I’ve highlighted some interesting numbers and takeaways from Akamai’s Q4 and full-year 2023 earnings for those tracking the CDN industry. At times, I hear some people suggest Akamai isn’t really in the CDN market anymore, which could not be further from the truth. The company still dominates the overall industry and is the largest player concerning every metric, including revenue, number of customers, and total traffic delivered. Akamai’s delivery revenue for 2023 was $1.542 billion and dwarfs the next largest competitor by 3-4 times revenue, based on a comparison of the same type and size of customer. Please note that Akamai does not report “CDN” revenue but “delivery” revenue.

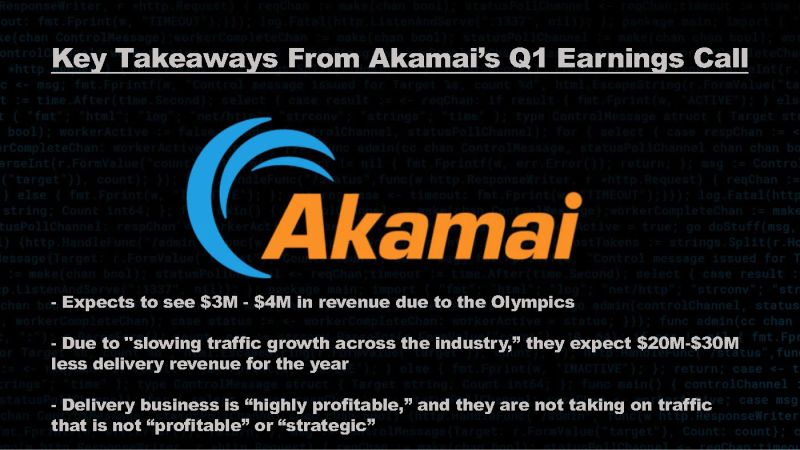

It is accurate that revenue growth in the CDN market has slowed over the past few years, with my CAGR estimate for the entire market in 2023 being 1-2%, excluding China. Akamai’s full-year 2023 delivery revenue was down 8% and is expected to be down again in 2024, year-over-year. Everyone following the CDN market knows it’s a tough business with high capex costs, low margins and competitive pricing. The removal of Lumen and StackPatch from the market will help remaining CDNs concerning renewals since those two vendors offered some of the lowest pricing in the market. That’s not to say they were successful in winning business from Akamai or other CDNs, but at times, they would get a small share of the overall traffic in a multi-CDN mix, or customers would use their pricing to negotiate against Akamai and other more prominent CDN vendors.

While fewer CDN vendors are in the market, customer traffic growth hasn’t accelerated significantly, pricing is always competitive, and many video customers have optimized their encoding, resulting in fewer bits delivered. The CDN business is all about the economics of scale for efficiency and profitability, and the focus is on taking on the right customers at the correct pricing and cost structure. Akamai highlighted this strategy and said they would continue to focus on reducing unprofitable traffic, including peak traffic. They also stated they would start charging a premium to deliver traffic in harder-to-reach places as it looks to right-size its delivery cost in these markets with the revenue it generates. This is smart business and is what every other CDN is doing.

Seven of Akamai’s top ten CDN customer contracts come up for renewal in 2024. They will be concentrated in the first half of this year, so the company is expected to take a temporary hit in overall revenue growth, which we have seen happen every few years during significant contract renewals. Akamai notes that select contracts Akamai acquired from StackPath and Lumen accounted for ~$20M in revenue in Q4 last year.

