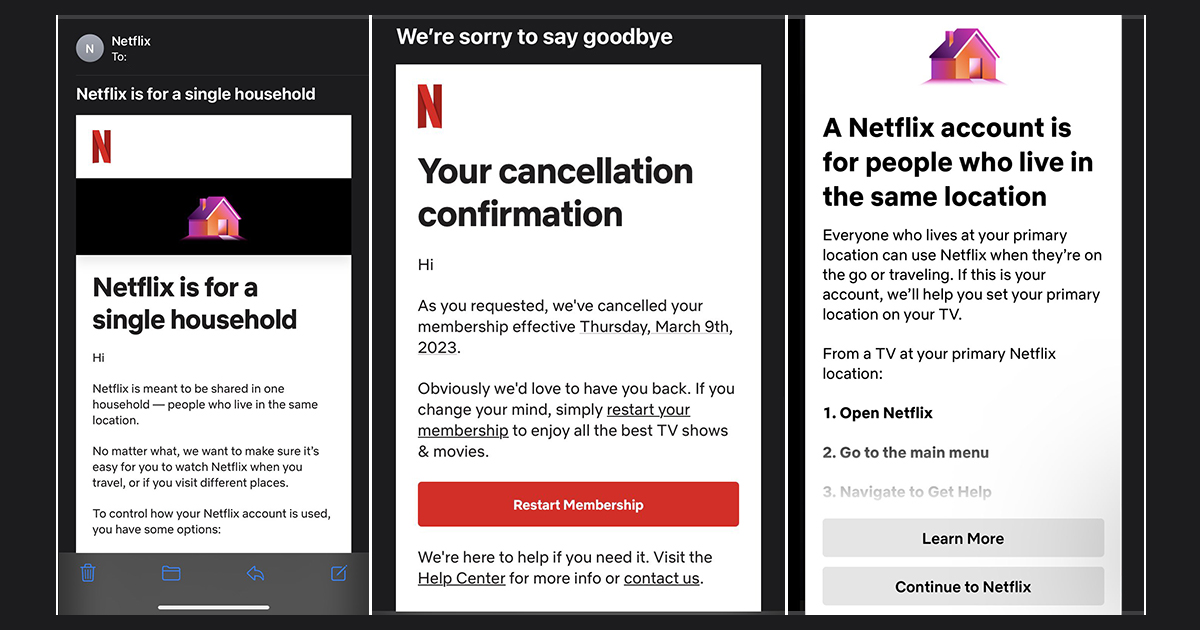

Netflix has a major problem. Since rolling out their new account sharing rules in Canada, New Zealand, Portugal and Spain, numerous problems with their policy have appeared. Customers have been left with a lack of details, confusing language, conflicting statements and instructions by Netflix support and a lack of transparency and clarity into how the new policy works. Over the past 48 hours, users are sharing their Netflix cancellation screens all over message boards and on social media.

Since the launch, I have spoken to more than a dozen friends in Canada, reviewed their accounts and chat logs with support and read through more than 1,000 comments on Twitter from consumers sharing issues they have encountered. I don’t say this lightly. Netflix has a very serious problem on their hands that needs fixing. If they roll out this new policy in the U.S. and other locations where they have the most subscribers, without making major changes, I think it will seriously hurt their subscriber numbers in a negative fashion.

The biggest problem Netflix has encountered is the poor job they have done in explaining to customers what has changed. Netflix is now enforcing that their service can only be used within a “single household”. Netflix has restricted their plan not based on who you are related to, but rather to a single address. As Netflix’s language states, “a Netflix account is for people who live in the same location.” While some might argue that Netflix has always said their plans were to be used by people living at the same location, that’s not how consumers think of it. In 2013, Netflix rolled out a new plan they called a “family” plan and while Netflix doesn’t use that term any more, that’s still how most of their customers think of being able to use Netflix, amongst family. Netflix may have changed their definition of a “household” a long time ago, but that definition has not changed in the eyes of consumers.

Some of the chat logs I have seen from Netflix support told users that if Netflix, “detects persistent use of a device outside of the primary account owner’s household, we may ask them to verify that device before it can be used to watch Netflix.” What is considered “persistent use” and what’s the methodology behind that? All I can find online is Netflix saying, “We use information such as IP addresses, device IDs, and account activity to determine whether a device signed into your account is connected to your primary location.” Netflix says that if you trigger this alert, you will have to sign into your account and verify the device based on a “verification code sent to the account owner email address”. Once you do verify the device, how long will the device work? Multiple users are reporting online that Netflix support has told them the device will be able to stream for 7-days and then will need re-verification. Online, I can’t find any mention of this.

