CDN Video Traffic Update: Higher Demand for VOD Content and Software Downloads, Offset By Loss Of Live Sports

Over the past week I’ve spoken to nearly every major CDN, many ISPs, as well as dozens of content owners to get an accurate sense of the traffic growth they are seeing for live and on-demand video streaming. Based on those I talked to, overall traffic growth specific to video on third-party CDN networks was up between 12%-20% in March, when compared to February. Video on demand traffic and game downloads are up, as one would expect, but overall video traffic growth isn’t higher as some might think, due to the loss of live sports.

Over the past week I’ve spoken to nearly every major CDN, many ISPs, as well as dozens of content owners to get an accurate sense of the traffic growth they are seeing for live and on-demand video streaming. Based on those I talked to, overall traffic growth specific to video on third-party CDN networks was up between 12%-20% in March, when compared to February. Video on demand traffic and game downloads are up, as one would expect, but overall video traffic growth isn’t higher as some might think, due to the loss of live sports.

While the media is quick to use all kinds of numbers when talking about the growth of streaming, use cases like video conferencing and multiplayer gaming has little to no impact on the CDNs. It’s important to know which services use third-party CDNs, what technology they are using and which online services deliver a lot of the content themselves.

Zoom and other web collaboration services are designed as one-to-few solutions, not one to many, like webcasting based offerings that use streaming media technology. The majority of services like Zoom don’t use CDNs to deliver their video. Sometimes they rely on third-party CDNs for the caching and acceleration of APIs or other pieces of content that are very small in size, but that doesn’t drive much in the way of additional traffic to CDNs. [Side note, this morning Zoom said it’s daily meeting participants went from 10M in December to 200M in March.] And when it comes to multiplayer gaming, third-party CDNs don’t deliver any of that video. None of that video goes across their network.

CDNs do deliver software downloads of games like Fortnite and Call Of Duty and CDNs are seeing a big growth in that traffic. To put it in perspective, a two-hour movie streamed at 4.5Mbps takes up just over 4GB of data. The last COD update on the PS4 in February was 51GB in size, the one before that was 53GB in size, and the COD 1.18 update that rolled out on March 27th was 11.5GB in size. The last three updates combined were over 115GB of data, for just one game. That’s equivalent to watching 29 movies, at two hours each, encoded at 4.5Mbps. This is why when CDNs like Akamai and others report earnings they always mention that “software downloads” was the big driver in the media vertical.

This isn’t to say that third-party CDNs deliver all of these game downloads. Many ISPs utilize virtual servers from the game companies/platforms to help deliver the content inside their networks, but some third-party CDNs certainly do benefit. It should be noted though, this is not “video” traffic, it’s software. So for all the media reports saying “streaming” is the biggest driver of growth for CDNs, many times that’s not accurate. “Gaming” is a use case, it’s not a “type” of delivery. Talking to ISPs in the U.S., March 10th was the largest day of traffic on their networks so far, even surpassing any traffic they have seen since then. ISPs told me that Xbox One and PS4 game download traffic was up “40%” on average that day, with one ISP saying the traffic was up “62%” on the 12th.

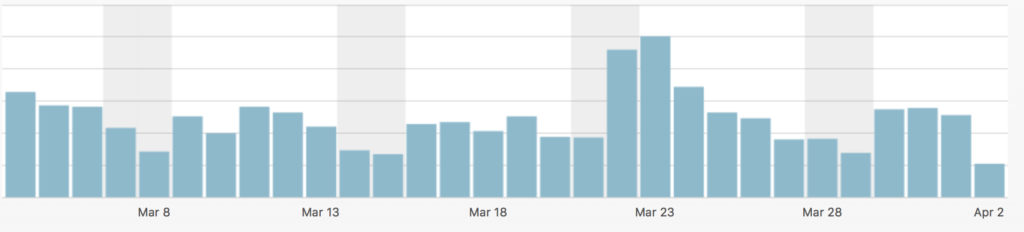

When it comes to video streaming, traffic is up across all of the third-party CDNs I spoke with, but it’s not up by that much, due to the loss of live sports streaming. More people are watching video during the day, both VOD movies and TV shows as well as live news, but the traffic at night looks similar to a month ago. I’ve seen some reports that talk about the peak hour of usage on ISP networks, but that’s talking about all traffic on their network, not just video streaming. For video streaming, the peak hours are 7pm-11pm Eastern Time and Sunday night is the busiest night of the week. CDNs I spoke with told me that a week ago, Sunday night traffic was up, but not by much. ISPs I spoke with said traffic was up 7%-10% on average, specific to streaming.