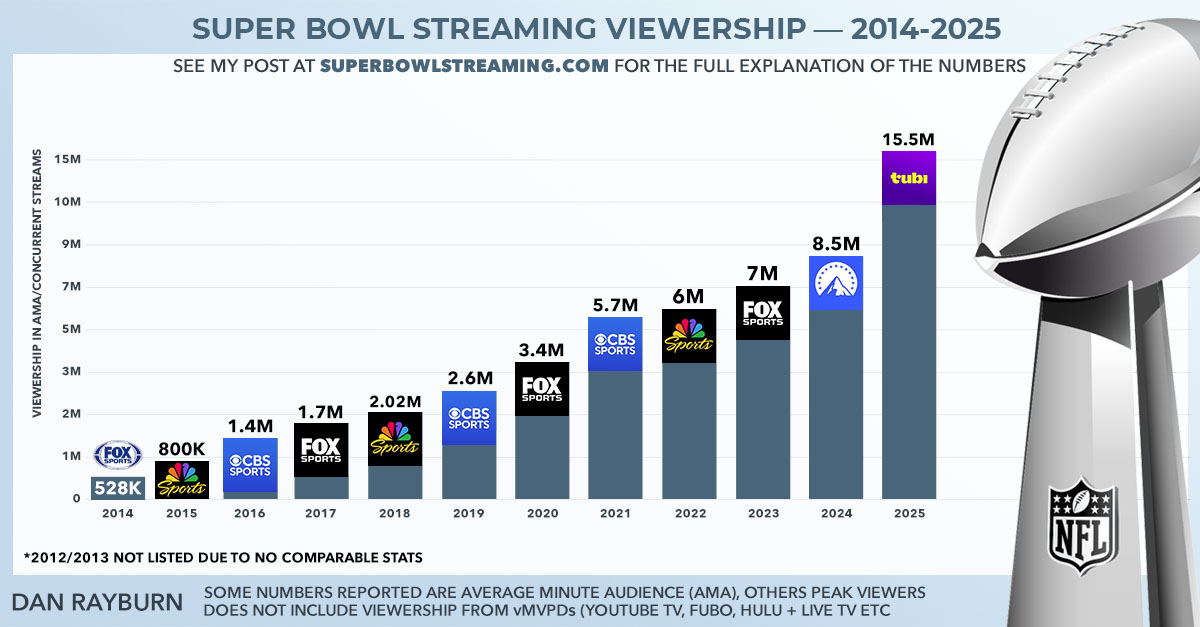

Some vendors in the market, especially smaller ones, like to claim Akamai has a “legacy” network for CDN services and isn’t “next generation,” which is laughable. The numbers tell the story. While Akamai didn’t discuss this on their earnings call, I will report that for both the NFL Wild Card game on Peacock and the Super Bowl stream on Paramount+, Akamai had the majority of the video traffic. There is nothing “legacy” about their CDN, and they are at a size and scale that, so far, no other CDN has gotten close to.

Of course, one could argue it doesn’t make sense to get as large as Akamai anymore due to the delivery market’s lack of overall revenue growth, the low margins, and the high capex costs of running the business. That’s a fair argument, which is why CDNs now make most of their money on RSVP fees for one-off live events, not bit delivery. If a CDN is going to put more capacity in place for an event, they want to guarantee revenue from the RSVP fee they charge, regardless of the traffic that might show up. It’s smart business on the CDN’s part and shows how much they all take cost into the equation.

I will have a more extensive post soon with an update on the overall CDN market and a second post on why Akamai’s CDN scale is important for other segments of their business. Yesterday, they announced their plans to push generalized compute out to the edge in what they call their Gecko edge computing initiative. Akamai is in a unique position to do what few, if any, CDN providers can: bring the cloud and edge together into a single continuum of computing.

Updated February 21, 2024: A recently published report claims that Akamai is in talks with some very large media customers about offering “free delivery of video traffic” in exchange for “signing over a significant portion of their cloud computing workloads.” Akamai tells me this report is “inaccurate” and that giving anything away for free “never makes sense.” Like all vendors, Akamai always discusses additional discounts with customers who increase their aggregate spend across the company for multiple services. But that doesn’t mean Akamai’s services are being offered for free, as that’s not a good business practice. For those who understand the CDN business, the economics do not allow video delivery to be given away as a loss leader.

Note: I have never bought or sold stock in any public CDN ever, including Akamai, Edgio, Fastly, Cloudflare, Amazon, or any other vendor listed at www.cdnlist.com