If your kids are away at college, or deployed in the military, or you are charging your Tesla car at a Supercharger, based on Netflix’s language, these are use cases where you are no longer allowed to use the same Netflix account. Maybe you still can stream with your account, but the point is it’s unclear to consumers. When it comes to traveling Netflix says, “members can still easily watch Netflix on their personal devices or log into a new TV, like at a hotel or holiday rental,” but Netflix’s instructions online of how to do this are vague saying, “open the Netflix app on your mobile device(s) while connected to the Wi-Fi network at your primary location once a month and then when you arrive at the second location.” That might work for mobile devices, but what about a TV or device connected via ethernet at the second location? These instructions are found on the Netflix Canada FAQ page under the heading of “second home or frequent travel to the same location”, but what if it’s not the “same location” when traveling?

Adding to the confusion is language on Netflix’s site that says, “If you don’t watch Netflix on a TV or don’t have one, you do not need to set a primary location for your account.” Does that mean one can share their account with others outside of their primary location as long as Netflix is only being viewed on tablets and phones? Only a few days ago, on February 8th, Netflix tweeted out via their Netflix Canada account saying, “We know there’s been a lot of confusion about sharing Netflix,” and they provided a link to a short post on their website that lacks any details.

Starting on Saturday and now 24 hours later, going to Netflix’s FAQ page brings up a message that says, “We are currently experiencing a higher than normal wait time for support via phone and chat. Please try again later or check our online help center for answers to frequently asked questions.” It’s no wonder support is so busy.

Another issue that came to light is language on Netflix’s website stating that if you have two ISPs in your house, Netflix probably won’t work on both of them. Netflix’s Canada help page says, “If you have multiple Wi-Fi networks, we may only recognize one as your primary location. Devices connected to Wi-Fi networks that are using different ISP accounts or that have different external IP addresses may be blocked from watching Netflix.” If Netflix is using more than just IP addresses in their decisioning like they suggest, why would two ISPs be a problem? You could do a look up of both IPs and see they are at the same location.

There is also no explanation by Netflix of how devices will stream from within the same home, if they use ethernet to connect and not Wi-Fi. I have a TV in the basement where Wi-Fi doesn’t work, so it’s connected via ethernet. Based on Netflix’s language, the TV has to connect to Wi-Fi at least once every 31-days to be able to stream. Or maybe it doesn’t if it sees a similar IP on the device? In practicality, the TV connected to ethernet may work with no problems. But the point is, Netflix doesn’t address any of these questions anywhere online so consumers are making their own assumptions.

Another big question that Netflix doesn’t answer on their website or in any chat log I have seen to date is whether or not the account holder can change their primary location as often as they like. What do you do if you move? What if you rent a house for the summer and live at another location for a few months? What if you have a second home? Netflix says, “You can always update your primary location from a TV by connecting to your Wi-Fi,” but they don’t say how often you can do that. Will users have to do this every time they go on vacation and then change it back to their home addresses after each trip?

In response to a member of the military, Netflix support told them they would have to get a second account if they want to use Netflix in Canada as well as another country they might temporarily be stationed at, since Netflix’s new rules don’t allow you to add another person outside of your household in another country. Netflix is not taking into account people who work remotely for a living, traveling amongst different countries, which might be more people than ever in this new hybrid workforce. Netflix seems out of touch with how many in the world now work and the changes that have taken place since the pandemic.

In calendar year Q4 2022, Netflix had a Domestic (US and Canada) ARPU of $14.78, which doesn’t include any ad revenue. That means on average, for every user that cancels Netflix, they need two new people added to a Netflix account, at an average of $8 per user, just to make up for the user they lost. In my opinion, those seems like bad odds to take with the business.

Netflix knows that consumers gravitate to things that are easy to use. That’s been the hallmark of Netflix since the beginning. But with Netflix’s new account sharing rules, it is no longer convenient and consumers are confused. Netflix’s messing has been poor, its language vague and at times, conflicting. I can’t find any FAQ page on Netflix’s website that answers all of these questions on a single page. You have to click on multiple hyperlinked words, directing you to multiple pages to try and find more details. Online, some users are reporting they have cancelled their service simply due to the confusion and not having a clear understanding of how it all works, even if some of their assumptions are in fact wrong. Consumers don’t like uncertainty.

One would “assume” that Netflix is rolling this out in regions where they have fewer subscribers so they can learn from the experience and make changes for when they roll it out in the US, where they have the most subscribers. If this is not the case and Netflix rolls this out in the U.S., as is, they are going to see a volume of cancellations large enough to impact the numbers they give out to wall street, which we would see show up in calendar year 2023 Q2 earnings. I have no insight into how many consumers have already cancelled their accounts in the countries this has been rolled out in, or how many may have added a new user to their account, but as you can see online, this is a snowball rolling down hill.

Netflix should have made this simple by using simultaneous streams as the methodology to determine when you have to pay to add another user to your account. Customers would understand that metric and Netflix would not have to track IPs, devices, where a user was located or have users sign into Wi-Fi with devices every 31-days. If Netflix doesn’t backtrack on how they are rolling this out and realize how complex they have made it, their subscriber churn could get ugly.