In October of last year, Level 3 announced that it would offer their content delivery services for video for the same price that it was charging for transit. Many in the industry incorrectly saw this as Level 3 saying they were undercutting other CDNs in the market and entering the industry as the low-cost leader, which is not the case.

If I remember correctly, Level 3 has over 2,000 customers for its IP transit services. It’s only natural for them to roll out a pricing plan that they can use to target current customers buying other products like transit. But instead of many seeing it for just that, too many in the industry took it as a sign that Level 3 started a "price war" amongst the CDNs. For all those who have written about Level 3’s pricing and a price war, why is it that none of them that I have seen have ever mentioned any real numbers of what Level 3 charges? Where is the data behind this Level 3 "price war" that so many talk about? How come no one will give an example of what Level 3 is actually charging? And if you aren’t a Level 3 customer for IP transit services, their new pricing model gives you no indication of what they charge for CDN services without transit. Too many people want to make this more complicated than it is and want to talk to the "perception" of a Level 3 price war instead of finding out what they are actually charging for content delivery.

I’ve seen a bunch of Level 3 quotes and RFP responses and Level 3 is not undercutting the other CDNs in the industry just to win business. They are not the most expensive in the industry, nor are they the cheapest. From what I have seen, on large volume deals (over 50TB), Level 3 is a few cents more per GB delivered on average. But of the deals I hear Level 3 winning, like the one they announced yesterday with the Democratic National Convention, Level 3 is winning business where it involves more than just content delivery. In many cases it involves back-haul, transit, VYVX services, co-location and other products. Level 3’s approach to the market is that they will gladly take on the customers who need high-volume delivery and commoditized CDN but they are really targeting the more complex business that involves more than just the CDN product. It’s the same marketing angle and approach to the market that Internap is using and Level 3 and Internap are more similar in their services offered than Level 3 is to Limelight or Akamai.

I expect we will see more announcements about customer wins by Level 3 like the one from yesterday that involve multiple products and services outside of CDN. Is that to say that companies like Level 3 and Internap are eating into the market share of Limelight, Akamai and others? In most cases no, as they are all going after a core group of different customers with different needs. There is no CDN on the market today that is a perfect fit for every customers needs. Yes, all the CDNs are competing on some of the very commoditized business, but most of them are now distinguishing themselves by going after different sized customers, in different verticals, with different solutions. They have all become a lot more focused in knowing who they should target and who they shouldn’t. A few years back, CDNs tried to be everything to every customer. Today, the majority of them are very good as knowing what business not to go after.

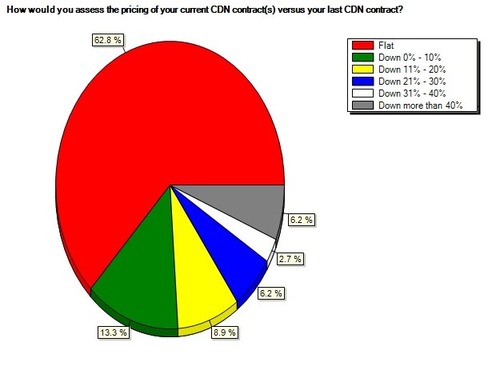

I’ll be putting out more CDN pricing data over the next 30 days as we are collecting CDN data from customers via this survey. We’ve already had a few hundred CDN customers fill it out and I expect a few thousand over the next couple weeks.