CDN Netskrt Discloses Network Capacity, Revenue, and How it Adds Capacity Profitably

Netskrt Systems has carved out a meaningful foothold in the global streaming video market, particularly tier-one live events such as NFL football games, supporting both TNF on Prime Video and the recent Super Bowl on Peacock. It has done this in a manner unlike most of its competitors, focusing on broad, deep deployment of pure software POP instances that reduce its underlying costs. The cost factor is the key, since historically we have seen CDN vendors grow capacity at the risk of burning a lot of cash.

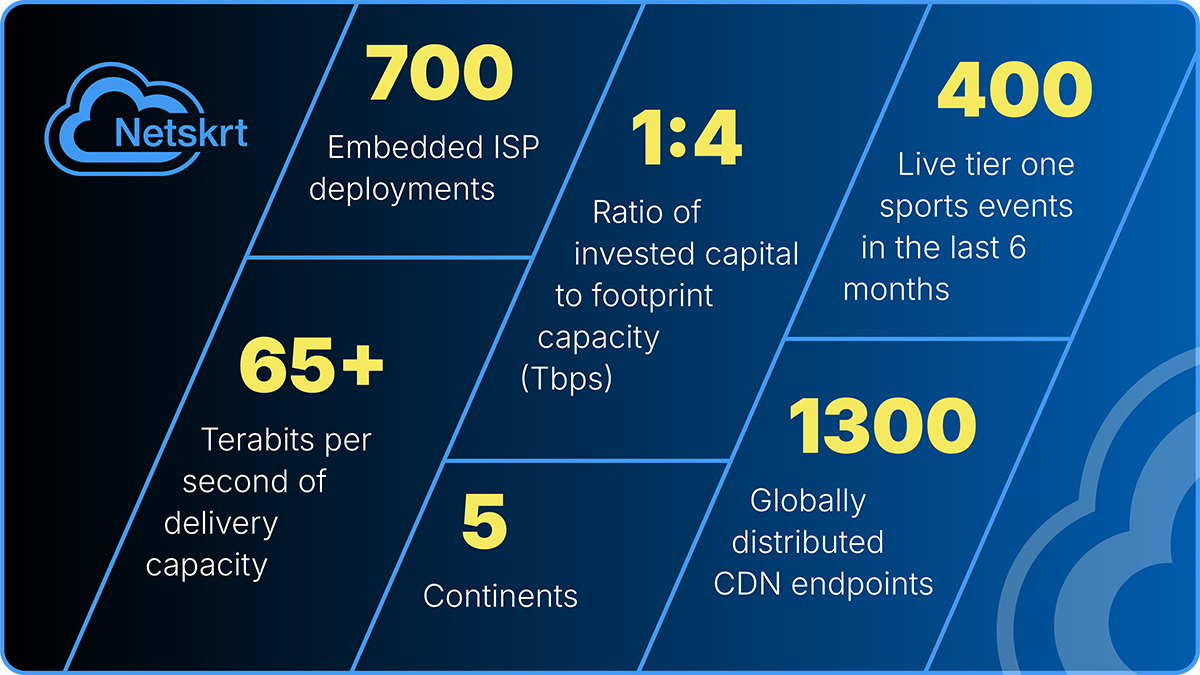

The net result, the company tells me, is the ability to operate profitably under the demanding price umbrellas imposed by global streaming platforms. And this does show up in its numbers. Netskrt has built far more capacity and generated more revenue with less invested capital than its CDN peers, at its current size. With about $30 million in invested capital, Netskrt expects to exceed a 1:1 capital-to-revenue ratio in 2026 and a 1:4 capital-to-capacity ratio. Conventional CDNs typically operate closer to a higher multiple, but few disclose the ratios publicly.

Netskrt informs me that its current “steady state” capacity is about 65 Tbps, but notes that because software instances can be spun up when and where required, whether on bare metal, virtual machines, or containers, the effective capacity that can be instantiated in 24 to 48 hours is substantially greater. In fact, when it wants to, Netskrt said it can even spin up capacity in cloud-based spot instances in minutes.

This approach, which the company likens to a software-defined CDN, gives Netskrt considerable flexibility while also taking a sledgehammer to capital costs. Further, it’s a stratified infrastructure. Where Netskrt sees persistent, long-lasting demand for capacity, it can deploy iron to meet that demand in a manner that leans more toward CapEx than OpEx. Where it sees the reverse—in particular, the bleeding edge of spiky demand curves associated with live sports that are inherently seasonal, it can lean in the opposite direction. Executing this is more than just a business strategy; Netskrt says it requires CDN technology capable of positioning and repositioning content, as well as live-streaming POPs, in response to a complex array of real-time conditions.

Roughly half of Netskrt’s capacity is embedded in last-mile ISP networks, with the balance allocated to its mid- and global tiers. From a geographic perspective, Netskrt now reaches across North America, South America, Europe and regions in APAC. Netskrt’s current growth trajectory, which has picked up significantly over the last year, will see it reach 150 Tbps by the end of 2026. Their partnerships with large network and bare metal suppliers like Lumen enable them to ramp up to these levels quite quickly.

The company recently conducted a survey with professionals from 55 global ISPs to better understand how major events impact network performance. You can check out the results from that study here.