Streaming ARPU Rises in Q3 Due To Higher Pricing, Lower Wholesale Subscribers

With all the OTT price increases in 2023 and the recent launch of new AVOD tiers, the ARPU (Average Revenue Per User) metric is becoming one of the most critical data points that OTT services and Wall Street are closely tracking. The number of net new subscribers added each quarter is still an important metric, but OTT services can have fewer subs and more revenue as long as they increase how much money they are getting from subscribers each month. More importantly, with many streaming services projecting to reach profitability this year, a higher ARPU can help them achieve that faster, even with fewer subs.

Comparing ARPU data from previous years to today is difficult since streaming services have raised pricing more frequently than before, and many have also rolled out services internationally with different pricing and, in some cases, bundles that offer promotional pricing. In addition, streaming services make less per wholesale subscriber; for instance, what Verizon pays Netflix per subscriber in the Verizon bundle, and higher or lower advertising revenue can also skew the numbers, either way, each quarter. Services that offer a discount when you pay for a year in advance would also see their ARPU numbers skewed based on how many users sign up for the 12-month plan.

Some are unaware that streaming services get paid less monthly for wholesale subscribers. Still, Disney, for instance, includes this language in their financials, saying, “Wholesale arrangements have a lower average monthly revenue per paid subscriber than subscribers that we acquire directly or through third-party platforms.”

Adding to the complexity are new advertising-supported plans that can initially lower ARPU but have the potential to make up the difference, or even more revenue, over time. Almost no OTT service breaks out their advertising revenue from their overall SVOD ARPU, with Fubo being the lone exception.

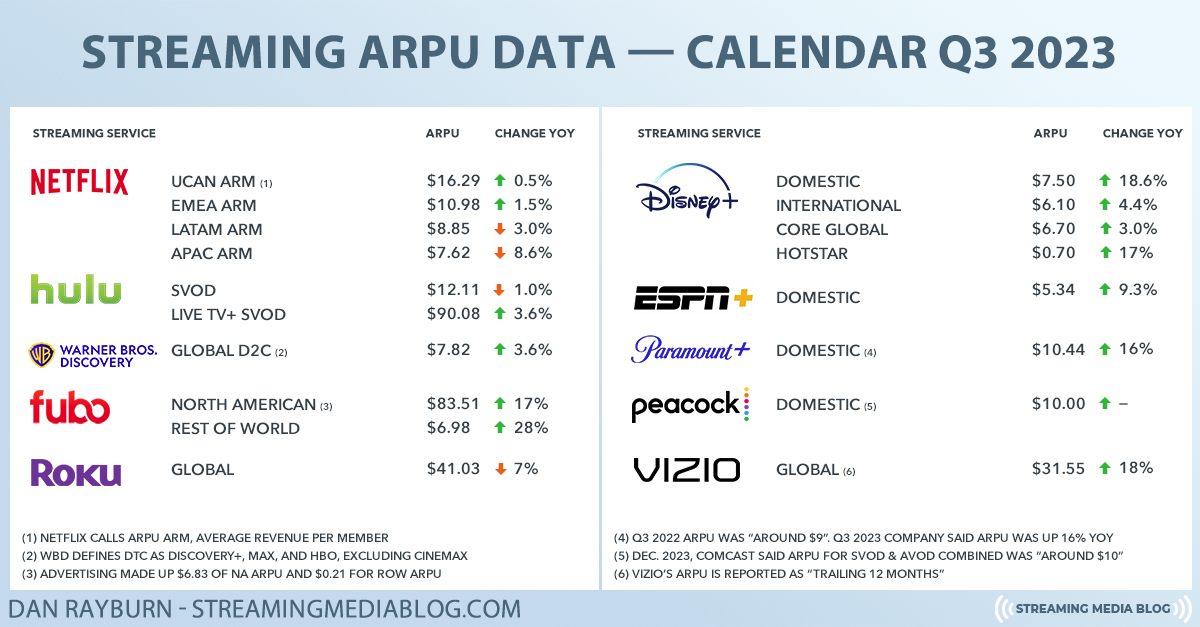

The chart includes a breakdown of ARPU for streaming services based on publicly available data from earnings, interviews, and SEC filings. All numbers are from calendar Q3 2023 or the last time ARPU was given out, which is noted. The growth or decline number excludes the year-over-year effect of foreign exchange rate movements. Just as Netflix reports it, the numbers assume foreign exchange rates remained constant with foreign exchange rates from each prior-year period’s corresponding months.

These streaming services were left off the chart due to their previous ARPU data being old:

- iQiyi: China ARPU, $2.17, SVOD and AVOD combined (Up 12%)

- Eros Now: India ARPU, Premium subscriber, SVOD and AVOD combined, “in the range of $1.20 to $1.30”, per regulatory filing (Last reported Q4 2022)

- Lionsgate Play: India ARPU, $0.50, SVOD and AVOD combined (Last reported Dec 2022)

- Starz: Domestic ARPU, “around $6”, SVOD (Last reported Q3 2022)

No ARPU data has been released for services including AMC+, Acorn TV, Amazon Prime Video, Apple TV+, CuriosityStream, DAZN, Epix, Freevee, MotorTrend TV, NFL+, Sling TV, Tubi, YouTube TV, Tubi, Pluto TV, BritBox, and many others.