Over the past few weeks, everyone in digital media circles has been talking about the HEVC/H.265 video coding standard including who’s adopting it, how much it will cost to license and what the launch of the Open Media Alliance might mean. The spotlight on video has burned so bright that next-gen audio has not been covered at all. This relative obscurity is unwarranted, however, given both the complementarity of these two next-gen technologies and the imminence of important standards-based decisions.

There have been dramatic technological improvements in audio ready to be broadly deployed and adopted to support the advanced video features about which everyone is talking. As consumers flock to update their home theaters, and also their mobile devices, the pressure is on to deliver something that also sounds fantastic. And 3D audio delivers that perfect complement to 4K UHD content.

Using 3D audio, sound sources can be placed in virtual locations. This allows audio to sound as if it is coming from any direction—such as from behind, above or below a listener—regardless of the location of the speakers. Proponents of 3D audio describe it as an “immersive technology,” and for anyone who has experienced it, it seems almost unreal, clearly a step-change in user experience.

As with any new technology, a “Beta vs. VHS” watershed moment for adoption is likely to happen. For 3D audio, that moment could be a decision expected this fall concerning “ATSC 3.0” by the Advanced Television Standards Committee. By way of background, the ATSC is a global nonprofit whose membership includes broadcasters, electronics manufacturers, broadcast equipment makers, regulators and related experts. ATSC ushered in the era of digital television, and its new standardization process is being watched closely by many industry observers for TV and beyond. Its 3.0 audio and video selections will potentially be deployed in billions of devices and content titles over the next decade. For video, the main contender is HEVC. For audio it’s up for grabs, with MPEG-H 3D Audio and AC-4 vying for adoption. Another technology, DTS had been in contention as well, but it has been withdrawn from ATSC consideration.

The ATSC’s decision on audio is expected to occur in October, and a host of technical issues are being debated and carefully evaluated concerning, among other things, readiness for adoption. But as anyone familiar with standards would tell you, however, it’s not only about technical features and readiness for adoption. A major issue to be discussed and debated by the ATSC and certainly by industry relates to intellectual property rights and to licensing. The business model supporting a large number of innovations in the audio and video industries consists of sophisticated R&D outfits investing heavily in creating improved generations of technology (and, of course, patenting the resulting inventions), and then licensing those technologies and intellectual property to industry adopters.

The Dolby AC-4 technology is standardized through ETSI and Dolby has submitted a licensing declaration to ETSI. Just last week Dolby published some details on their program and pricing. To get some more details about all of this, I spoke to the experts at Black Stone IP who track the audio licensing market very closely. Elvir Causevic and Ed Fish from Black Stone IP told me that from their review of ETSI declarations, “it appears that Dolby is the only one with patents covering AC-4 technology”. This is consistent with Dolby’s history, where they traditionally have all, or nearly all, of the patents required for their technology. The announced licensing rates at high volume, for the entire system (plus software, support, etc.) is at $0.15 for mobile devices.

As concerns MPEG-H 3D, this Audio standard was developed by the ISO/IEC Moving Picture Experts Group (MPEG), and the normative requirements were formalized as the MPEG-H 3D Audio Main Profile. Black Stone IP recently published a research report utilizing publicly available data, including available patent and pricing information, to arrive at an estimate of what licensing the MPEG-H 3D Audio Main Profile will cost.

