Amazon Lowers CloudFront CDN Pricing, Estimate CDN Business Brings In $75M

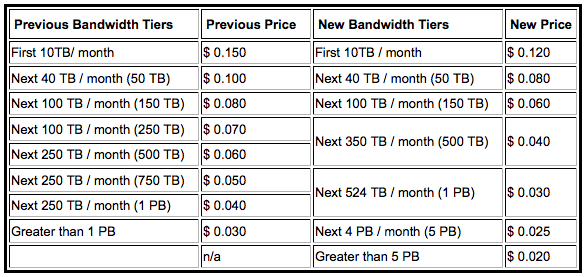

I didn’t have a chance to cover this when it happened, but on July 1st, Amazon announced they were lowering the pricing of their CloudFront CDN delivery service. By my count, this is now the fifth time Amazon has lowered their pricing since launching CloudFront in November of 2008. If you need any more evidence of just how quickly CDN pricing has declined, when Amazon’s service launched, the lowest pricing they offered on their rate card was nine cents ($0.09) per GB delivered. Today, their lowest rate card pricing is two and half cents ($0.025) per GB delivered and I’ve seen Amazon quote a penny ($0.01) per GB delivered for large volume deals. Here’s a chart of their new pricing and data tiers compared to their previous pricing.

Amazon also announced that customers no longer have to pay for any inbound data transfer and they introduced new pricing tiers for their high volume users for what they call “Reserved Capacity Pricing, classified as customers doing more than 5PB of delivery per month. While Amazon does not yet have the suite of services labeled as “value add” by other CDN vendors in the market, it’s pretty hard to argue with the fact that Amazon has helped commoditize the basics of storing and delivering video over the Web.

While Amazon does not break out their revenue for their suite of Amazon Web Services, including their CloudFront offering, based on my estimates and from having talked to others in the CDN space who know Amazon’s customers and traffic, I estimate that CloudFront will contribute about $75M in revenue to Amazon this year. If that number is accurate, it makes Amazon close to being the third largest CDN in the market based on revenue.

One thing Amazon’s revenue shows is that it takes any new vendor in the CDN space a long time, meaning more than 2-3 years, to get revenue into the $100M+ range. If Amazon grows their CDN business by 25% next year, which is a lot, it would have taken them 4 years to reach the $100M number. The same could be said for Level 3, based on their current growth. It took Limelight Networks five years to grow revenue from $20M to about $150M. Entering the CDN space takes a really long time, lots of money and is not as easy as some suggest. Back in 2009, Microsoft said it cost them “several hundred million dollars” to build out their CDN and bring about 70% of their traffic in-house by the end of last year.

While some are quick to say that Amazon is only competing for the commodity portion of the market and won’t compete with any value add services, think again. Amazon has some pretty ambitious plans for their AWS platform and a lot more services are on the way, including ones the market would classify as value add.