The advance program for the 2013 Streaming Media East show (#smeast) taking place May 21-22, at the Hilton hotel is NYC is now complete. The program below details all of the round-table panels and how-to sessions. All sessions in red are not available for speaking as the presenters have already been chosen.

If you are interested in placing a speakers on any of the sessions in black, which consist of a moderator plus four speakers, please contact me. Anyone who wants to speak or place a speaker from a company must send me an email with details on the speaker showing how they are a fit for that session. I have already started placing speakers and SPOTS WILL GO FAST.

If you have any questions, you can always call me anytime at 917-523-4562.

Tuesday, May 21, 2013

10:30 a.m. – 11:30 a.m.

A101: Creating OTT Apps For Connected Devices

Today’s content services must contend with a playback environment comprised of hundreds of different device platforms, many of which require different technology frameworks and development approaches. This session will outline what is happening with various UI technologies including Flash, HTML5, and Webkit, and detail what silicon vendors are doing to aid support for premium content services. Attendees will also learn about platform SDKs and what is required for content owners to deliver their services to connected devices.

Moderator: Mark Donnigan, GM, Dune HD

B101: Integrating Streaming, Videoconferencing, and Unified Communications Solutions

Learn how organizations leverage existing videoconferencing infrastructure as a production studio when integrated with a video streaming system, as well as how videoconferencing allows presenters in multiple locations to participate jointly in webcasts. Finally, learn how this is all good news to those implementing streaming solutions, because now they can be budgeted as part of a larger video communications budget.

Moderator: Mike Newman, VP, GM, Video Content Management, Polycom

C101: A Brief History of Netflix Streaming Technology

Netflix started streaming in 2007 with an Internet Explorer plugin that hosted Windows Media Player. Today, there are more than 80 million active Netflix devices including smartphones, tablets, game consoles, and connected TV’s. This session walks through the technical history of the Netflix streaming service, looking at some of the key engineering decisions, codec and packaging, and a few key hacks. Some of topics that will be covered include Netflix’s first adaptive streaming client, their most unusual project, the BD-Live adaptive streaming client, and how Netflix developed their iPad app in just 60 days.

Presenter: David Ronca, Manager, Encoding Tools, Netflix

D101: How To: Encoding Video for iDevices

This session starts by detailing the playback specs for all iDevices, old and new. Then you’ll learn the strategies used by prominent iTunes publishers to serve the complete range of installed iDevices. Next, the seminar switches to cellular wireless delivery, with a technical description of Apple’s HTTP Live Streaming (HLS), including recommendations for the number of streams and Apple’s encoding parameters. You’ll walk away knowing how to encode for both iTunes and mobile delivery to iOS and compatible devices.

Presenter: Jan Ozer, Principal, Doceo Publishing

11:45 a.m. – 12:30 p.m.

A102: How HBO Launched Its OTT Service In Europe

In December 2012, HBO launched a direct to consumer OTT service in direct competition with Netflix in the Nordic region. This session will describe why and how this first OTT offering was launched. Attendees will see what the HBO consumer offering looks like, what technologies and platforms are used for the service, and the lessons HBO has learned so far.