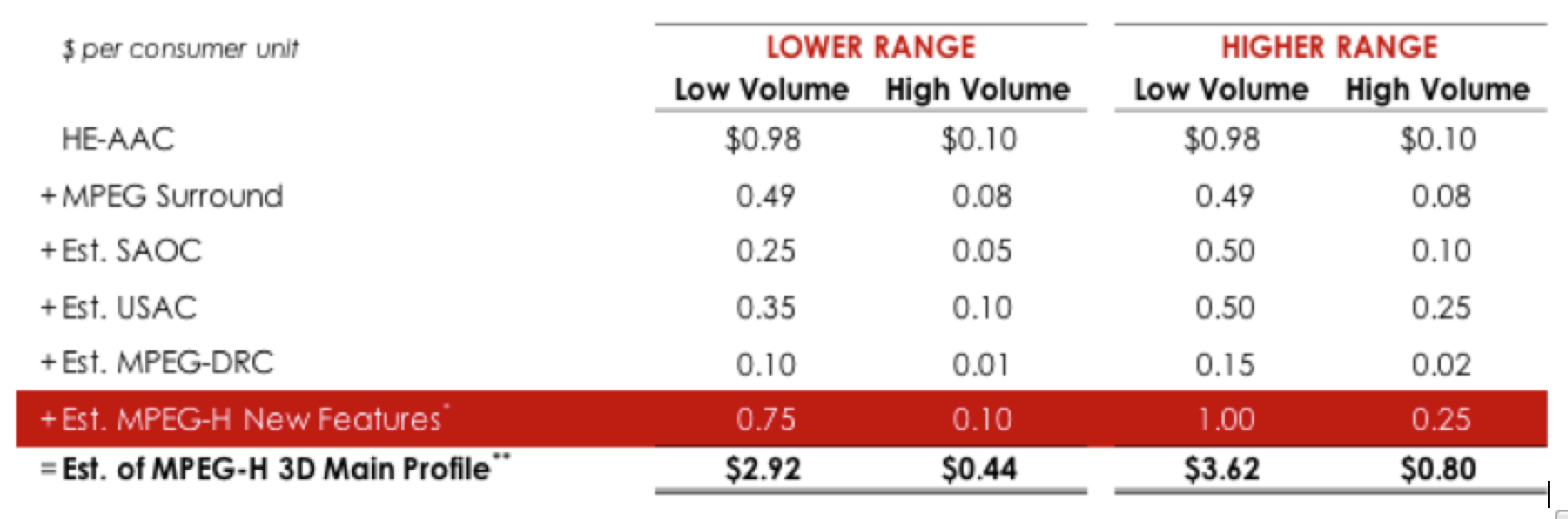

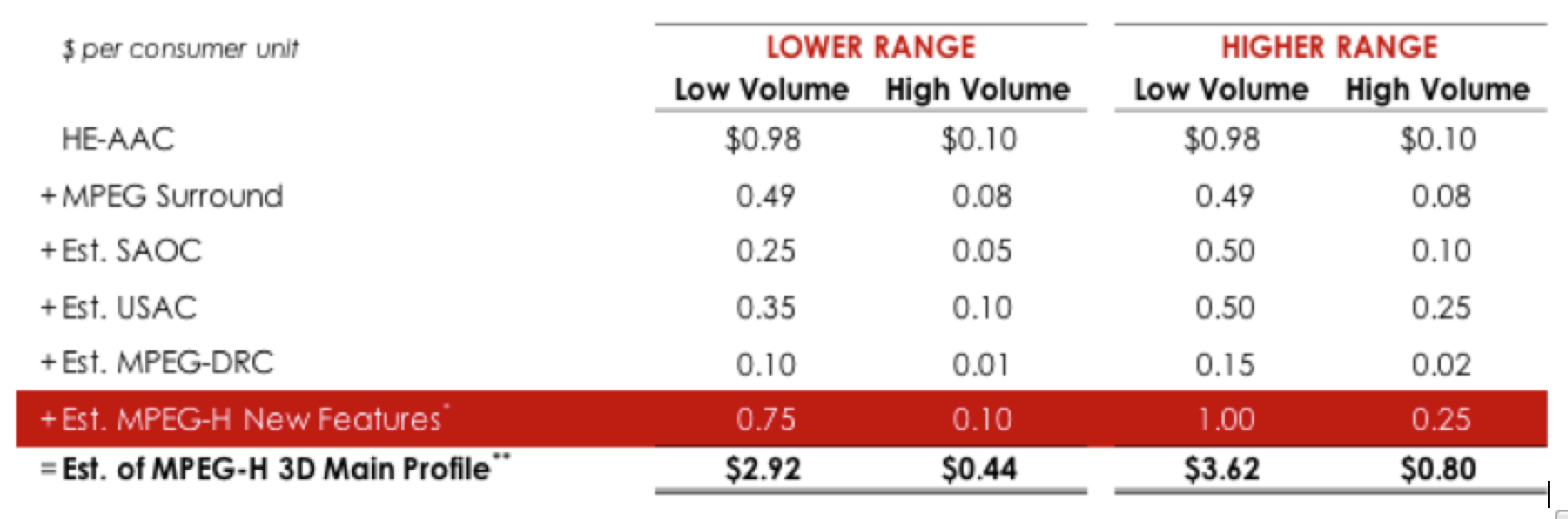

Black Stone IP says that for MPEG-H 3D Audio, the implementation of the full standard in its “Main Profile” requires incorporation of six underlying standards, meaning that licenses may be needed from numerous patent holders and even patent pools in the U.S. and around the world. Those six standards are HE-AAC, MPEG- Surround, SAOC, USAC, MPEG-DRC, and finally the specific “new features” unique to MPEG-H, such as “higher order ambisonics.”

Black Stone IP has estimated that the aggregate MPEG-H 3D Audio Main Profile per-unit royalty payment, for a low-volume product, in the 500,000-unit-shipment range, could be in the range of $2.92 to $3.62. In the case of higher-volume products, in the 75-million-unit range, estimated payments would be expected to be lower, varying in the range of $0.44 to $0.80, as detailed in the table below. Black Stone IP mentioned that they could not exclude the possibility of some MPEG-H 3D Audio Main Profile patent holders asking for content-related service fees (not to be confused with “content fees,” which it has not seen being proposed).

Recently, two of the three MPEG-H Audio Alliance licensors, Technicolor and Fraunhofer, announced a program license for their patents “based on a comparatively small but still powerful subset of the MPEG-H 3D Audio standard,” with pricing from $0.15 to $0.99, depending on volume, and no content-related services fees. It is not clear to Black Stone IP, however, which features and tools from their category “MPEG-H New Features” or other underlying standards are included in this license pricing, despite a careful study of the announcement and publicly available materials. While this issue may be cleared up in future announcements, there will be natural concerns as to which features may be avoided from the implementation and what will be the feature set and quality of what is left. In its analysis, Black Stone IP counted over 2,000 individual company patents and patent applications that have potential applicability to MPEG-H 3D Audio Main Profile, across dozens of companies, some of which very sophisticated IP licensors.

