CDN Pricing Stable In Q4, Down About 20% For The Year, Market Size $675M

Normally I present my latest CDN pricing data in-person at each Streaming Media East and West show, but I am not able to make it to the West show in LA this week. So I've put all the data that I would have presented on Q4 CDN pricing into this blog post and welcome any follow up questions in the comments section or you can give me a call if you need any additional details. (note: you can always find my latest pricing post at www.cdnpricing.com – Previous Quarters: Q2 11 Q1 10, Q2 10, Q4 09, Q1 09, Q4 08, Q3 08, Q2 08, Q1 08. For a complete list of all the CDNs in the market, see www.cdnlist.com)

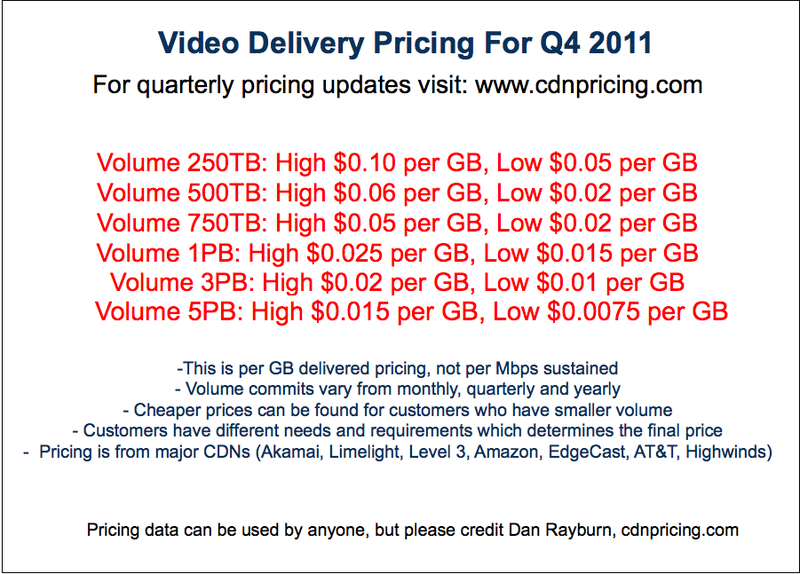

Since I last put out pricing data in the market for Q2 of this year, not much has changed. For the most part, pricing for video delivery services amongst the largest CDNs (Akamai, Limelight, Level 3, Amazon, Highwinds, AT&T, EdgeCast, Verizon) has remained very stable and for the year, I expect pricing, on average, to be down about 20%. In 2010 pricing was down on average about 25% and in 2009, down 45%, so 2011 has seen the lowest pricing decline for video delivery services in the last three years. There are many reasons for this and one of them is that traffic is not growing as fast as some had expected. Sure, traffic growth amongst the big boys like Netflix, Hulu, MLB etc. is happening an astonishing rate, but those are not the average size content owners.

Most CDN customers aren't doing the kind of volume Netflix is and is not growing at the rate they are, hence, they are not seeing that big of a pricing decline. (As a side note, Netflix now pays about two cents per movie for delivery, down from five cents two years ago.) Another reason that pricing has remained fairly stable is that many companies aren't simply looking for the lowest cost leader. While some still always want to suggest that an incumbent CDN like Level 3 is winning deals with just a lower price, the fact is they own their network and have a cost advantage. And when content owners like MLB say they have selected Level 3 to deliver their videos because Level 3's network performs better or as good as other CDNs, it shows content owners are choosing quality first and price second. No content owner who has any serious business model, be it PPV, subscription or ad based can afford to have a service that does not perform well. So while price is always a factor, performance matters more than ever before.

One of the biggest reasons that video CDN pricing has been so stable is that many CDN contracts are no longer being priced on a per GB delivered model and CDN vendors no longer have to list out pricing for a specific type of content, like video. When a content owner is looking for only one kind of delivery, it's very easy to see what they are paying per GB to deliver their content. But as more and more content owners are bundling in multiple services from the CDN vendors for services like software downloads, small object delivery, application acceleration etc. all of those services get rolled up into one price based on a per Mbps sustained model.

As a result, CDNs no longer have to break out their pricing per product and have more flexibility with their pricing since they are blending it amongst many different services. Back in 2009, roughly 80% of the content owners I spoke with had contracts based on per GB delivered pricing. Today, in speaking with the CDNs directly and the content owners, I would say that 60% or so of the contracts for video delivery are now priced on a per Mbps sustained basis. I expect to see more of this in 2012 since the CDNs are all hard at work trying to diversify their product portfolios and revenue away from simply delivering bits from point A to point B. Due to this shift, I have started giving out pricing numbers on a per Mbps sustained model as well as per GB delivered, below, and will provide further details on per Mbps pricing in the New Year.

For those that want to compare the data I have given out over the past few years, please note this is not an exact science. If volumes stayed the same, it would be easy, but since the commit levels go up each year, the volume buckets I give out pricing for also change. You will see for this quarter that I'm not even giving out pricing on a 100TB a month deal as that's not just too small of a volume for the bigger CDNs. While that's not to say they won't take on a customer of that size, the commit levels from customers they are targeting tend to be much larger.

Corrected (see below): As for per Mbps pricing, a 100 Mbps commit per month averages $7 a Mbps high and $5 a Mbps low. A 250 Mbps commit per month averages $5 a Mbps high and $4 a Mbps low. A 500 Mbps commit per month averages $3 a Mbps high and $2 a Mbps low. Pricing on small deals average around $20-$25 per Mbps. (Note: thanks to those who pointed out I had wrongly put in Gbps commits instead of Mbps commits. It is now fixed to show Mbps.)