Presenter: HBO/Qbrick

B102: Content Preparation And Transcoding For Multiscreen Delivery

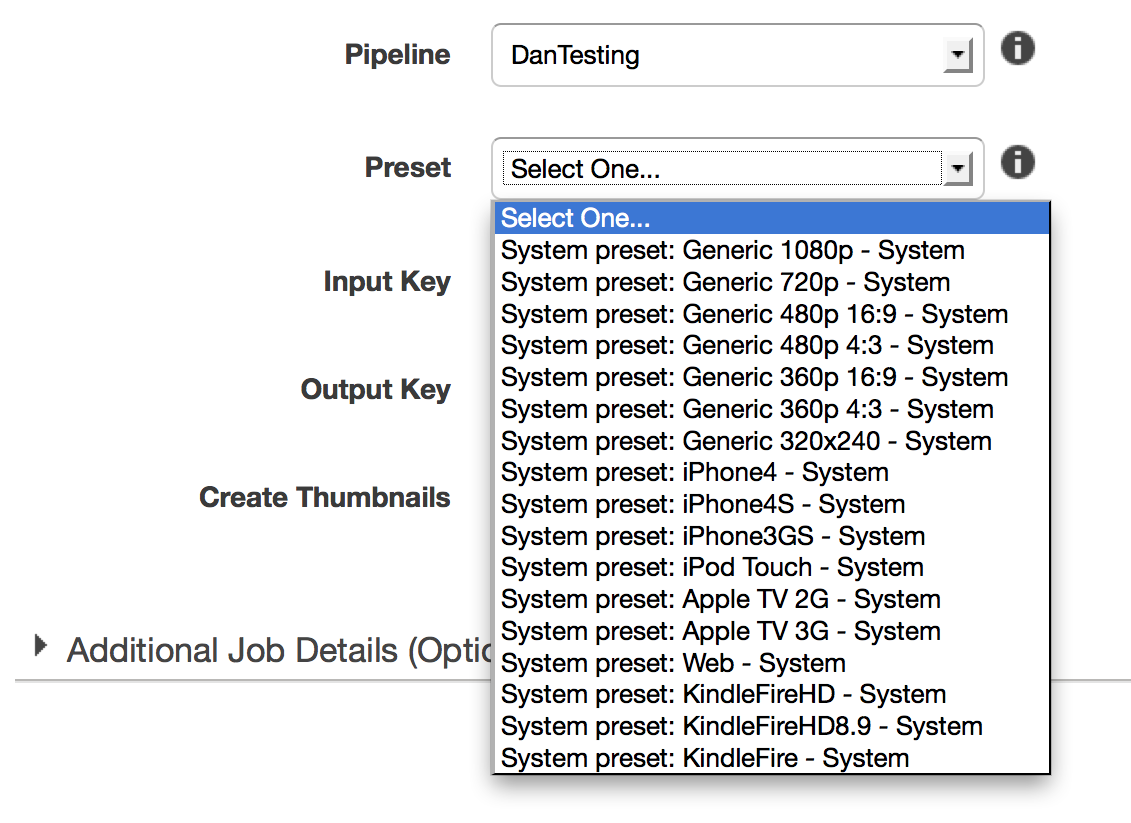

With the introduction of adaptive streaming formats, a growing number of IP-enabled streaming boxes, and the proliferation of handheld devices, content owners face increasing challenges for multi-screen content preparation. A key part of that content preparation is the encoding of content for each device, the algorithm choices/trade-offs, codec settings, and the particular requirements of various distribution platforms. This session will analyze the key components of file-based transcoding and will talk practically about converting content for multi-screen delivery.

C102 : Driving TV Everywhere—Innovations, Challenges and the Tools of the Trade

TV Everywhere offers the promise of letting customers watch what they want to watch, wherever and—ideally—whenever they want to watch it. In order for TV Everywhere to take hold, MVPDs need to open up, partner, and extend their services to their customers wherever they may be. Given technical limitations, rights limitations, and sensitivities around brand and user experience, how are MVPDs innovating around this challenge and getting comfortable with sharing their services and customer relationships? Find out what MVPDs and partners are doing to make TV Everywhere a reality, and learn about some of the experiences that are becoming available to end consumers.

Moderator: Mike Green, Senior Director, Strategy & Development, Comcast

D102: How To: Using File-Based Workflows With Live Streaming To Replicate The Linear Television Experience

This presentation will walk you through the process of turning your video on demand (VOD) library into an online broadcast channel. Learn how to make a broadcast channel from VOD assets and the methods for distributing live streams to desktops and portable devices for all co-viewing opportunities. The session will also detail specifics on encoding, leveraging your CMS to integrate metadata, how to set up a playlist mechanism, and how to turn the file-based encodes into live HD streaming.

Presenter: Rob Roskin, Senior Performance Advisor, Level 3

1:45 p.m. – 2:30 p.m.

A103: The Cost Benefits of Enterprise Webcasting

If you’ve been struggling to demonstrate the value of your webcasts in measurable terms, this session is for you. The audience for this presentation will take away a working formula that computes the real cost benefit of a webcast. Learn how to collect and measure data that can be used to justify corporate webcast efforts. Attendees will learn how to measure the benefits of using viewer registration, webcast scheduling, total webcast cost avoidance, viewer analysis, and webcast funding.

Presenter: Darrell Prowse, Webcast Producer/Director, The Boeing Company

B103: Understanding the Significance of HEVC/H.265

The most recent video compression standard, HEVC / H.265, was placed into final draft for ratification earlier this year and is expected to become the video standard of choice over the next decade. As with each generation of video compression technology before it, H.265 promises to reduce the overall cost of delivering and storing video assets while maintaining or increasing the quality of experience delivered to the viewer. This session will address what H.265 is, how it differs from previous generations of compression technology including H.264, key barriers to widespread adoption, and thoughts on when H.265 is likely to be implemented.