Recently, two of the three MPEG-H Audio Alliance licensors, Technicolor and Fraunhofer, announced a program license for their patents “based on a comparatively small but still powerful subset of the MPEG-H 3D Audio standard,” with pricing from $0.15 to $0.99, depending on volume, and no content-related services fees. It is not clear to Black Stone IP, however, which features and tools from their category “MPEG-H New Features” or other underlying standards are included in this license pricing, despite a careful study of the announcement and publicly available materials. While this issue may be cleared up in future announcements, there will be natural concerns as to which features may be avoided from the implementation and what will be the feature set and quality of what is left. In its analysis, Black Stone IP counted over 2,000 individual company patents and patent applications that have potential applicability to MPEG-H 3D Audio Main Profile, across dozens of companies, some of which very sophisticated IP licensors.

Comparing Video Licensing Costs and Audio Licensing Costs

Consider video IP licensing costs for HEVC. One patent pool, led by MPEG-LA, has announced a single rate of $0.20 per unit for all devices and regions. A second pool, HEVC Advance, announced a range of pricing, with lowest cost of $0.50 for mobile devices in Region 1 markets, and $0.25 in Region 2 markets. Other patent holders not in the two existing pools have yet to make public announcements on their requested HEVC licensing rates.

With estimated MPEG-H 3D Audio main profile licensing at a cost of $0.44 – $0.80, at best, for high volume, one can see that implementors should pay close attention to, and consider potential licensing costs of, audio in parallel with technical evaluations of 3D audio.

3D audio is transformational and critical for wider adoption of next generation consumer devices, and may, in fact, influence the timing of adoption of video as well. Many consumers consider audio an important factor in the hardware system they purchase for the playback of video. As the ATSC and the entire media industry consider which audio technology should be paired with HEVC for the new generation of home theater and other applications, it seems evident that a fine balance needs to be struck between the commercial quality that consumers now require and the pricing of intellectual property licenses that will be needed depending on solutions chosen.

