Harmonic Doing a Strategic Review of Their Video Business but Doesn’t Need to Sell

During Harmonic’s Q3 earnings call the company announced they will undergo a strategic review of their video business. While some are suggesting this means their product line is having problems, is not a sign of weakness with the video business or with the company. The company has a responsibility to shareholders to conduct a review when other companies have shown interest in potentially acquiring part of their business and Harmonic commented that they are looking at their “capital allocation priorities over the next several years.” These are steps good companies take to evaluate their business in the mid to long term.

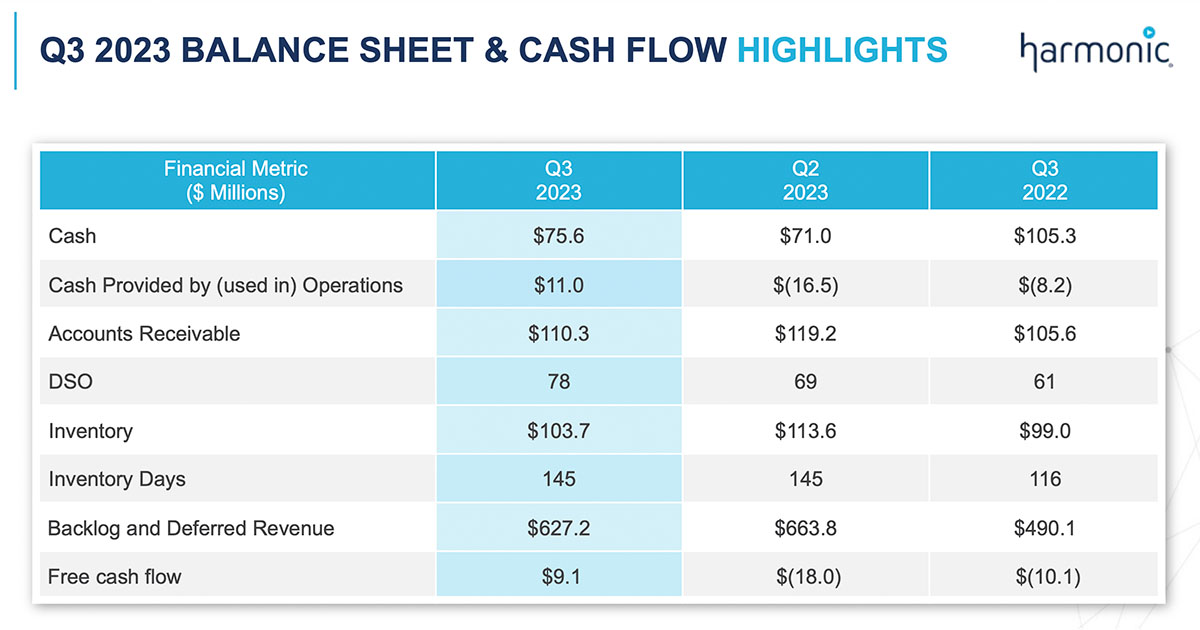

As of the closing price of their stock on October 31, in the last 5 years, Harmonic’s stock has given investors a 75.16% return (Earlier in the year the return was 337.81%). They generated free cash flow of $9.1M in Q3 and have $75.6M in cash plus another $6.3 million in short-term investments. They guided to a range of $80-$95M in cash for the end of Q4. Their gross margins for all their business lines have been consistent with very little decline.

Revenue growth for the video business was down year-over-year, but that’s not surprising considering how long sales cycles are taking. Half of their new SaaS wins in the quarter were with historic appliance customers so there will be some time needed to transition from on-prem to cloud. Their video SaaS revenue made up 24% of all video revenue in the quarter and is growing. For Broadband they said they still expect to see a rebound in Q4 and the potential to hit record revenue in the quarter.

Harmonic has a healthy balance sheet and are in the driver’s seat of what they do with any of their business lines IF they were to choose to sell something off. The one big risk to the business is that Comcast represents 41% of total revenue, so a high concentration like that is always a risk but is something that is well known.

Don’t let people distract you from the actual numbers especially when they are comparing Harmonic to private companies and making references to other companies “growing faster” or having “great results” when they don’t know their numbers or break any of them out. Even some of the companies who are public that they are comparing them to haven’t even put out Q3 numbers yet.