While pricing data is useful, you can't really evaluate its impact on the CDN vendors specifically unless you talk about volume trends as well. For 2011, I expect the average volume growth to average about 60%, up from 45%-50% last year. So while traffic growth has increased, it's not been at the level some were predicting at the beginning of the year, which shows in some of the earnings data from the CDN vendors. For 2012, I don't expect it to be a big year for CDN growth. I expect we can see up to 15% traffic growth again, but I think it is really 2013 when we see the volume of traffic really spike, thanks to all of the devices that will finally be in the market, being used by consumers.

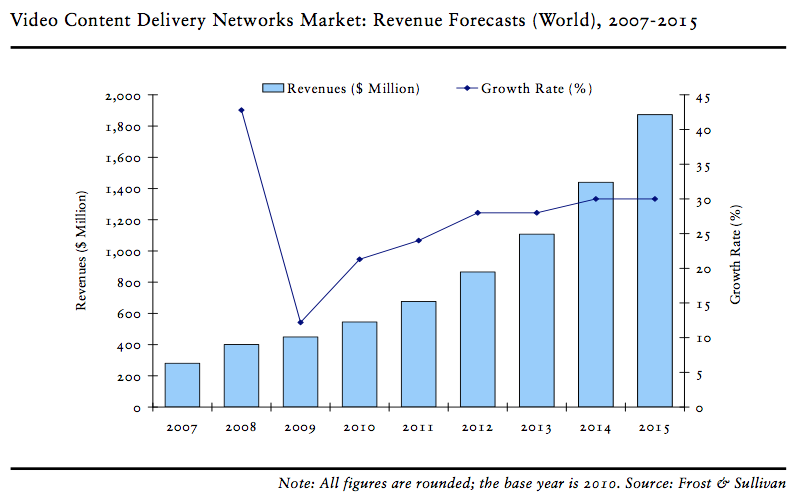

That's not to say that the CDNs can't grow, but as we all know, the biggest growth for the CDNs in terms of revenue is going to come from services like mobile content acceleration, application acceleration and those services defined as "value add" by the CDNs. That said, don't underestimate the CDN business. While it's not growing by leaps and bounds now, it will. We saw a huge surge in 2006 in volume growth thanks to YouTube, Flash and some other industry trends and I expect we will see that big surge again in about 12-18 months. So don't count video out as a way for CDNs to make money. The CDN business is all about the economics of scale and if the volume hits and a few things align properly, we'll see that big growth again that we have seen in year's past. Here is a chart from a Frost & Sullivan's 2010 CDN report on the projected size of the CDN market, about $675M this year, specific to video delivery via third party CDNs. (Contact me if you want details on how you can get the full report.)

I'm always asked what the catalyst for growth is in the market and while many expect there to be one driver, their isn't. I don't see anything happening in 2012 that will make traffic growth on the CDNs explode, but Amazon's Kindle Fire is going to help. No one item like HD video, mobile, broadband devices etc. have enough of an impact by itself to cause a huge growth in the market. But taken all together, these items are the real catalyst for growth and I expect we will see that surge in traffic on the CDNs in 2013. Originally I thought we might see it late 2012, but neither Roku, Apple TV, Boxee, Logitech Revue etc. have sold enough devices in the market to make a major impact on the CDNs. Adoption rates will continue to grow for these devices, but not at the rate some may think or suggest and it will still be some time before they enable the next surge of traffic on the CDNs.

While I expect the CDN industry for video delivery to be pretty stable next year, keep in mind that any combination of a Level 3 and Limelight partnership will probably push pricing down faster in the market. Also, Verizon is one you are going to hear a lot about in 2012 and they own their own network, so they also have the potential to affect the market price for these services if they get to scale quickly enough next year. It's too early to know if that will happen, but keep an eye on Verizon as they are going to be competing in the CDN space. As for AT&T who also owns their own network, I still have no data points on their CDN business to have any idea on the level of success they are having. I see them in some RFPs, but not a ton and we still don't have any idea on their customer count or their true size and scale.

Amazon continues to do well with their CloudFront CDN service and by my estimates, will do about $75M this year in total CDN revenue this year. While Amazon's CDN service still does not have a lot of the bells and whistles that the other CDNs have, there is still a huge market for the kind of customer Amazon is targeting and they will continue to compete for more CDN contracts next year. Also, Amazon is in this for the long-term and at some point, will also start rolling out other services that would be defined as value add by the industry, so they are one to keep an eye on.

I know some are going to ask me about the impact on Akamai having to re-price some of their big M&E contracts that will be coming up in the new year, as we saw in Q1 of last year. Honestly, I have no idea how that will impact Akamai as we don't know what percentage of Akamai's CDN revenue those top customers make up. We don't even know how many CDN customers Akamai has for video or what percentage of traffic on their network is video related. But, even with pricing only dropping by 20% on average this year and voulme increase by 15% over last year, Akamai's M&E revenue has been pretty flat, or down the past few quarters. This makes sense as the big M&E customers are getting more than the average decline in pricing when it comes to contract reneweals due to larger volumes. But I also think it is due to Akamai losing the overall percentage of the customers total traffic, like we have seen with MLB and Netflix. So it's too early to know how their re-pricing will impact them in 2012, but it's something to watch in the New Year.

If you want to know more about the impact that carriers, telcos and MSOs could have on the CDN market, (otherwise defined as the service provider market) I've covered that extensively at these blog posts below:

– Telcos And Carriers Forming New Federated CDN Group Called OCX (Operator Carrier Exchange)

– Akamai Developing A Licensed CDN Offering For Telcos and Carriers

– A Closer Look At Akamai's Strengths & Weakness For A Licensed CDN Offering

– EdgeCast and PeerApp Team Up To Combine CDN With Transparent Caching

– Cisco's Service Provider Video Platform Nearly Complete, Acquires BNI Video For $99M