Updated: Apptopia Updates Language To Make Their Blog Post Clearer, About OTT App Mobile Downloads

[Updated Feb 11th: I’ve changed the original title of this post because while the company didn’t notify me of this, I see that Apptopia has edited the language in their blog post and has added the words “on mobile”. This makes it clearer that they are now only specifically talking to mobile devices. I still don’t agree with them using the term “new user”, since they don’t know if the user is new, and can’t track if the person even opened or used the app they downloaded, but at least they added some additional words to make it clearer.]

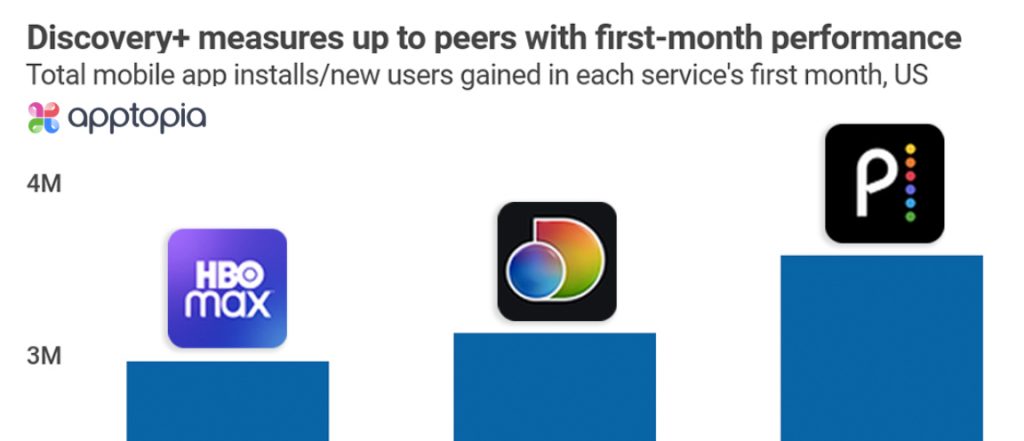

In a February 4th blog post talking about how many downloads Discovery+ had compared to other OTT services, Apptopia said, “During Discovery+’s first month live, HBO Max gained 3.4M new users, and Disney+ gained 3.6M. Peacock TV, on the other hand, only gained 1.9M new users.” These OTT related numbers they are giving out are not factually accurate as presented and are not “new users” of a streaming service. My private checks with some OTT services only confirms what is clear, the data and terminology Apptopia is using is flawed, with many non-existent definitions around the words they are using that’s adding confusion to the OTT market.

AT&T did not break out the number of stand-alone HBO Max subs they acquired in Q4, nor new subscribers, and they didn’t break out any numbers for January of this year. Apptopia calls their numbers “new user growth”, but when I reached out to Apptopia for this post, the company confirmed they can’t measure a new user or a “paying subscriber”. I downloaded the HBO Max app two times in January both for new iPads I acquired, but I was already a subscriber to HBO Max. So clearly my downloads should not be counted as a “new user” like Apptopia says I am. You also have users who watch content via streaming boxes, (which Apptopia doesn’t measure) and might add the mobile app at a later time. These are not “new” users of an OTT service. You also have the instance where someone might get a new mobile phone and have to re-download their app again. All of these use cases, Apptopia defines them as “new users”. On their website Apptopia says they “estimate” first time downloads, but don’t say how they do that or give any details. Their entire FAQ page on methodology is vague with almost no definitions.

It should also be noted that in Q4 AT&T disclosed an updated number of HBO Max “activations”, but they define activations as a “download of the app”, that’s it. You don’t even have to open it or create an account, so an app download does not equal a paying or new customer, hence why AT&T is very specific (and correct) with their language. And yet, Apptopia is using language of “new users gained,” which is not accurate. It’s also the reason why when NBCU talks about Peacock TV they specifically use the term “sign ups”, as they note that a sign up does not equal a “new user” or “subscriber”. Apptopia told me that in the “mobile app industry”, a download is considered a “new user”. Peacock TV and HBO Max are not “mobile apps”, they are OTT services where mobile viewing is one of the many ways you can consume the service. Apptopia’s definitions, headlines and conclusions are flat out wrong.

Apptopia also says, “for engagement, the US app (Discovery+) averaged just shy of one million daily active users in its first month (990K), giving it a stickiness score of approximately 62% (stickiness = DAU/MAU).” In the post, Apptopia doesn’t define what a “daily active user” is so I reached out to the company who pointed me to a definition on their website that says DAU is, “the number of users who opened the app at least once in the last 24 hours.” The problem with that definition is that Apptopia is using DAU’s to also define “engagement”, and putting a “stickiness” score on an app, with a false definition of engagement. Anyone in the video industry knows that engagement is measured by watching video, not just opening an app. Apptopia told me, “we do not have the ability to determine what users are doing once inside the app,” and yet they still put out a “stickiness score”, even though they can’t see true engagement within the app itself.

Apptopia’s Tweet about their blog post says Discovery+ has, “more new users than HBO Max gained in its first month live.” That’s not even close to accurate since Apptopia doesn’t measure OTT services on smart TVs, Roku boxes, Apple TV or desktop web browsers. Saying how many “new users” an OTT service has, for the entire month, when they don’t measure anything on streaming media boxes is simply false. And nowhere does Apptopia use words like “estimate” or imply this is their opinion, they state these numbers as facts. I’ve also seen Apptopia previously use phrases like “streaming sessions”, but there is no definition to go along with it. What is a streaming session?

Apptopia says that because they provide data on more than 7 million apps, “it would be hard to match every industry’s and every company’s exact terms to our own.” That’s a lazy and terrible excuse. When you are giving out data, and selling it to others, the data is only as good as the methodology you are using AND your explanation of what it means. Any company that is going to use slices of their data to say one company/service is doing better or worse than another has a responsibility to use the right terms, with definitions and transparency. Apptopia is doing none of these things with the OTT data they are presenting.

For those in the OTT industry, analysts and members of the media that cover the space, please don’t use Apptopia’s data to describe the success or failure of any streaming service. It’s hurting our industry when the data is used and it creates confusion and false expectations in the market.

Note: I reached out to Apptopia’s CEO before publishing in the hopes of having a deeper conversation than I did with their Head of Communications, about Apptopia’s terminology and methodology, but I never heard back.