Titan OS Unveils TV OS and Ad Platform, Targeting Europe and LATAM

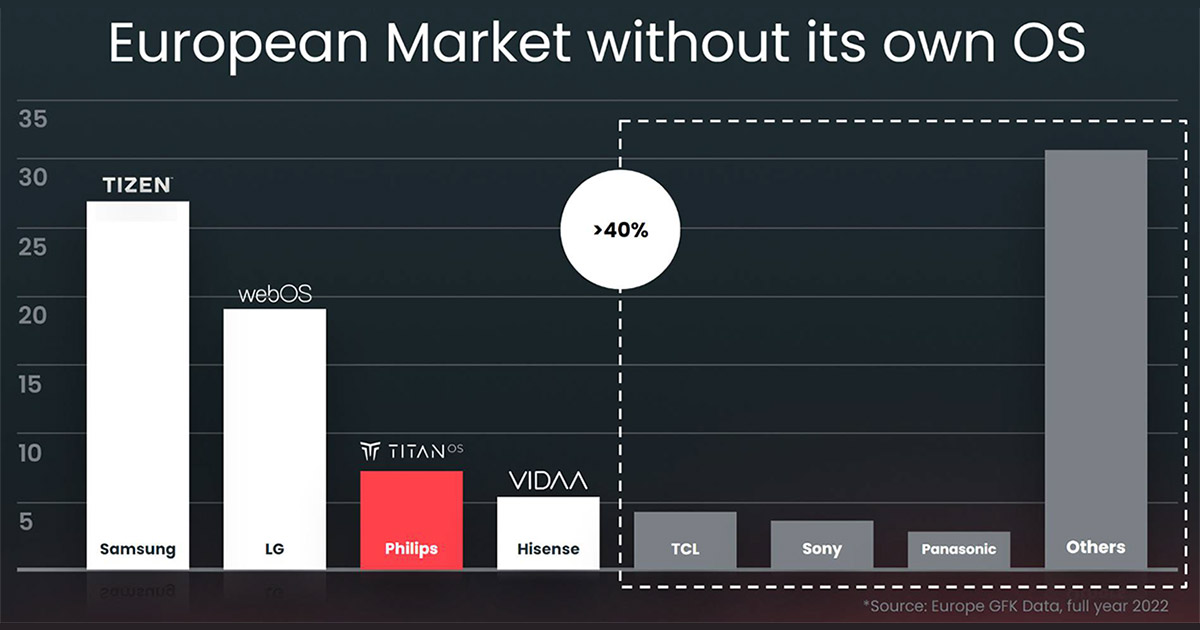

In the US, the TV OS market is highly competitive, and there’s little room for new entrants because many of the largest TV manufacturers, including Samsung, LG, and Vizio, operate their OS. On top of that, Roku, Google, and Amazon have established relationships with other brands like TCL, Sony and Hisense. But in Europe, the CTV market is different from the US, and this is where Titan, a new TV OS recently launched with Phillips as its main distribution partner, plans to concentrate their focus. In November, I had the chance to sit down with the Titan team in NYC and hear more about their product and their interest in the European market.

In Europe, Phillips has the third largest market share behind Samsung and LG. Connected TV penetration in Europe lags behind the US, and there is an opportunity to grow with many regional brands that don’t have their own OS. In addition to launching with Phillips, Titan also announced a partnership for branded TVs with Curry’s, the largest electronics retailer in the UK. The European advertising market differs substantially from the US since the continent has over three dozen countries and two dozen languages. Titan has built a network of local relationships with advertisers and agencies to create a new marketplace for CTV advertising built upon a robust data platform that complies with EU privacy laws.

Philips already has a partnership with Google TV but will deploy Titan on most of its models for 2024, including its upcoming entry-level Mini LED and LCD TVs, including the PML9009 Xtra Mini-LED and “The One” LCD (also known as the PUS8909). These TV models are expected to make up >60% of the overall volume of TV sales in 2024. Phillips will continue to use Google TV on the newly announced OLED+959 and OLED+909.

TV operating systems are important in the Connected TV ecosystem because they serve as a marketplace for streaming services, FAST channels, data and advertising. Operating systems build revenue off these lines of business and measure their success by growing ARPU. Growing revenue after the retail sale of a television is a trend over the last decade, pioneered by Roku, with many companies following a similar playbook. Margins in the highly competitive TV manufacturing business are shrinking, so having a recurring revenue stream to bolster profitability is necessary. In the case of Titan, they share recurring revenue with the TV manufacturers they partner with.

We have yet to see any company break out TV OS revenue from the rest of their finances, and almost no TV manufacturer breaks out revenue from their FAST offerings aside from Vizio. If I missed numbers from a manufacturer, please let me know in the comments. I don’t know if Titan plans to release any numbers over time, but it would be helpful for the industry to know the actual market size by region based on revenue.

Titan, based in Barcelona, has no plans to enter the US market anytime soon. Following the launch of Europe, the company plans to expand with Philips into Latin America.