Panelist: Keith Wymbs, VP, Marketing, Elemental Technologies

C103: Designing Content Services For The OTT Revolution

Broadcasters design their OTT distribution platforms considering many different factors, some of which can conflict with one another. Designing a product that both appeals to customers and enhances the offering can be constrained by budget, technical limitations, a fluctuating consumer device market, and existing licensing agreements and partnerships. This session will explore how some of the most notable content owners in the industry are looking to satisfy the desires of consumers as they successfully deliver their product through non-traditional distribution.

Moderator: Michael Dube, Manager, Systems Integration and Operations, HBO

D103: How To: Integrating Social Media With Webcasting at HuffPost Live

This session will take a deep dive into streaming technology and how HuffPost Live is integrating social media into its live broadcast platform. Learn how to leverage social networks like Google+ in live streams and what tools are available to integrate community features into live webcasts. Attendees will also hear best practices for leveraging your online community as on-air talent.

Presenter: Mike Whitmore, Head of Studio Technology, HuffPost Live

2:45 p.m. – 3:30 p.m.

A104: MPEG-DASH: The Next Steps Towards Broad Adoption

Members of the DASH Industry Forum will discuss what concrete steps have been taken in order to foster fast adoption of the new industry standard for adaptive streaming over HTTP. The session will discuss the recently published DASH264 Implementation Guidelines that cover both live and on-demand services, MPEG-DASH profiles, audio and video codecs, closed-caption formatting and common encryption constants. The panel will consist of representatives from all relevant parts of the ecosystem and will address the practical matters and relevance of MPEG-DASH based service roll-outs for streaming and hybrid broadcast applications.

Moderator: Jeff Tapper, Senior Consultant, Digital Primates

B104: Online Distribution and Monetization Strategies for the TV Industry

The Internet has disrupted nearly every facet of the TV industry, from programming to distribution to audience. And while the networks still rule the living room, many of them are struggling to find their footing online. In this session, we’ll explore some of the distribution options for those that want to bring their content to online audiences. The panelists will delve into the pros and cons of sharing content with YouTube, subscription-based services and syndication networks. They’ll also explore what kind of content—short form vs. long form—makes sense for each outlet.

Moderator: Ran Harnevo, SVP, AOL Video

C104: Utilizing YouTube As An Online Video Platform

As viewers continue to flock to YouTube, brands are reevaluating it as a practical alternative to costly online video platforms. In this session, experts will critique YouTube’s cost benefits, built-in audience, established marketing channels, native device compliance, and technical features, as well as discuss YouTube’s platform as a destination for engagement. Learn the pros and cons of using YouTube as a video platform and hear which content and distribution strategies YouTube is best suited for.

Panelist: Rob Sandie, CEO, Founder, vid.io

Panelist: Vanessa Pappas, Head of Audience Development, YouTube

Panelist: Paul Cooney, YouTube Partnership Manager, AOL

D104: How To: Choosing an Online Video Platform

This presentation will help attendees identify their requirements for an online video platform, with a particular focus on mobile and multi-channel scenarios. Learn about the products and platforms available in the market and the strengths and weaknesses of selected major players including Brightcove, Kaltura, and Ooyala. Get advice on how to get to a vendor short list, submitting brief and useful RFPs, what questions need to be asked, and other tips to ensure you choose the right solution.

Presenter: Theresa Regli, Principal Analyst, Real Story Group

4:00 p.m. – 5:00 p.m.

A105: Device Demos: Battle Of The $99 Streaming Boxes

With so many streaming devices in the market, trying to determine what each one offers in the way of streaming quality and content inventory can be quite confusing. In this special session, Dan Rayburn will present hands-on demos showcasing the leading streaming devices, including those from Apple, Roku, Boxee, Western Digital, Sony, Vizio and Netgear. Attendees will see these devices in action, learn which content platforms they run, and have a chance to ask questions.

Presenter: Dan Rayburn, Executive Vice President, StreamingMedia.com

B105: The Business of TV Everywhere

With the emergence of TV Everywhere, consumers can enjoy the benefits of authenticated channels like FOX Now, TWC TV, ESPN, Xfinity, and others across a multitude of devices. Is TV Everywhere a success today? Are providers seeing increased retention? Are new revenue models emerging that might exist as extensions for the TV Everywhere experience? What will TV Everywhere look like in the next five years? Join us for a lively discussion with the experts behind the TV Everywhere movement.