Some have suggested that the launch of Disney+ in Europe will be a large surge of traffic for the many third-party CDNs that Disney is using, but that new traffic for Disney’s service was already baked into CDNs projections for “new” traffic growth in March and April. So while that is new traffic, it’s not traffic that’s specifically being generated by what’s currently going on in the world. I’ve seen numbers saying that video streaming was up anywhere between 26%-80% in March, but note that a lot of the growth, whatever the accurate number is, comes from Netflix and other services that deliver most, and in some cases like Netflix, all of the video themselves. So while usage is up for Netflix and others, third-party CDNs don’t benefit financially from that growth.

According to Nielsen, (who’s data should not be quoted as the Bible as it’s missing a lot of measurements), Netflix and YouTube made up 49% of all content streamed to TVs the week of March 16th. Even if their numbers are off a bit, it’s safe to say we all know that Netflix and YouTube combined, usually take up about 50% of viewing hours or more. And 100% of that video traffic is delivered by Netflix and Google themselves. So when the media throws out all kinds of numbers around how fast video is growing, for those tracking the CDN market, it’s important to note that the growth of DIY companies usually has little to no impact on the revenue growth of third-party CDNs. The key is too look at the growth of video services from Hulu, ESPN+, Disney+, CBS All Access, Showtime, Sling TV, Fubo and many others who rely on third-party CDNs. Although some, like Disney and others, are already building out their own DIY efforts.

So what does this mean for third-party CDNs in 2020 from a business growth standpoint? Overall, the CDNs will see some nice traffic growth from new services launching like Disney+, Quibi, Peacock and consumers signing up for other already established OTT services. They will also benefit from larger game downloads but it should be noted that game developers have already said that these downloads will get smaller going forward. As an example, see this thread from Infinity Ward that talks to their intentions to “keep future updates from being this large” and to “minimize” their size. This follows in the footsteps of Apple and many others who have continued to cut their size of their software updates by a big percentage every year.

The downside for third-party CDNs is that live sports streaming on the Internet doesn’t exist and we have no real indication of when it might start again. None of the CDNs I spoke with said they had enough details yet to know what the impact would be to their business over the course of the year. How quickly sports comes back, and which leagues don’t, is anyone’s guess. If live sports don’t come back until Q4, the CDNs will have missed two quarters of live sports streaming traffic, which will impact the growth of their overall revenue numbers. I’m not saying they won’t grow at all, they will, but the rate of growth is what’s in question. The loss of some live sports traffic will be able to be made up in the form of additional traffic from VOD movies and TV shows, but live streaming of sports typically happens at a higher bitrate and users watch for longer periods of time, both of which contribute to more GBs delivered overall. I’ve seen a few people say things like, “the loss of real-time video delivery will be more than offset by increased traffic in VOD,” but that is NOT guaranteed at all and there is no data to back that up.

The other unknown is when people go back to work, which OTT services could get delayed in their launch and what the world looks like in another month or two. The delaying of the Olympics isn’t a big deal for any CDN, as it won’t have a material impact on their company from a revenue standpoint. Some CDNs I spoke with also suggested another potential scenario. When people do go back to work and things start to try and get back to some normality, many people will want to do more outside, spend time seeing others, visit places they haven’t been able to get to and potentially, spend less time in front of their TV. So some of the growth we are seeing now may not spill over into future months and the usual traffic they see on their network when things are back open, may have a lot more peaks and valleys and more unpredictability. There are bunch of unknowns right now, but the good news is, CDNs will benefit from the increased demand for video streaming, the question none of us yet know, is what that demand will look like for the rest of the year.

Side note: I just completed my media CDN pricing survey for Q1 2020. Please contact me if you’d like details on how you can get access to the raw data, minus customer names.