Netflix Viewers Consume Almost 10 Hrs Of Video A Month, Do Last-Mile Providers Have A Strategy?

Not surprisingly, Netflix continues to climb all of the Nielsen charts for viewing time per subscriber and total streams viewed with Nielsen saying the company streamed over 200M videos in March. With all of that traffic, it’s no wonder that U.S. based ISPs continue to worry about the impact Netflix video is having on their network and are working very hard on a solution. While none of them have yet to announce it, many are already deploying solutions to help cache Netflix content inside their network.

Recently, multiple last-mile operators have shared with me a few anecdotes on the impact of Netflix’s traffic on their network and the growth they are seeing. One ISP planned for a 40% to 50% growth in bandwidth per subscriber for 2011 and they hit that growth number in Q1. Essentially, they blew the bandwidth budget for the year in three months and are now scrambling to make budget adjustments that won’t dramatically impact their service and plans for 2011.

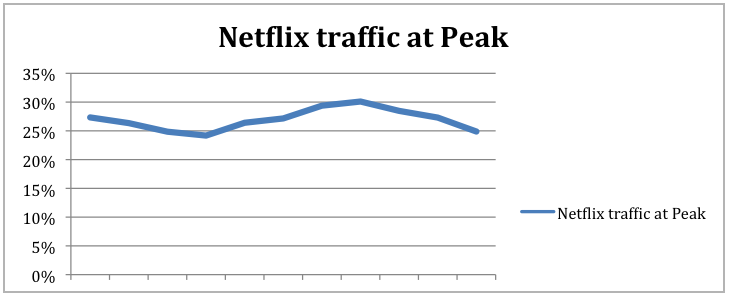

Sandvine reported Netflix as “more than 20% of downstream traffic during peak times” back in October but ISPs I have spoken to say the percentage is higher and growing. Just take a look at these numbers over the last week at one of the U.S. based ISPs I spoke with and you’ll see that their percentage of total traffic at peak is more than 20% and growing.

The numbers are climbing from 24% to 30% of all traffic at peak. Almost 1 in 3 bits during peak are feeding the OTT service as more videos become available and more subscribers join the service, this trend is only getting worse.

During the Q&A session at the IPTV World Forum last month, Bill Holmes, Netflix’s VP of Business Development claimed that the numbers reported by Sandvine were not a problem . (Check out the video around the 19min 40sec mark for the question and answer.) Here is a transcription, “just to clarify – that’s traffic, basically on the edge to the customer home, so with respect to net neutrality, what we are really advocating for is settlement free peering and the business model as we see it is, you know, essentially, Netflix pays to bring the bits to the, you know, to the last mile. Then that last mile relationship is one between the consumer and the operator. And so we feel its being monetized in that way. And we are looking to, you know, essentially, see how we can foster that type of business model across the board.” He also went on to say that Netflix traffic does not go “over the backbone” and that Netflix is not “saturating the pipes” and that the Internet is not in “jeopardy”. While I agree that the Internet is not in jeopardy, ISPs completely disagree with Netflix when it comes to the cost associated with the traffic.

While Reed Hastings, the CEO of Netflix, commented that the cost of bandwidth to an ISP is about 1 cent per Gigabyte, every ISP I have spoken to says that Netflix does not know the real cost since they don’t operate a network and are only quoting raw bandwidth pricing, which does not include any of the other expenses associated in upgrading the network, including hardware. The “last mile” in this context is really to the boundary of the ISP’s network and the Internet and there is a lot of cost to deliver those bits from that edge to the subscriber. Continually adding bandwidth and infrastructure is not a free endeavor, even in the U.S. where the cost of bandwidth is low.

Over a year ago, Netflix also said that bandwidth caps by ISPs would not impact their business and played down the idea that caps were a big deal, yet in a self-admitting fashion, last month Netflix reduced the quality of videos that are being served across Canada to fit into data caps. Subscribers are demanding higher quality, not lower and the ISP is caught in the middle of the value chain with few options as traffic grows.

This is a hot topic of debate right now and on May 9th, at the Content Delivery Summit, we’ll be hearing directly from ISPs and carriers who are speaking on the impact Netflix is really having on their network and the solutions they are deploying to combat it. You can register online for the Summit for only $395 using the promo code of DAN. Some of the confirmed speakers include Comcast, Verizon, BT, Orange France Telecom, Telefónica, AT&T and many others.