Moderator: Scott Rosenberg, VP, Business Development, Roku

C105: Using Cloud-Based Video Services For The Enterprise

It seems all you hear these days is about public, private, and hybrid clouds. Are cloud services applicable for enterprise video as well? This session will discuss the deployment options for cloud-based services for enterprise video with a focus on two primary methods of moving services to the cloud—encoding in the cloud and media management in the cloud. The session will address many questions around cloud-based enterprise services, including bandwidth concerns, pricing, and security. If you are considering moving to the cloud, this is a must attend session.

Moderator: Andy Howard, Founder & Managing Director, Howard & Associates

D105: How To: Evaluating the Effectiveness Of Your H.264 Encoder

Not all video encoders are created equal. In this session, the real-world video outputs of top commercial H.264 encoders are compared, including those from Telestream, Harmonic, Sorenson, and Adobe, as well as open-source options such as FFmpeg and x264. Learn what features you should have available in an encoding tool before you invest your organization’s budget in a solution.

Presenter: Robert Reinhardt, Creator, videoRx.com

Wednesday, May 22, 2013

10:30 a.m. – 11:30 a.m.

A201: Best Practices For Live Streaming Production

This session will discuss tips and tricks, best practices, and lessons learned regarding the technical setup of live streaming production. Learn how to stream multiple formats from a single encoder, use social networking overlays, leverage adaptive bitrate streaming, and transition between live streams from multiple camera angles using multi-encoder synchronization. Speakers in this session are the ones in the trenches, producing some of the largest live events you see on the web today.

Moderator: Philip Nelson, SVP, Artist and Media Relations, NewTek

B201: Strategies For Deploying Accessible Video Captioning

This session will discuss captioning and transcription solutions implemented by consumer content services and enterprise corporations. Learn the costs and benefits derived from captioning, as well as best practices and tips for implementing accessibility technologies. The panel will also discuss strategies for meeting upcoming accessibility regulations and emerging standards that impact online video captioning.

Moderator: Josh Miller, Co-Founder, 3Play Media

C201: Best Practices for Building an Enterprise Content Delivery Network

In today’s enterprise business environment, delivering video across the network requires choosing the right technology and strategy. This session will give you the scoop on how to create robust and scalable video delivery strategies for your corporation. Learn the factors that need to be analyzed, the key variables that determine your network requirements, and how to best deploy and manage such a solution.

Moderator: Cid Isbell, Information Technology, Wellpoint

Panelist: Alan Tardiff, Technical Specialist/Digital Designer, Prudential

D201: How-To: Building a DASH264 Client

With all the device fragmentation in the market, it is getting increasingly difficult to provide content to all of them equally. The MPEG-DASH specification promises to unify the field and provide a ubiquitous format that can be used by most devices. This technical session explores how to build a DASH264 player. We will explore a few different players, including one built-in JavaScript using the MediaSource APIs to run natively in some browsers, and another using OSMF and ActionScript that can run in any browser with a Flash player.

Presenter: Jeff Tapper, Senior Consultant, Digital Primates

11:45 a.m. – 12:30 p.m.

A202: Content Discovery in a Multi-Platform World

With the advent of connected devices, 2nd-screen remote control apps, smart TVs, and other devices for viewing video, how does a consumer find what to watch? From traditional TV grids to new views of what is most popular or most social, how will the television discovery experience change? Will the difference between TV shows or videos that are live, VOD, DVR, and from OTT continue to be blurred in the eyes of the viewer? Come hear who will win and who will lose in this unbundled non-linear world and what the new business models look like.

Moderator: Richard Glosser, President, Hilltop Digital

B202: Monetizing Video Opportunities in Education

The exponential growth of smartphones and tablets is increasing the pressure in academia to offer more learning options online via the use of video. But only a handful of universities have implemented a comprehensive video strategy. This session will discuss how to use live streaming to attract part-time and international students as well as renowned faculty and guest speakers. While most academic executives and deans only analyze video from a dollars and cents perspective, this session will discuss ideas on how to incorporate it from a strategic standpoint.