According to Elvir Causevic, Black Stone IP’s CEO, “while industry attention all summer has focused on the next generation video standard, the ATSC’s decision in October will be an important moment for the next generation audio technology that is key to the home theater consumer experience. As with any standard, IP licensing costs and predictability should be a critical part of the assessment.” I will try to provide a follow up post next month after the ATSC makes their decision. For more on this topic, check out Black Stone IP’s recently published reports.

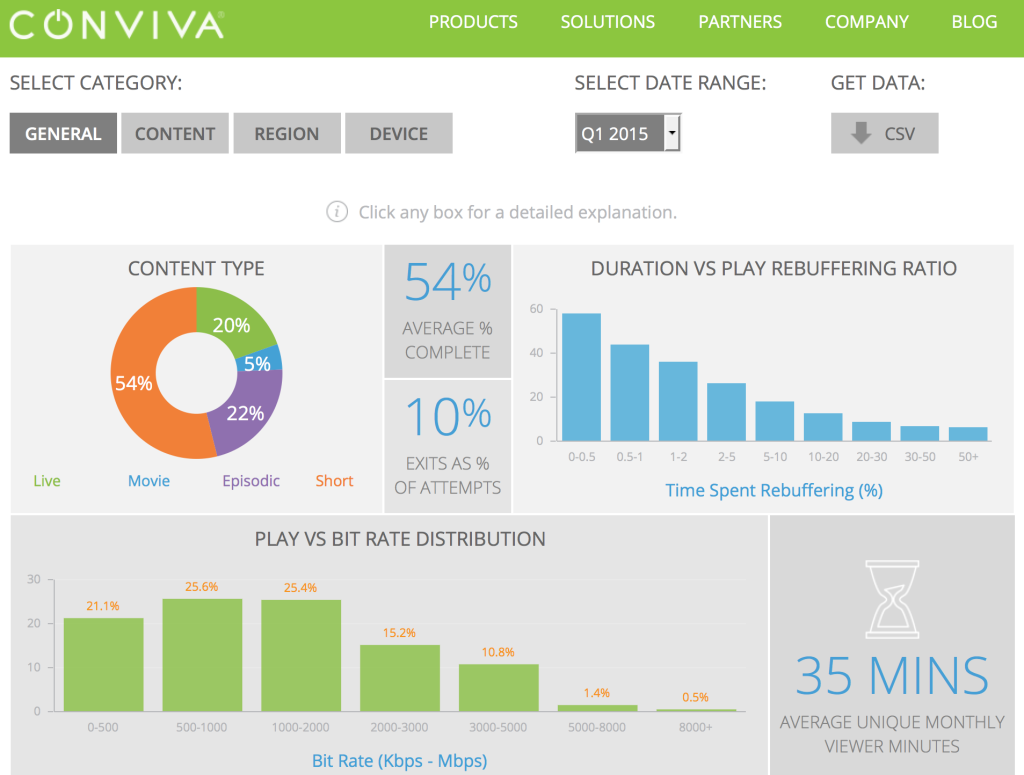

The source of the data is comprised of Conviva’s global intelligence network and includes data from premium media companies including HBO, ESPN, Viacom, CBS, Sky, Foxtel, and Yahoo. This information can be used to assess performance of Internet delivered video for benchmarking purposes, for geographic expansion, or for evaluation of the success of an OTT offering. Conviva has made it simple for analysts and others to download the data so that business analysts might draw high-level insights into the performance of streaming videos. Conviva gave me some additional details on the data collected and the methodology:

The source of the data is comprised of Conviva’s global intelligence network and includes data from premium media companies including HBO, ESPN, Viacom, CBS, Sky, Foxtel, and Yahoo. This information can be used to assess performance of Internet delivered video for benchmarking purposes, for geographic expansion, or for evaluation of the success of an OTT offering. Conviva has made it simple for analysts and others to download the data so that business analysts might draw high-level insights into the performance of streaming videos. Conviva gave me some additional details on the data collected and the methodology: