AMD has announced a new 5nm based ASIC based media acceleration solution, that’s being marketed as the Alveo MA35D, targeting video streaming applications that are highly personalized and interactive by nature, demanding low to ultra-low latency. This PCIe accelerator card is designed to enable up to 32 x 1080p60 transcode channels using the AV1 codec, while also supporting the H.264, and H.265 standards. AMD says the card can achieve a full 1080p60 ABR transcode at 1W for reduced power consumption and cooling.

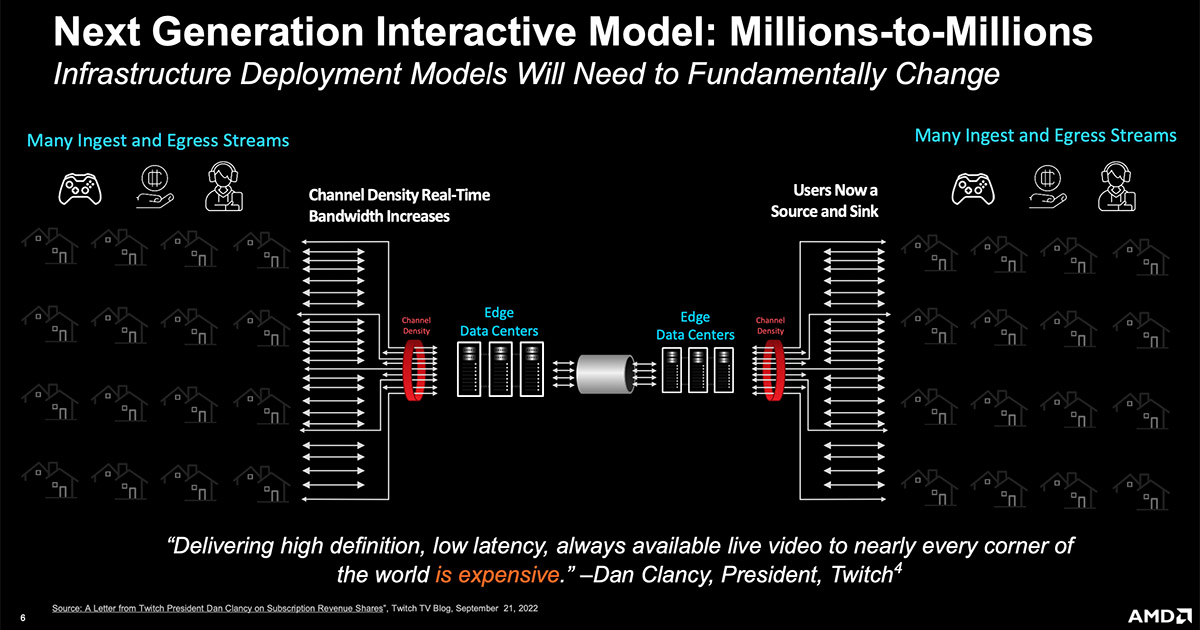

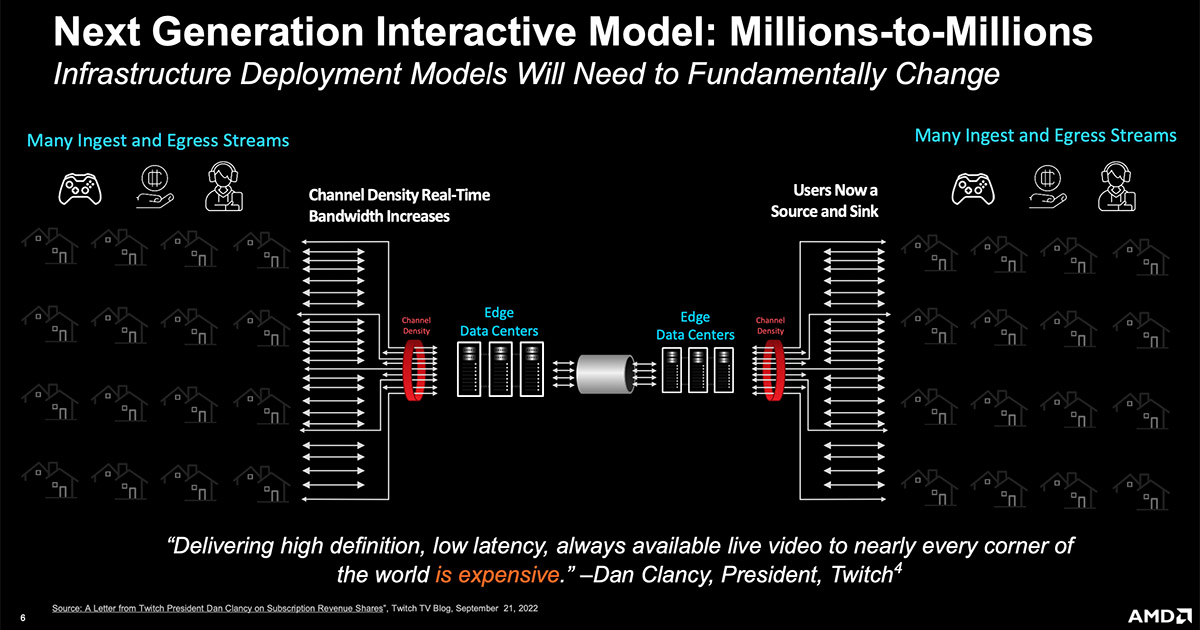

The Alveo MA35D is targeting the rapid growth of what AMD calls “Second Generation” interactive media applications such as cloud gaming, live eCommerce, watch parties, sports betting, as well as ‘blended experiences’ that integrate many of these services at once. AMD says they anticipated the upcoming opportunity for these use cases several years ago and recognized the challenges in terms of infrastructure and operating costs to scale broadly. Their solution can achieve ultra-low latency transcodes—8ms at 4kp60—by offloading the video pipeline with hardware acceleration of decoding (AV1, H.26x, VP9), scaling, compositing, encoding (AV1, H.264, and HEVC), and additional pre- and post-processing functions.

With this new chip they’ve integrated AI processing enabling “Smart Streaming” to improve perceptual visual quality while simultaneously reducing bandwidth consumption per stream. During my discussions with Sean Gardner (Head of Strategy & Market Development) from AMD Video Acceleration group he stated that, “by creating an AI-enabled, intelligent video pipeline, customers will no longer be tied to the historical inefficient ‘configure for worst case scenario or Set & Forget’ approach when configuring and operating their video transcoding services. Now they will be able to adjust settings dynamically. While this new intelligent, dynamic processing will be able to demonstrate a 25% bandwidth reduction under certain conditions and content types, AI is not fool proof.”

It makes sense that this is why AMD has instantiated a VQ feedback loop. This VQ feedback loop integrates a hardened IP block that monitors in real-time, every frame coming out of the encoder, analyzing the dynamic changes being driven by the AI processing unit to ensure they are operating within the target QoE/QoS range set by the operator. According to AMD what makes this significant is the fact that not only can they do this in real-time but at full density, providing the ability to transcode 32 channels of 1080p60 using AV1 and consuming 32W for this use case.

There is significant excitement in the industry around the development of video applications with new engagement and monetization models. AMD says it worked closely with leading providers to understand both their technical requirements and infrastructure challenges and tailored their new platform to meet the streaming density, performance, power-efficiency, and most importantly—cost-effectiveness—to scale these use cases. The 35W, HHHL PCIe card is priced at $1,595 USD MSRP, sampling to key customers today and will be in full production in Q3 of this year.