Moderator: Jasmit Chilana, Web Services, IT Services, British Columbia Institute of Technology

C202: UFC Case Study: Solving The Multiformat, Multichannel, Distribution Challenge

The Ultimate Fighting Championship hosts weekly events, distributing live and VOD content across 100 different digital distribution points on a daily basis. This presentation will showcase UFC’s digital media workflow, including how they handle transcoding, digital asset management, and the specific technologies and processes that were implemented to solve UFC’s massive multiformat, multichannel, distribution challenge.

Presenter: Christy King, VP, Digital, Technology R&D, UFC

D202: How To: Best Practices For Live Streaming Delivery

This session provides best practices, lessons learned, and a general overview of the technical set-up for a professional live streaming production. Learn about transmission methods (IP, cellular, fiber, satellite), encoding on site or off, picking the proper encoder for the job (software vs. hardware), maximizing encoder & CDN efficiency, and delivering adaptive HD streaming to the desktop, mobile, and OTT boxes. Come learn how to improve your next live event.

Presenter: Dylan Armajani, Digital Workflow Technologies Specialist, Viacom

1:45 p.m. – 2:45 p.m.

A203: How To: Streaming with TriCaster

Learn the best tips and tricks to get the most out of your TriCaster unit.

B203: Monetizing TV Everywhere Across Multiple Platforms

As changes in technology and viewer behavior have altered how consumers watch TV, so too has the pay TV industry been forced to reexamine how content is monetized. This session will map out key new standards and technologies that pay-TV providers can leverage to capture ad dollars as TV is viewed everywhere and at any time, including approaches for delivering the reach advertisers need, despite audience fragmentation; using addressability to minimize wasted ad spends; increasing engagement with viewers via interactivity and second-screen tie-ins; and increasing efficacy via better measurement.

Moderator: Chris Hock, SVP, Product Management, BlackArrow

C203: How The BBC Ensured Live Streaming Resilience For The Olympics

Live video streams were key to the ambitious online user proposition for the London 2012 Olympics, and that coverage had to mirror the very high traditional broadcast standards of resilience and quality. Hear the challenges the BBC faced when designing a resilient HTTP streaming infrastructure that was designed to cope with huge volumes. Learn about the solution the BBC used during the games and hear what changes to their methodology was required to build resilience into a cloud-based infrastructure.

Presenter: Kiran Patel, Senior Product Manager, BBC

D203: How To: Choosing an Enterprise-Class Video Encoder

This session will discuss factors to consider when choosing an on-demand enterprise video encoding systems from the likes of Digital Rapids, Elemental, Harmonic, Sorenson, and Telestream. Factors incorporated into the analysis will include performance, output quality, quality control options, format support, expansion options, programmability, and other variables. If you’re considering buying an enterprise encoder or upgrading your current systems, you’ll find this session particularly useful.

Presenter: Jan Ozer, Principal, Doceo Publishing

3:15 p.m. – 4:00 p.m.

A204: The Future of Digital Entertainment in a Multiscreen World

This panel of leading service operators and content owners will discuss how they solve some of the challenges in delivering the creator’s intended entertainment experience across new devices and consumer use cases. The panel will also share their vision on where the future of digital entertainment is heading and key industry drivers that could enable the next-generation entertainment experience on mobile and tablet devices.

Panelist: John Pacino, VP, Digital Design and User Experience, NHL

B204: How Old Media Is Embracing Online Video and New Media

This session will discuss how converging media technologies are redefining traditional distribution methods; how interactive and on-demand services are changing; and how entertainment and news video is being consumed. Come hear from some of the leading publishers, broadcasters, and advertisers about the impact that video and new media is having upon their business models.

C204: The Business Case For Deploying Multi-Language Video

Since only 5.5% of the world speaks English as its native language, there’s a big opportunity to grow your audience by moving rapidly into global markets. This panel is an opportunity to learn the economics and business case for producing and distributing video in multiple languages. Each participant will discuss best practices, what’s ahead, distribution options, and the economics of their investments in reaching the emerging world in video.

Moderator: David Orban, CEO, Dotsub

![]() Last Thursday, privately held Strangeloops Networks, which focuses on web optimization, announced they had been acquired by Radware (RDRW). Terms of the deal were not announced but multiple industry folks say Strangeloop was valued at under $20M.

Last Thursday, privately held Strangeloops Networks, which focuses on web optimization, announced they had been acquired by Radware (RDRW). Terms of the deal were not announced but multiple industry folks say Strangeloop was valued at under $20M.